Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Stocks extended their uptrend on Friday following Powell’s dovish speech at Jackson Hole. A local high may be close.

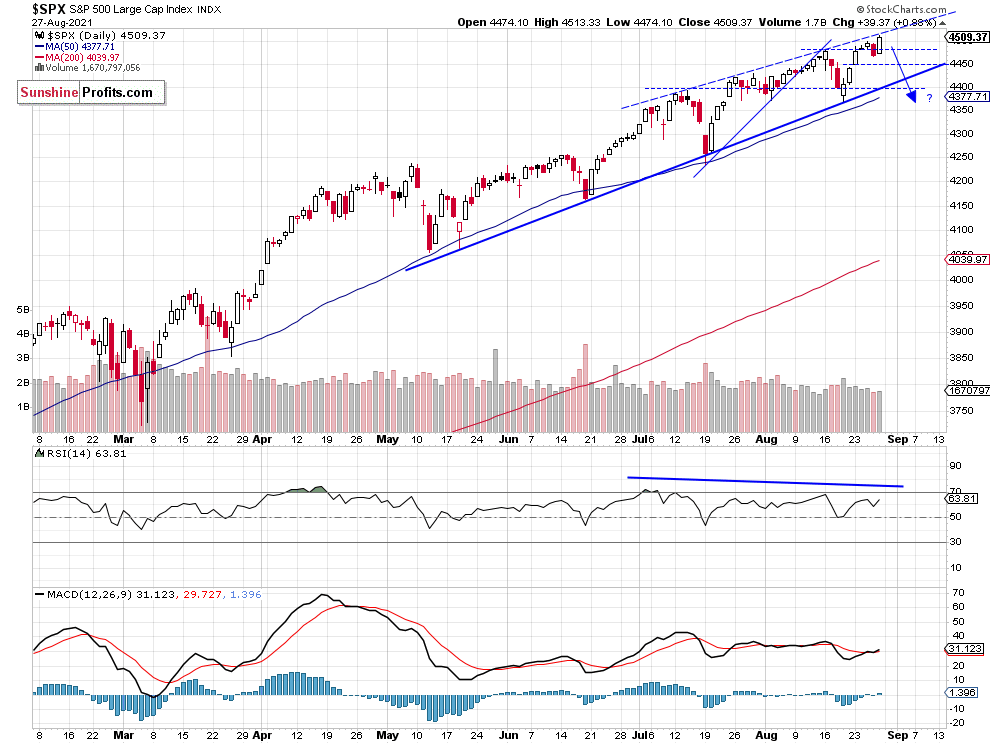

The S&P 500 index gained 0.88% on Friday (Aug. 27) after some dovish remarks from Fed Chair Powell at the Jackson Hole Symposium. On Thursday it lost 0.58%, so the net gain wasn’t that big. However, the index has managed to reach yet another new record high of 4,513.33. The market remains elevated following the recent run-up, so we may see a more profound profit-taking action at some point.

The nearest important support level of the broad stock market index is now at 4,500 and the next support level is at 4,465-4,470, marked by Thursday’s low. On the other hand, the resistance level is at 4,515 and the next potential level of resistance is at 4,550. The S&P 500 bounced from its four-month-long upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Climbs Along Medium-Term Trend Line

The S&P 500 index remains close to its almost year-long upward trend line. The nearest important medium-term support level is at 4,300, as we can see on the weekly chart:

