Trading position (short-term; futures; our opinion): long positions (100% position size) with stop-loss at 3370 and initial upside target at 3400.

Trading in a tight range again, stocks are set up for a sizable move - and if you look at the credit markets, I think a break of the Feb highs is at hand. Don't be taken in by the lackluster daily advance decline line or advance-decline volume - $VIX doesn't appear ready to mount an immediate challenge, and neither is the dollar.

Such were my August 11 observations:

(...) With the dollar rally running into headwinds yet again, the risk-on trades gets another ally.

Last but not least, the correction in gold I called for on Friday to happen, takes away from the momentary inflation fears. And inflation rearing its ugly head, that would have the power to throw the stock bull out of whack. We aren't there yet.

The greenback is probing its recent lows again, gold is recovering from the preceding steep correction, and long-term Treasuries have stabilized. Such a combination is momentarily conducive to the budding stock upswing (watch Walmart data coming in) - my June 5 point about stocks remains valid also today, because stocks:

(...) don't love many things more than money printing.

The analyses in the coming few days will be briefer that you're used to from me, but rest assured that behind the scenes, I am looking at the very same broad set of charts that power my trading decisions. For business reasons related to your Stock Trading Alerts, I want to thank you for your patience before the number of charts presented comes roaring back later this week.

So, what markets have I picked today as the gems having most bearing upon the S&P 500 immediate future?

S&P 500 in the Short-Run

I'll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The short-term hesitation in the S&P 500 daily chart appears to be drawing to its end. The turn in the volume makes me think that increasing market participation is on the horizon, and if credit markets are any guide to go by, chances are stocks will move higher next.

The Credit Markets' Point of View

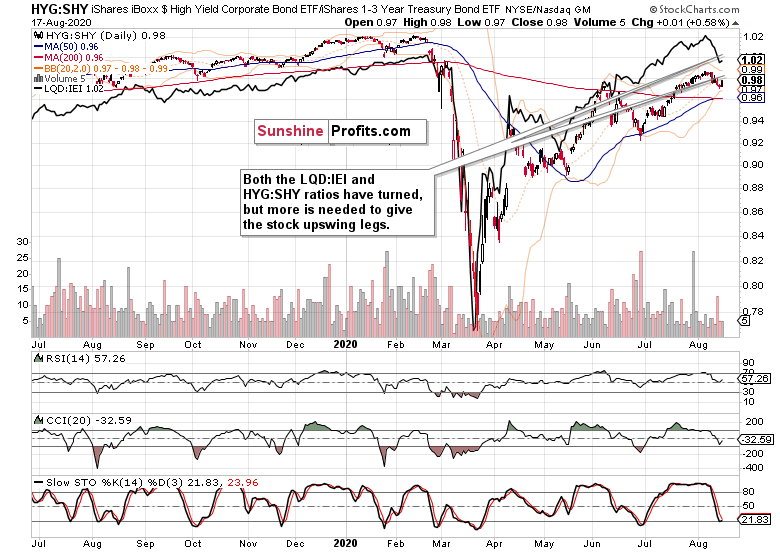

High yield corporate bonds (HYG ETF) have turned, though the volume didn't convince just yet. Coupled with sideways to higher price action next though, is what would lend more credibility to the credit market upswing, which is by the way mirrored to a certain degree with the stabilization in investment grade corporate bonds (LQD ETF).

Both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - have risen yesterday.

Should such encouraging price action continue (and looking at Treasuries, chances are it would), that would take some pressure from the still relatively extended S&P 500 prices when compared to the HYG:SHY ratio.

In other words, less headwind for the stock uptrend.

Summary

Summing up, the S&P 500 upswing still has higher odds of continuing than not, and the reasons go beyond the nascent turnaround in the credit markets including the PHB:$DJCB ratio. The Russell 2000 keeps acting strong, and emerging markets have assumed leadership among the stock indices. Copper refused to decline yesterday yet again, and Baltic Dry index is also rising. Put/call ratio has turned higher, giving firepower to the less crowded bullish side of the trade than was the case a few days ago.

As I wrote yesterday, the economic recovery story is gaining traction, and stocks are likely to be helped in their upswing once long-dated Treasuries level off, which they are doing as we speak. Given technology performance, the stock bulls aren't looking to be holding the short end of the stick.

Trading position (short-term; futures; our opinion): long positions (100% position size) with stop-loss at 3370 and initial upside target at 3400.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.