Trading position (short-term; our opinion): Long positions (100% of the regular size), with stop-loss level at 3170 and the initial target price at 3400.

The chief suspect catalyst of yesterday's lower open in stocks, was the coronavirus cases spike courtesy of China's spread tracking update. Yet stocks smartly recovered their earlier losses, and once again reached for a new 2020 high. And in intraday terms, they've made it. Today's premarket trading is no different - another intraday 2020 high. Is this a case of parabolic buying?

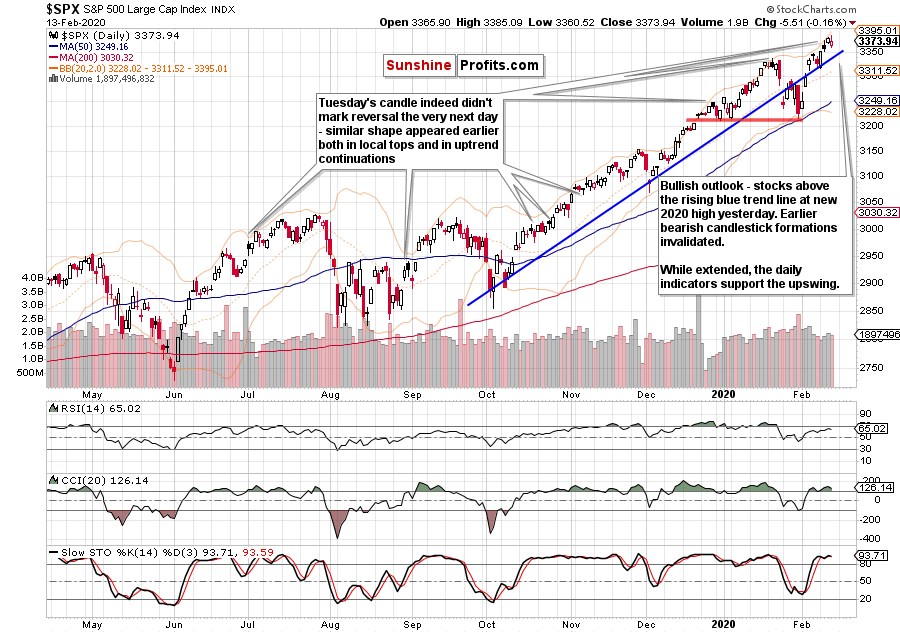

We'll examine the daily chart first (charts courtesy of http://stockcharts.com).

Let's recall our yesterday's observations as they're still valid today:

(...) Stocks reached a new 2020 high yesterday, hinting that Tuesday's candle marks uptrend continuation after all. Just take a look at the above chart again - it shows how many times were similar candles followed by renewed push higher.

Yesterday's opening losses in stocks turned out to be no more than a blip on the screen. The bulls are pushing them higher in today's premarket session as well. Stocks are trading comfortably above the rising blue trend line and the posture of daily and weekly indicators is unchanged. While extended, they're supporting the upswing.

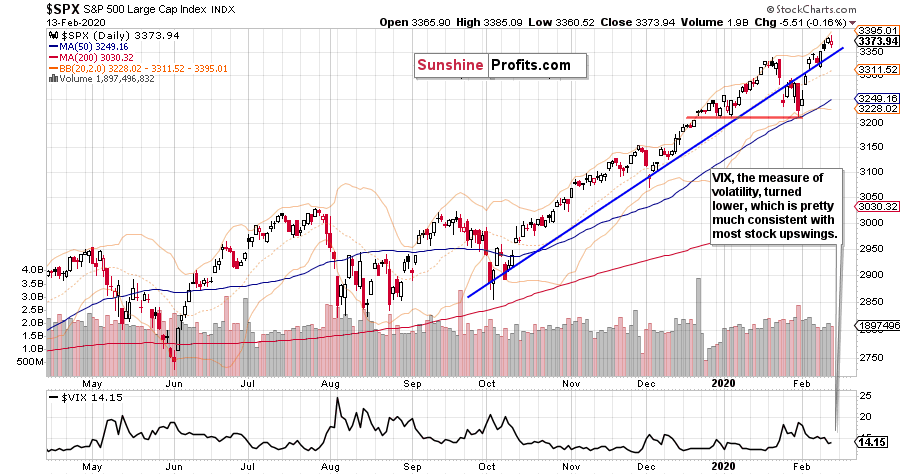

Does it mean that some kind of buying frenzy is underway? Let's turn to most people's favorite volatility measure to find out.

VIX is based on the implied volatility of S&P 500 option, and represents today's expectations about the market's future path. But as experience tells us, stocks usually go down faster than they move higher. Therefore, it's not surprising that the volatility measure turned lower as stocks have been making their way up - regardless of the intraday moves that you have seen on the above chart.

Not only it's not odd to see VIX turning lower, it's actually a hallmark of an uptrend that doesn't burn itself out while climbing higher and higher. Let's remember the following quote by the philosopher Lao Tzu: "The flame that burns twice as bright burns half as long". Applied to the current situation in stocks, it means that the upswing is wisely expending its bullish energy and is free from emotionality-driven spikes -thus, the best is yet to come.

As you have seen, the technical factors speak overwhelmingly in favor of the long position. The chart examination reveals a strongly bullish outlook, and the fundamental backdrop presented yesterday supports higher prices ahead as well.

Summing up, the S&P 500 outlook remains bullish. Price examination, weekly and daily indicators are sufficiently supported by the breadth indicators, and continue to favor upswing continuation. The VIX examination reveals that the move higher remains healthy and is far from getting extended. As the index keeps making and challenging new 2020 highs practically on a daily basis, any imaginable correction isn't likely to stretch below 3200 in our opinion. The currently open long position remains justified, and our aim is to let the many bullish factors in this stock bull market keep working to our benefit.

Trading position (short-term; our opinion): Long positions (100% of the regular size), with stop-loss level at 3170 and the initial target price at 3400.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care