U.S. stocks recovered Monday’s losses and kicked off December with more gains. The rallies we saw in November continued on to start the final month of 2020 - a year which has been quite trying and difficult.

News Recap

- The Dow Jones, which jumped as high as 400 points to hit a new intraday high, closed up 185.28 points, or 0.6%, to 29,823.92. The S&P 500 notched a record closing high and also rose 1.1%, while the Nasdaq gained 1.3% and also closed at a record high.

- Sentiment was boosted after lawmakers revealed on Tuesday a $908 billion stimulus plan that includes over $200 billion in Paycheck Protection Program small business loans.

- Additional vaccine news helped spur the markets as well, after Pfizer and BioNTech applied to the European Medicines Agency for conditional marketing authorization of their coronavirus vaccine. This could potentially put the vaccine to full use in Europe before the end of 2020.

- Electric-car maker Tesla (TSLA) gained 2.7% after S&P announced that the stock would be added to the S&P 500 index on Dec. 21 in a single step, despite the company’s large size. Apple (AAPL) also rose 3% along with Intel (INTC) to lead the Dow higher. Communications and financials led the S&P 500, rising at least 1.9% each.

- Zoom Video (ZM) was the laggard of the day and fell 15.3% despite reporting better-than-expected earnings for the third quarter.

- Markets picked up where they left off in November. The Dow rallied 11.8% in November, posting its best one-month performance since January 1987. The S&P 500 and Nasdaq also rose 10.8% and 11.8%, respectively, for their strongest monthly gains since April. After November’s gain and Tuesday’s rally, the S&P 500 is now up 13.8% for 2020.

- Value stocks and small-caps led last month’s rally since these are stocks largely reliant on an economic comeback. The vaccine news of the last several weeks buoyed the sentiment. The iShares Russell 1000 Value ETF (IWD) rallied 13.4% for the month, and outperformed its growth counterpart, the iShares Russell 1000 Growth ETF (IWF), by more than 3%. The small-cap Russell 2000 also had its best month ever and rose more than 18%.

- However, not all is well. Both Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin spoke before Congress on Tuesday, with Powell stating that the economic outlook for the U.S. was “extraordinarily uncertain,” and that the surge in COVID-19 cases “could prove challenging for the next few months.” Powell further said that a full economic recovery is unlikely until people feel safe and confident.

- Additionally, according to data compiled by Johns Hopkins University, more than 13 million COVID-19 cases have been confirmed in the U.S. along with over 266,000 deaths. Shutdown and emergency measures continue to be reimposed worldwide and in the U.S. Most recently, New York Gov. Andrew Cuomo’s announced that the state was reimplementing emergency hospital measures.

- ISM data also showed that U.S. factory growth slowed in November. Although figures pointed to expansion in the overall economy for the seventh month in a row, according to the ISM Manufacturing report, the PMI for the US fell to 57.5 in November from a two year high of 59.3 in October. Figures came in slightly lower than market forecasts of 58.

There will be optimistic days where investors rotate into cyclicals and value stocks, and pessimistic days where there will be a broad sell-off or rotation into “stay-at-home” names.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, and optimism and relief will permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would be like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening, such as small-caps, should thrive.

It is a simple fact - markets will continue to wrestle with the negative reality on the ground and optimism for an economic rebound in 2021. While more positive vaccine news continues to trickle in day by day, there is still discouraging COVID-19 news, economic news, and geopolitical news to consider. Amidst the current fears of a double-dip recession with further COVID-19-related shutdowns and no stimulus, it is very possible that a short-term downside persists. However, Tuesday’s stimulus update offered some kind of hope. Due to this tug of war between good news and bad, any subsequent move downwards will likely be modest in comparison to the gains since the bottoms in March and since the start of November. It is truly hard to say with conviction that another crash or bear market will come. If anything, the constant wrestling match between sentiments will keep markets relatively sideways.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible. But it is hard to say with conviction that a big correction will happen.

I decided to do something a little bit different for today’s newsletter. Rather than examining the broader indices, I decided to kick off December with an assessment of the driving and diving sectors of the broader market. I will discuss some of the most important sectors moving the markets, and what my short-term, mid-term, and long-term outlook is.

