Hi Folks,

A quick message and update today, as the Fed has thrown some monkey wrenches into the equity markets this week.

As of 10:37 AM ET June 18, 2021:

- SPY has crossed below its 50-day simple moving average ($417.38 today). The 50-day SMA has held up well on previous attempts. If you have been waiting for a pullback in the SPY, here it is. The Fed has changed perceptions this week, but the overall trend is still higher in the index. Even though it feels like the sky is falling, let’s take the emotion out and consider trying what has been working on repeated occasions at or near the 50-day simple moving average.

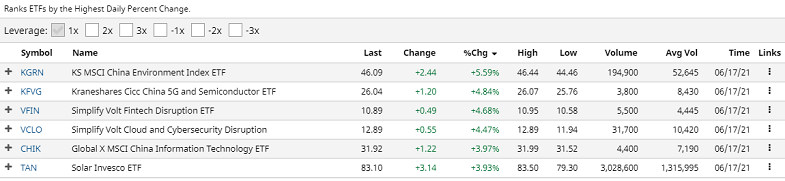

- TAN was explosive yesterday, and was the 6th best performing ETF of all non-leveraged ETFs in yesterday’s session. Thoughts are to stay long this name.

- WOOD traded through the bottom end of our upper opinion range; which is ok, as we are approaching it on a scaling basis, with our next target to add another tranche around $79.07 - $80.00 levels at this time.

Q: Just a few questions for Rafael. Thanks for the alerts. made a killing on TAN calls but lost half as much in DIA tanking today. Can you give a bias on DIA (DJI Index) as we go along. Do you believe the 50ema has any strength?

Other questions my account is pretty small at 3k USD, is there any way you could make a priority/certainty on your positions, length (swing, day trade or investment), target, stop, and any potential options position you would take with a small account - i like using long calls a lot and am just getting to know defined risk vertical credit/debit spreads.

I'm having trouble developing a bias towards certain indexes. The top of the IWM range worries me since it never drastically oversold under the monthly range.

Thank you very much,

-Andrew

A: Thanks for writing in, Andrew! This week is a unique one for sure, with the Fed providing new guidance for interest rate hikes that seems to have the market in a bit of a tizzy. Regarding the DIA, I have not been following it as closely as the SPY lately. While I cannot provide any investment advice, I can say that the DIA does look oversold based on the RSI(14), with a reading around 29.06 as I write this. This doesn't mean that it can’t move further to the downside. I also see that it has broken the 50 Day EMA that you mentioned (around $339.77).

Thank you for your suggestions and questions. Regarding long calls, that can be a tough strategy when implied volatility spikes (like we are seeing now). It tends to make calls more expensive because of the higher implied volatility. My initial thoughts are to refrain from long calls in the indices on a day like today, until there is a more clear direction of the overall markets based on the new Fed information. Perhaps in the future, we may cover some options ideas. However, due to the higher risks and experience required in trading options, it is not for everybody.

Regarding IWM, I know what you mean. All of the equity indices are taking it on the chin today. Again, while I cannot provide any investment advice, I would suggest avoiding using any leverage right now (including options) until the market gets a chance to further digest the news of this week.

I am glad to hear that you found the TAN analysis useful. Have a great weekend!

Below are updates on the markets we are currently following:

To sum up the current viewpoint and opinion:

I have BUY opinions for:

- iShares Trust Russell 2000 ETF (IWM) for an index reconstitution trade. At this time, I would be looking to be long and then exiting upon the actual reconstituted index going into place on June 28, 2021. Buy the rumor, sell the fact type of trade. Buy Pullbacks. For equity-bearish folks, see the IWM/SPY spread idea in the May 27th publication. Always use a stop loss level that caters to your individual risk tolerance.

- Update: 06/18: Equity indices are all in the red and the IWM is @ $223.62 the last time I checked. It is getting closer to the $223.36 level when initiating coverage. Opinion: stay long and avoid emotion. Let’s see if it can recapture its 50 day SMA by the close today.

- Defiance Quantum ETF (QTUM) between $44.00 - $49.50. Update 06/16: QTUM closed at $49.43 on Monday. In case you missed this one, I think there is still time to get on board and will raise the buy idea zone to $44.00 - $49.50. It looks like it wants to break out of its range soon, but could find some sellers at the psychologically important $50 level. Update 06/18: If you are following this one, sit on our hands and see if it can test the 50 day SMA (currently $47.77) Always use a stop loss level that caters to your individual risk tolerance.

- Amplify Transformational Data Sharing ETF (BLOK) between the 200-day moving average and $40.00 200-Day Moving Average is currently $39.49. BLOK has a history of high volatility, so proceed with caution. Always use a stop loss level that caters to your individual risk tolerance. Update 06/18: Waiting for lower prices.

- Invesco MSCI Sustainable Future ETF (ERTH) between $67.76 - $70.82. Always use a stop loss level that caters to your individual risk tolerance. Update 06/18: ERTH had a last trade of $75.70 today. Hold longs. Chugging along. If you missed this one, let’s see if we can get a pullback to the 50-day moving average, which currently sits at $74.04. I am liking this one more and more for a long-term holding and will be willing to hold through short-term pullbacks at this time.

- Invesco Exchange-Traded Fund Trust - S&P SmallCap 600 Pure Value ETF (RZV) at the 50-day moving average. Patience and wait for the pullback. Always use a stop loss level that caters to your individual risk tolerance. Update 06/18: RZV 50-day MA is 92.91 today. There may be a potential entry opportunity. Always use a stop loss level that caters to your individual risk tolerance.

- iShares Global Timber & Forestry ETF (WOOD) Initial buy idea zone between $79.07 and the 200-day moving average ($79.72 as of 06/15 close). Update 06/16: Given the price action in the lumber futures described in today’s alert, consider an entry into ½ of a normal position size between $86.50 - $87.50. Should it pull back further, we can look to add another ½ position size. Update 06/18: WOOD traded through our first tranche idea level. Now, should it proceed lower, we may consider looking to add the other half of the position between $79.07 and $80.00. Always use a stop loss level that caters to your individual risk tolerance.

- SPDR S&P 500 ETF (SPY) between $412.26 (61.8% Fibonacci retracement level) and the 50-day moving average ($416.58 as of the close on June 15th). Update 06/18: See above. Always use a stop loss level that caters to your individual risk tolerance.

- Invesco Solar ETF (TAN) between the 50-day moving average ($80.32 as of June 14th) and $81.50. Look for an intraday pullback for entry. Update 06/16: We wanted a pullback and we got a big one on Tuesday, with the range being $78.00 - $80.69. Ideally, this was taken advantage of on this pre-Fed meeting day. There could have been some “sell the news” price action with the SEIA report being released yesterday. Although we are below the 50-day MA, I like the previous consolidation and would look to be long at these levels. Always use a stop loss level that caters to your individual risk tolerance. Update 06/18: See above.

I have SELL opinions for:

NONE

I have a HOLD opinion for:

- First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID). GRID has traded through our idea range of between $86.91 and $88.17. Update 06/16: GRID closed at $92.06 yesterday, bucking the trend of the overall down day. That is excellent price action. Update 06/18: 50-day SMA is sitting at $89.29. If you wanted a pullback for entry, you may have it today. .Opinion: hold longs.

- Always use a stop loss level that caters to your individual risk tolerance.

Have a great weekend. Let’s give this market time to digest the news before considering taking a different stance. Right now, it is just a pullback in a healthy bull market.

Thank you,

Rafael Zorabedian

Stock Trading Strategist