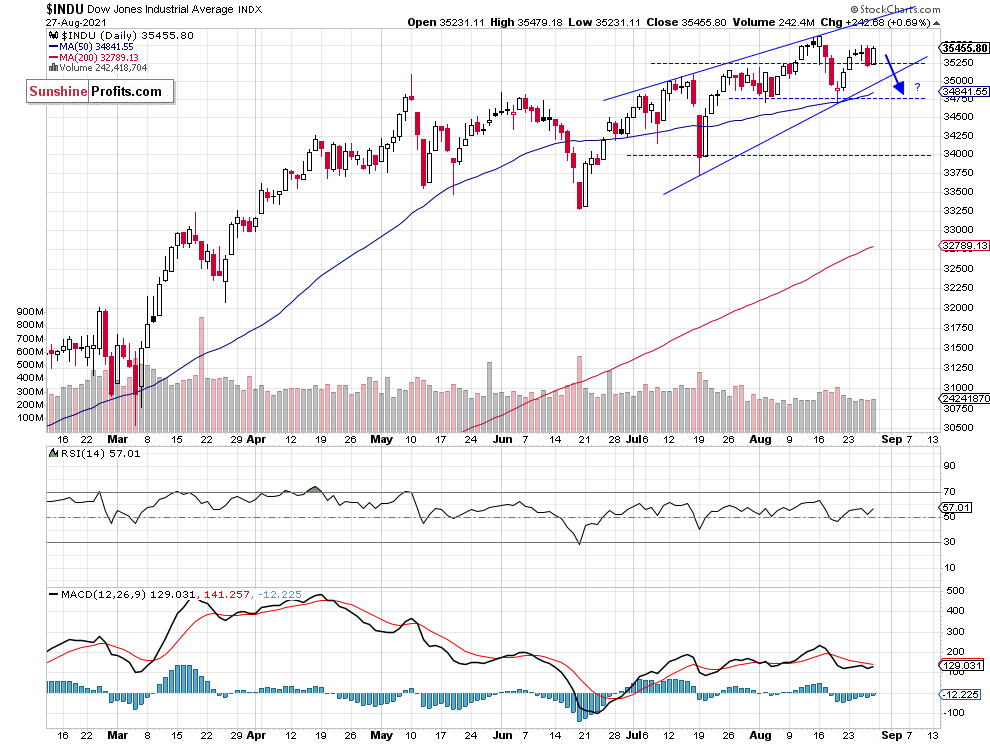

Dow Jones Remains Relatively Weaker

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index is trading within a potential rising wedge downward reversal pattern. Recently it was relatively weaker, as it didn’t reach a new record high like the S&P 500 and the Nasdaq. The support level remains at around 35,000, as we can see on the daily chart:

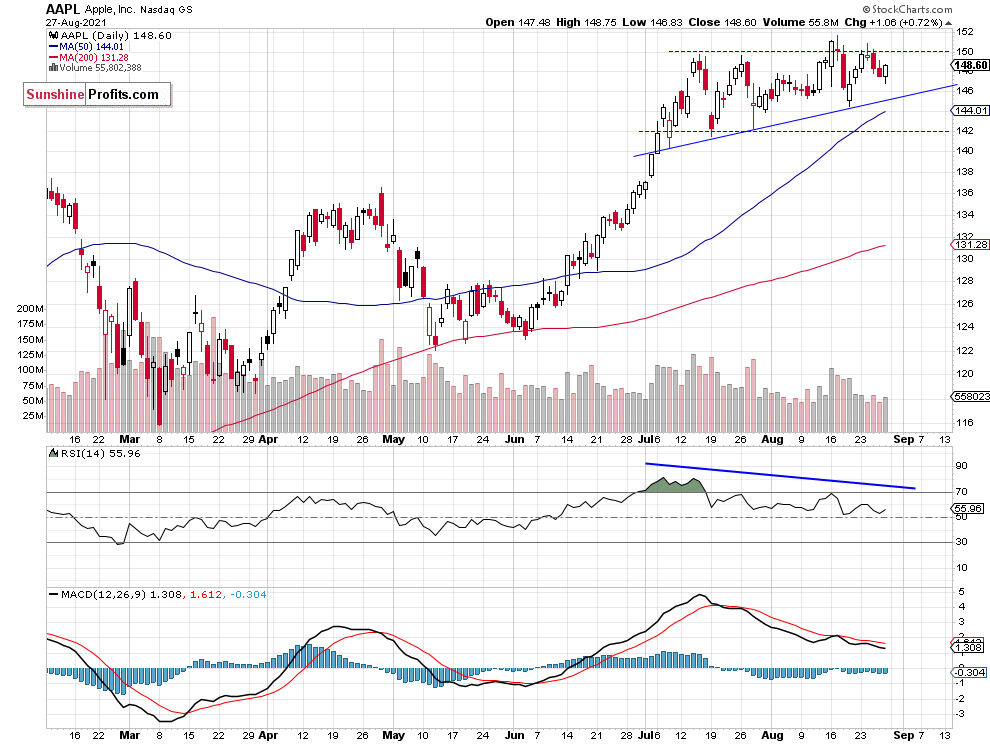

Apple’s Direction Will Be Important for the Market

Apple stock weighs around 6.1% in the S&P 500 index, so it is important for the whole broad stock market picture. It continues to trade within a consolidation along the resistance level of $150-152, marked by an August 17 record high of $151.68. The breakout direction may be significant for the stock market’s main gauges. We can still see negative technical divergences between the price and indicators. Overall, it looks like a medium-term topping pattern. The two-month-long upward trend line remains at around $145.

Short Position is Still Justified

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. The position was profitable before the recent run-up. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index reached a new record high on Friday, as it retraced its decline for that day. So, the dovish speech from Fed Chair Jerome Powell led to another record-breaking rally. However, the market seems short-term overbought and we may see some profit-taking action soon. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market extended its advance, as the S&P 500 index broke above 4,500 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting a 5% or bigger correction from the new record high.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care