Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

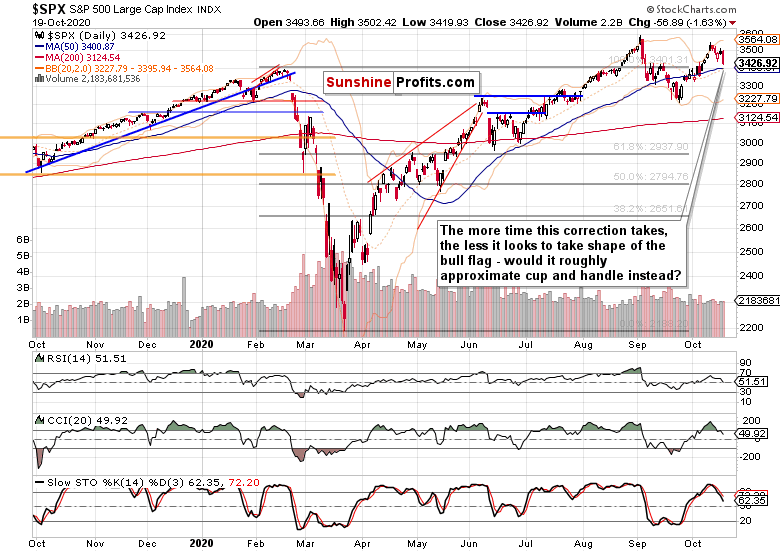

A bull flag, still a bull flag? Monday's price action is making me doubt that. It's starting to take a bit too long for a bull flag – unless you would want to measure it from the September lows. In which case, the formation would start to resemble cup and handle instead.

With much talk hitting the airwaves about the double top lately, some degree of anxiousness is understandable. But that's the short-term, and I ask whether it has the power to flip the medium-term outlook bearish. Yes, it's short-term concerning when momentum stemming from Thursday's intraday reversal is lost this easily, and prices move back to square one.

The ball is back in the bulls' court, and it's their turn to show they can stabilize the index solidly above 3440, and take it back to the spitting distance of 3500 where it reached yesterday.

While the charts show that's far from unthinkable (and actually highly likely if you step back and look at the dynamics at play), it could take more than a few days before that happens – unless stimulus fireworks arrive. Judging by my yesterday's article, I am not betting on that – and certainly not the farm.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Taking one look at the daily chart shows that the current correction might actually feel worse than it really is. No technically important level has been broken – but the Feb highs are in peril again.

The volume says no decisive battle has been fought yet. Will it, or will we see a similarly fast liftoff as on Thursday? I still see that as more probable than for yesterday's decline to continue long enough to force mid-term outlook reconsideration.

Credit Markets’ Point of View

Starting with the high yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio, we're not in a breakdown situation. I rather see second half of September as a false breakdown – an attempt that has been rebuffed. Stocks are just getting a bit nervous here in my view.

Long-term Treasuries (TLT ETF) on the other hand can turn up here again. While that wouldn't be a flight to safety in a risk-off rush, it could still put some short-term pressure on stocks. That's especially the case when the dollar is examined.

I talked recently quite a lot about the greenback woes and that the world reserve currency is likely to finish 2020 at lower values than it is currently trading at. At the same time, I said that it's ready to put up a fight here – and yesterday' lower knot coupled with the daily indicators, points at this possibility clearly, regardless of the USD index trading at around 93.25 currently.

The point is that the short-term move higher, which I see as approaching, will likely put some pressure on stocks. The way S&P 500 sectoral analysis looks at the moment, would make it likely.

Technology took a hit yesterday, healthcare and finance too – it was materials, industrials, consumer discretionaries and utilities that did the best lately. Beaten down energy might also surprise. Such a mix simply isn't conducive to a sharp stock upswing right now.

Peeking Under the $SPX Hood

The Force index has finally moved below the zero line. It took time, and the boundary wasn't defended successfully yesterday. Does it portend a sharp drop? No, not necessarily, no. Trying one's patience though? Yes, that's the camp I lean towards. Probably this sharp a daily move, is what could turn out to be the one and done by the bears – when it come to sharpness of a given move.

The daily advance-decline line paints a more cautious picture, especially if the sellers retake initiative, and erase today's premarket upswing. The above chart certainly shows that stock prices are under short-term pressure – pressure whose length and depth is being decided currently.

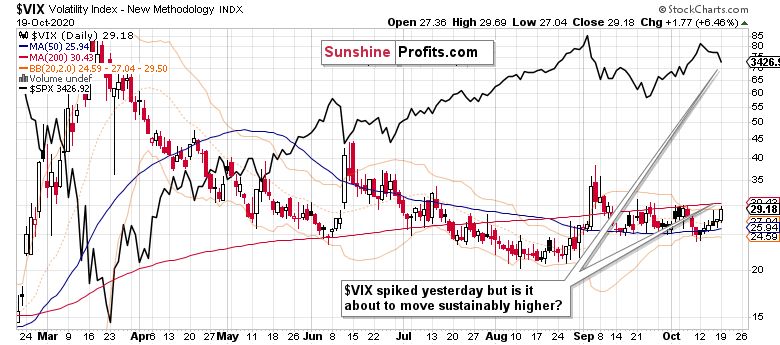

Volatility is highlighting that point nicely. The third larger wave of its decline after the early September spike, didn't get too far – the values haven't really profoundly declined. On the other hand, it can easily spike over 30-35 before calming down again.

Summary

Summing up, Monday's session presents a formidable short-term setback, and took away from the short-term outlook's clarity. Stock prices can go on hanging by the fingernails as one stimulus "deadline" after another passes, or can get under pressure fast. It's unclear how that would turn out right now, but (as I have been rarely saying over the last many months, now it's that right time to say so because the danger of a renewed downswing is here now) stocks can get under pressure quite fast.

Would that change the medium-term picture though? Despite the look of the week in progress, it's not my go-to scenario. Instead of greed, we're slowly approaching fear readings, all the time while the options markets keep being quite complacent. That tells me we're likely facing some kind of a renewed downturn next, but wouldn't the rebound be similarly hard to time because of how fast it would happen?

And what if the stimulus negotiations surprise on the upside? Neither commodities not smallcaps are selling off, and the dollar has to refute my cautious tone first. Stock bulls, prove yourselves.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.