Driving

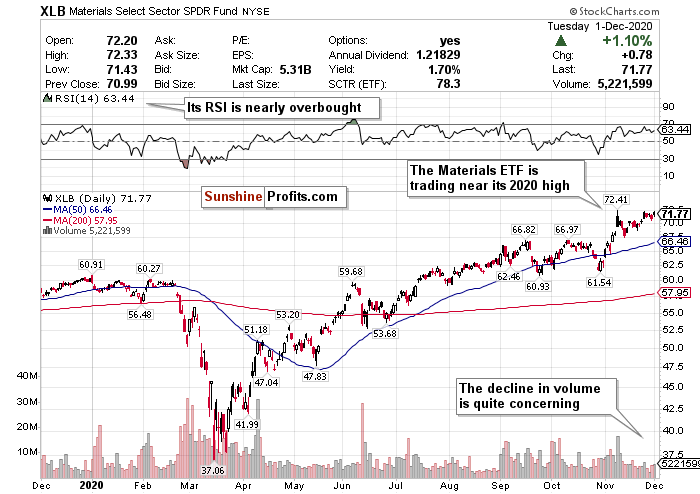

Materials (XLB)

The materials sector, as represented by the XLB ETF, has been one of the largest beneficiaries of the vaccine rally. Investors have been so bullish on materials and any resulting vaccine prospect, that the XLB ETF is trading near its 2020 high. Although the ETF somewhat pulled back yesterday, it gained 1.10% today.

Cyclical sectors such as materials are set to be the biggest winners from an economic reopening in 2021. But similarly to the S&P, there are signs of weakness and sustainability in the rally. The volume has plummeted, the RSI is nearing overbought territory, and there are simply not enough economic fundamentals to go off of. The continuation of the run that materials have been on largely depends on the global economic recovery and if a COVID-19 vaccine can be safe and scalable. If this happens and a double-dip recession can be averted, then materials will surely boom further. For the time being there is too much uncertainty to make a conviction call, therefore, this is a HOLD for the short-term. However, I am considerably more bullish on materials in the long-term.

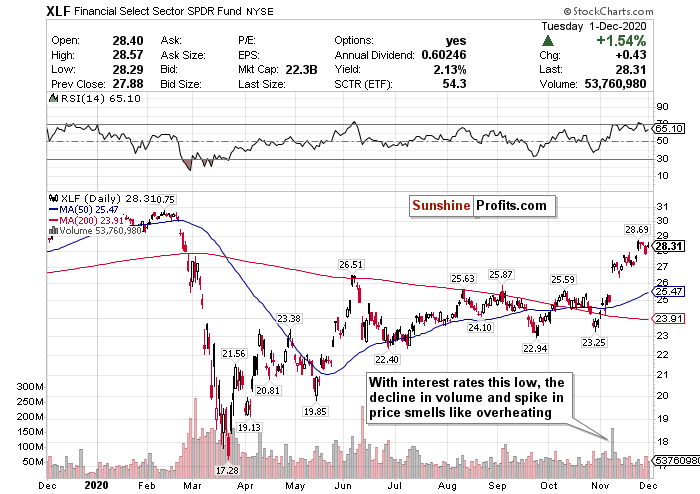

Financials (XLF)

No sector has performed as well as energy in November, outside of financials. With optimistic sentiment on businesses fully re-opening in 2021, banking stocks have surged. Furthermore, higher quality loan applications have fueled the rally.

But buyers beware. Interest rates are still at unprecedented lows and will not change until possibly 2022-2023. Interest rates are a huge driver of banking revenue, and until these rates start rising again, profit margins will continue to narrow. Despite this, there is another tailwind for banking stocks that could push them higher - the influx of new investors and new money in the markets. There has been such an influx of new retail investors with fear of missing out on the rallies, that certain big investment bank stocks have seen record growth.

I worry about overheating in this sector - judging from its RSI, decline in volume, pricing position relative to its moving averages, and proximity to its 2020 high. Without rising interest rates, it’s hard to fully justify the gains.

The theme of mixed sentiment continues for this sector. However, because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for at least the next year or two, I have this at a SELL. Take the profits while you can.

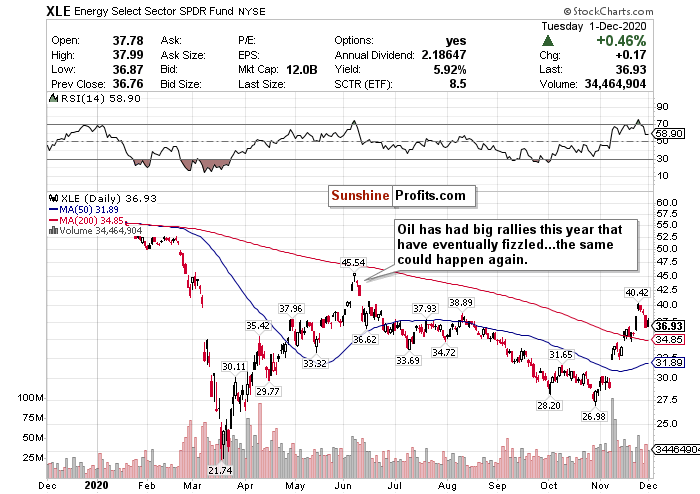

Energy (XLE)

