Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Previous Monday, stocks declined as well – yesterday is thus no precedent. Yet both cases have important differences – a week ago, the volume wasn't as high and there was no lower knot. Yesterday, the bulls stepped in and erased almost half of intraday losses.

Does it mean they're out of the woods already? I am not so sure about the short run – after all, the solidly above 3400 levels in the S&P 500 futures were given up, and the 3400 which I see as key, is being probed from below. Thus far successfully as stock futures trade at over 3405 as we speak.

But a lot more has to happen, and ideally today or shortly in order to prove my yesterday's observations as correct in the mid-term:

(…) Elections are here in two weeks, and the S&P 500 keeps being resilient – above 3400. It doesn't matter right now that I looked (and look) for it to be so (though should the 3400 area get broken, the resultant selloff would be likely sharp), but it's nothing short of a demonstration of the markets' collective wisdom given that more than half of Americans are preparing for a civil war.

This is indeed a stark choice the nation faces, and against the many polls, I'm making it clear today that I expect a Donald Trump landslide. Yes, this has serious and positive implications for the stock market. Can you imagine how the capitalistic system would take to Biden's increased social spending, Obamacare expansion, more progressive tax code, $15 an hour federal minimum wage or the Green New Deal?

I think that stocks anticipate the incumbent's win.

So, how dicey is actually the short-term outlook?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

The stabilization as seen on the daily chart, gave way to heavy selling. Is that a disaster? I don't think so. In the second half of September, there was a similar day with a long lower knot too.

And what happened then? A retest combined with a slight undershoot of the preceding lows – and then a rebound that hasn't looked back since. Such a scenario would fit the post-election rally from the timing point of view as well – approximately.

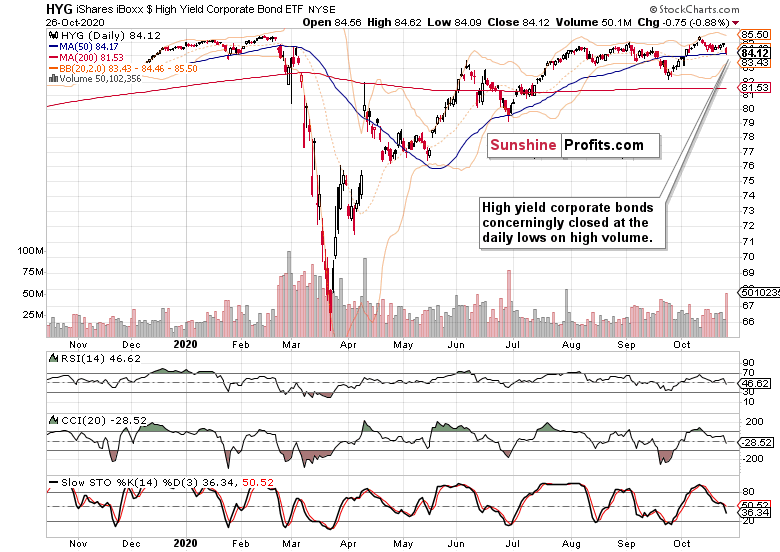

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) declined, and on extraordinary volume. Closing near the daily lows – but isn't that a puke point similar to end of June instead? This could very well be true, so let's see further whether a daily risk-off period hypothesis holds water or not.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved as if it was indeed a strong risk-off day only. I am not jumping to conclusions whether it's a daily occurrence or a turnaround – I'm strongly leaning towards the former and discounting the latter.

High yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio have weakened, but it's still in the context of a daily decline only. This is not a rollover, it doesn't look like one yet. Far from it, and I look for the ratio to support the stock upswing as we go.

The Dollar

While long-term Treasuries (TLT ETF) have risen sharply, the dollar can't seem to shake off its blues while the precious metals are holding up fine, and copper is readying another move higher. These factors point to a kneejerk reaction yesterday, and favor a modest S&P 500 recovery today.

Summary

Summing up, stocks declined sharply yesterday, but I still see the move as temporary – the 3400 line that I see as critical in the short-run, has practically held. The Russell 2000 erased even more of its intraday losses than the 500-strong index, making me think that the time for the bulls to respond, is approaching.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.