Energy was the best performing sector in November. Largely fueled by holiday travel, and optimism that fuel demand could return to normal levels in 2021, energy witnessed robust gains for the month. However, there are simply too many headwinds to be overly euphoric. Although crude reached its highest levels in months last week, it has somewhat pulled back this week due to delays and issues with the OPEC+ production agreement.

Additionally, while energy is still largely undervalued, nobody truly knows what oil’s long term prospects are with the increased adoption of renewable energy.

This is not the first robust energy rally that we have seen this year. Energy’s last rally from the bottoms of March to June saw similar types of gains that eventually fizzled. While there is vaccine optimism now that was missing before, conditions are largely the same on the ground with regard to COVID-19 and travel demand. Therefore, my call is to take profits and SELL.

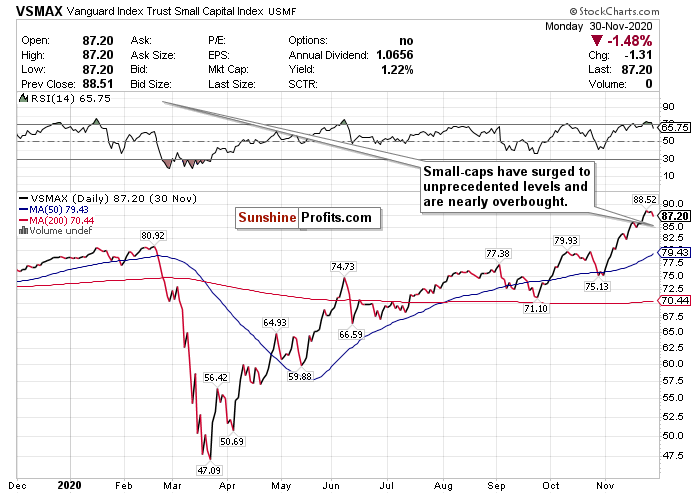

Small-Caps (VSMAX)

Small-caps were the biggest winners in November outside of energy. What makes this market rally different from the rally in April/May, is that small-cap and cyclicals have led it rather than tech. This is a bullish sign for an economic recovery and shows that investors are optimistic that a vaccine will return life to more normalcy in 2021. As mentioned before, the small-cap Russell 2000 had its best month ever in November and rose more than 18%.

However, from the chart, it’s pretty evident that small-cap stocks have overheated in the short-term. These are stocks that will “sell the news” more so than other stocks and will experience more volatility in the short-term. I would HOLD in the small-term, and maybe take some profits if you can - but do not fully exit these positions. BUY for the long-term recovery on a pullback.

Diving

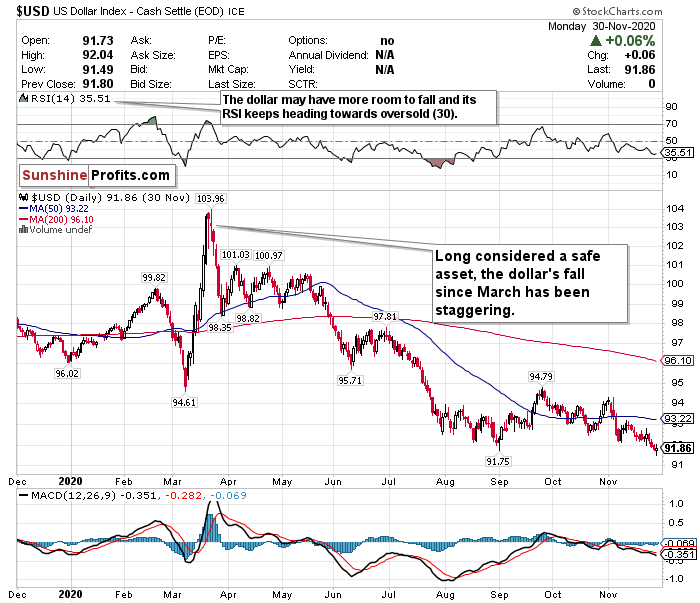

US Dollar ($USD)

The US Dollar ticked back up somewhat today, but still remains around its 7-month low, and its lowest level compared to a basket of currencies in over two years. The dollar’s plunge in excess of 10.5% since peaking in March has been staggering.

Many believe that the dollar could fall further as well due to a multitude of headwinds.

If the world returns to relative normalcy within the next year, investors will continue to be more “risk-on” and less “risk-off.” Which means that the dollar’s value will inevitably decline further.

While it is too early to call the dollar’s decline as the “demise of the world’s reserve currency,” all of the economic stimulus that has been pumped into the markets combined with record low-interest rates, will hurt the dollar’s value in both the short-term and long-term. Furthermore, another stimulus package is all but a certainty and will cause more drops in the dollar’s value as well. Strategists at Goldman Sachs predict a further 6% decline over the next 12 months, ING analysts forecast as much as a 10% drop, and most notably Citigroup predicts a shocking 20% drop in 2021.

This plunge is concerning both in the short-term and mid-term for the US economy. A declining dollar means the strengthening of other foreign currencies such as the Yen or Yuan. Although US Treasuries have somewhat recovered, this could mean bad things for their values as well.

The plunge of the dollar has been so severe that it is currently trading below both its 50-day and 200-day moving averages. Furthermore, its 200-day moving average is considerably higher than its 50-day, further illustrating the sharp decline.

While the dollar may have more room to fall, according to its RSI, it is approaching oversold territory. Although the dollar’s RSI did not move much on Tuesday, pay close attention to it over the coming weeks. If the USD’s RSI drops below that oversold 30 level, there may be an opportunity to buy the currency at a bottom or near bottom. However, for the time being, there may be more room for the world’s reserve currency to fall and...

For now, where possible, HEDGE OR SELL USD exposure.

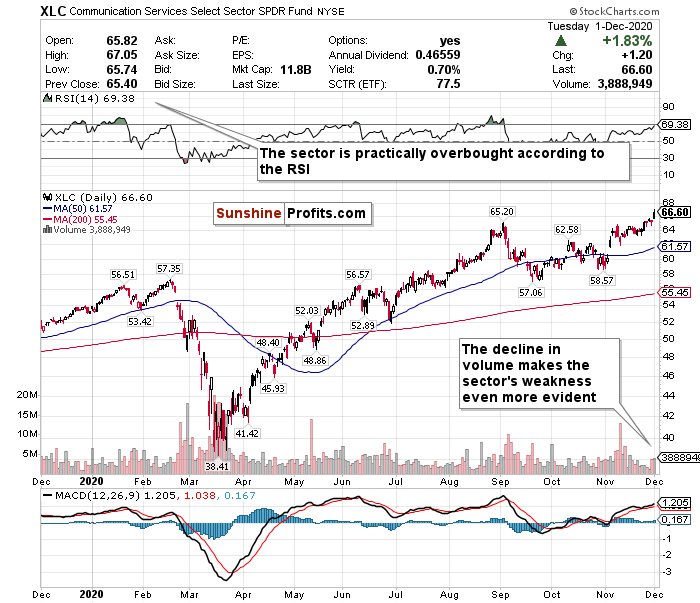

Communication Services (XLC)

Communication services have not rallied as much as other sectors. Despite Tuesday’s rally, the sector continues to trade relatively sideways. There are serious overvaluation concerns, as its RSI indicates that it may be overbought. The decline in volume has also been sharp and swift. For the long-term, communications stocks have largely underperformed other sectors as well. It’s hard to foresee how this sector will truly benefit from a vaccine rally relative to other sectors, therefore, I give it a SELL call.

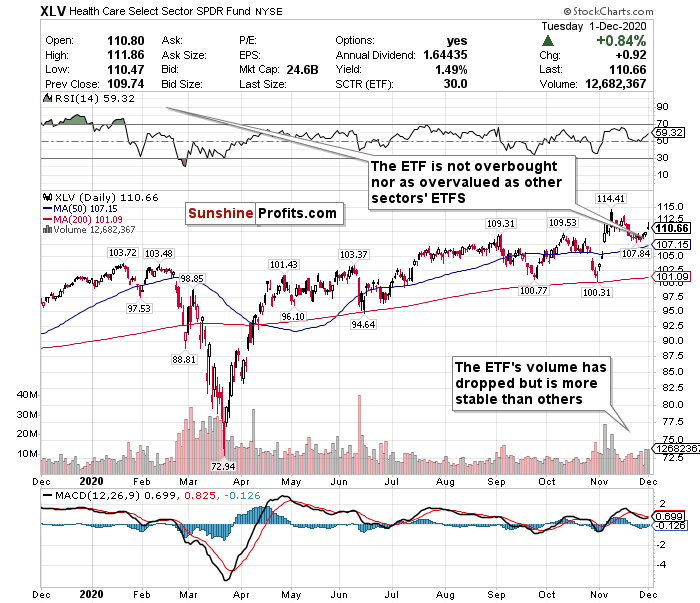

Health Care (XLV)

Although healthcare should in theory benefit from a vaccine, it continues to be one of the market’s biggest underperformers. Although a vaccine will cause short-term surges in companies that are directly involved in vaccine production and distribution, it will not be a profit driver long-term for these companies. Additionally, the vaccine will only benefit a few companies while the rest of the sector lags. The pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon.

Outside of a few companies, it’s simply hard to see the upside in healthcare now. However, according to the chart, the volume is stable, the ETF isn’t terribly overvalued, and it is not as close to overbought territory as other sectors. While there will not be as much upside in this sector as others, there will not be as much volatility either. Therefore, I give this a HOLD call.

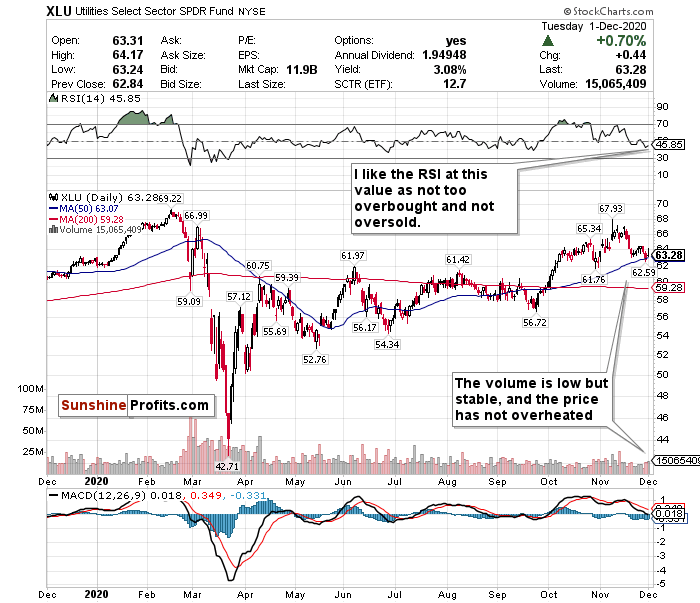

Utilities (XLU)

Utilities is a classic sector for defensive investors. It is a sector that does not move much, either upwards or downwards, and is generally a safe place to park your money. However, investors have increasingly fled this sector towards more risk-on investments. Yet in the short-term and long-term, this sector may be a good hedge against volatility and bad news, and may be a good sector to invest in for exposure to renewable energy and 5G.

According to the chart, this is possibly the best sector in the market to find value right now as well. Utilities are not exciting and they will not give you robust returns. However, these are stable investments - if not boring. They do not pose the same type of overheating risks as other stocks, such as small-caps and energy. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much upwards or downwards.

Summary

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the vaccine/treatment front poses significant optimism for 2021 and beyond. Although jobless claims underwhelmed last week for the second week in a row, and are at their lowest point in 5 weeks, the long-term outlook for equities, namely value stocks, and cyclicals, could be very positive.

November has ended, and we are thankfully in the home stretch of 2020. This has been a year filled with turmoil and pain, and will hopefully end with happiness and optimism. But COVID-19 will not disappear before 2021 begins, and may be here with us a little bit longer. But if November showed us anything, it’s that there is finally a light at the end of the tunnel. However, until COVID-19 is brought under control or disappears, there will be a continuous tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road. However, it is very plausible that there could be some short-term uncertainty and volatility mixed in. But please remember how sharp and swift the rally was after the crashes in March. Since the markets bottomed on March 23rd, the Nasdaq is up 84%, the S&P is up 66%, and the Dow is up around 63%. In the long-term, markets always end by moving up, and are focused on the future rather than the present.

The additional vaccine news from Pfizer and BioNTech was encouraging. It may be a matter of days or weeks before the vaccine can finally be rolled out to essential workers and high-risk individuals. However, when will it be scalable to the mass public? Can the vaccine be safely and effectively mass distributed? Will there be complications?

If everything goes well with the vaccines, and the virus can be somewhat contained, the short-term volatility may be worth monitoring for opportunities before the eventual mid-term and long-term reality turns positive and stable in 2021.

To sum up all our calls, I have a BUY call for:

- Small-Caps (VSMAX) - but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- S&P 500 (SPY)

- Materials (XLB)

- Small-Caps (VSMAX) - in the short-term

- Health Care (XLV)

And I have SELL calls for:

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist