Briefly:

Intraday trade: The S&P 500 index gained 0.1% after opening 0.1% higher on Monday. The broad stock market will likely open higher this morning. We may see more short-term fluctuations following the early June rally.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes gained 0.1-0.6% on Monday, as they continued to trade within a short-term consolidation. The S&P 500 index gained more than 180 points from its previous week's Monday's local low recently. It is currently 2.2% below its May the 1st record high of 2,954.13. The Dow Jones Industrial Average gained 0.1% and the Nasdaq Composite gained 0.6% on Monday.

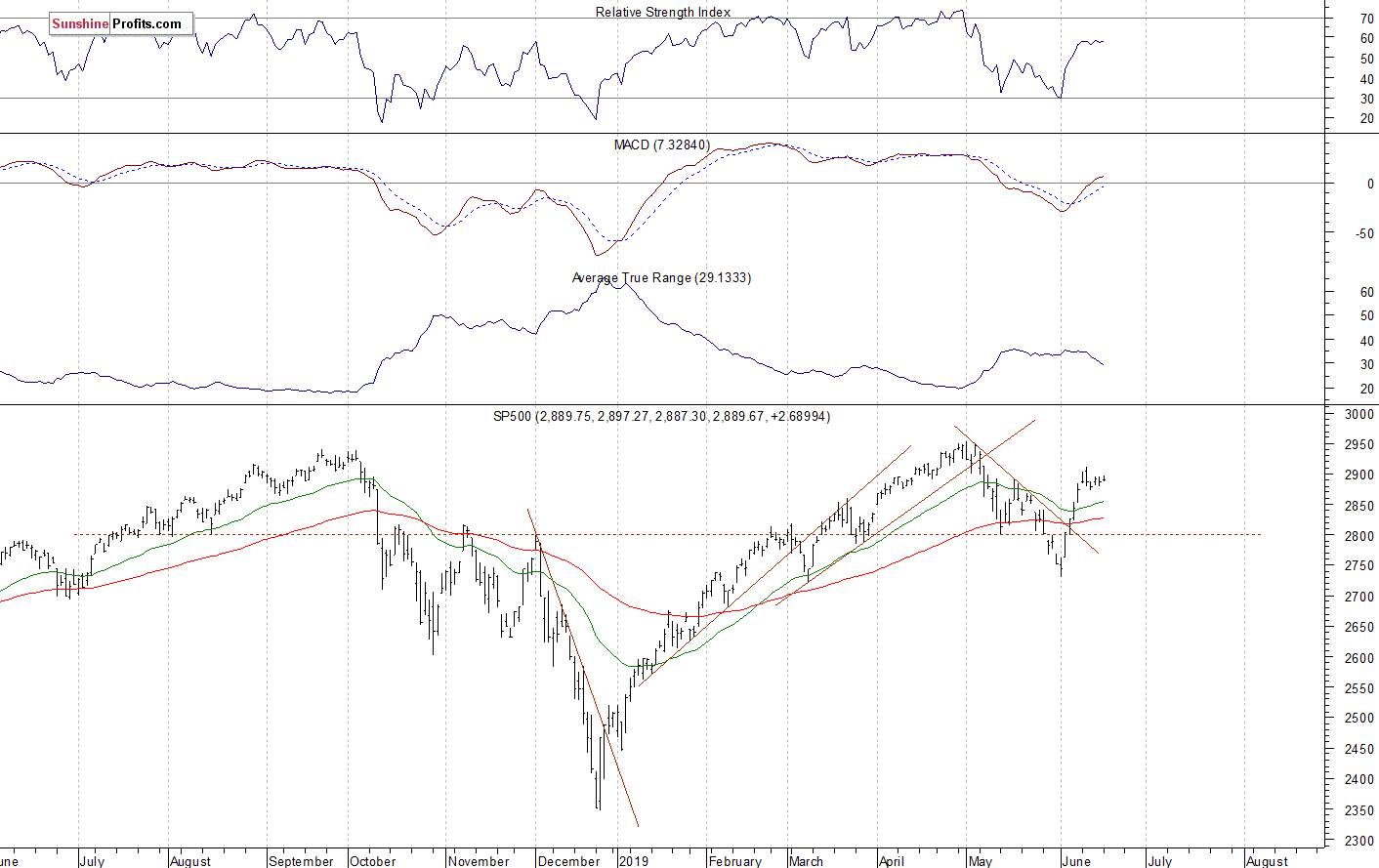

The nearest important resistance level of the S&P 500 index remains at 2,900-2,910. The resistance level is also at 2,930-2,950. On the other hand, the support level is at 2,875-2,880. The next support level remains at 2,830-2,850.

The broad stock market broke above the last year's high in the early May. But then the S&P 500 index retraced all of the April's advance. The market also broke below its two-month-long upward trend in the early May. And then it got back higher following breaking above the month-long downward trend line:

Positive Expectations

The index futures contracts trade 0.4-0.9% above their Monday's closing prices, so the expectations before the opening of today's trading session are very positive. The European stock market indexes have gained 0.8-1.4% so far. Investors will wait for some economic data announcements today: Building Permits, Housing Starts at 8:30 a.m.

The broad stock market will likely continue to fluctuate within a short-term consolidation. We may see an attempt at breaking higher. However, investors will likely wait for tomorrow's Fed's Rate Decision release.

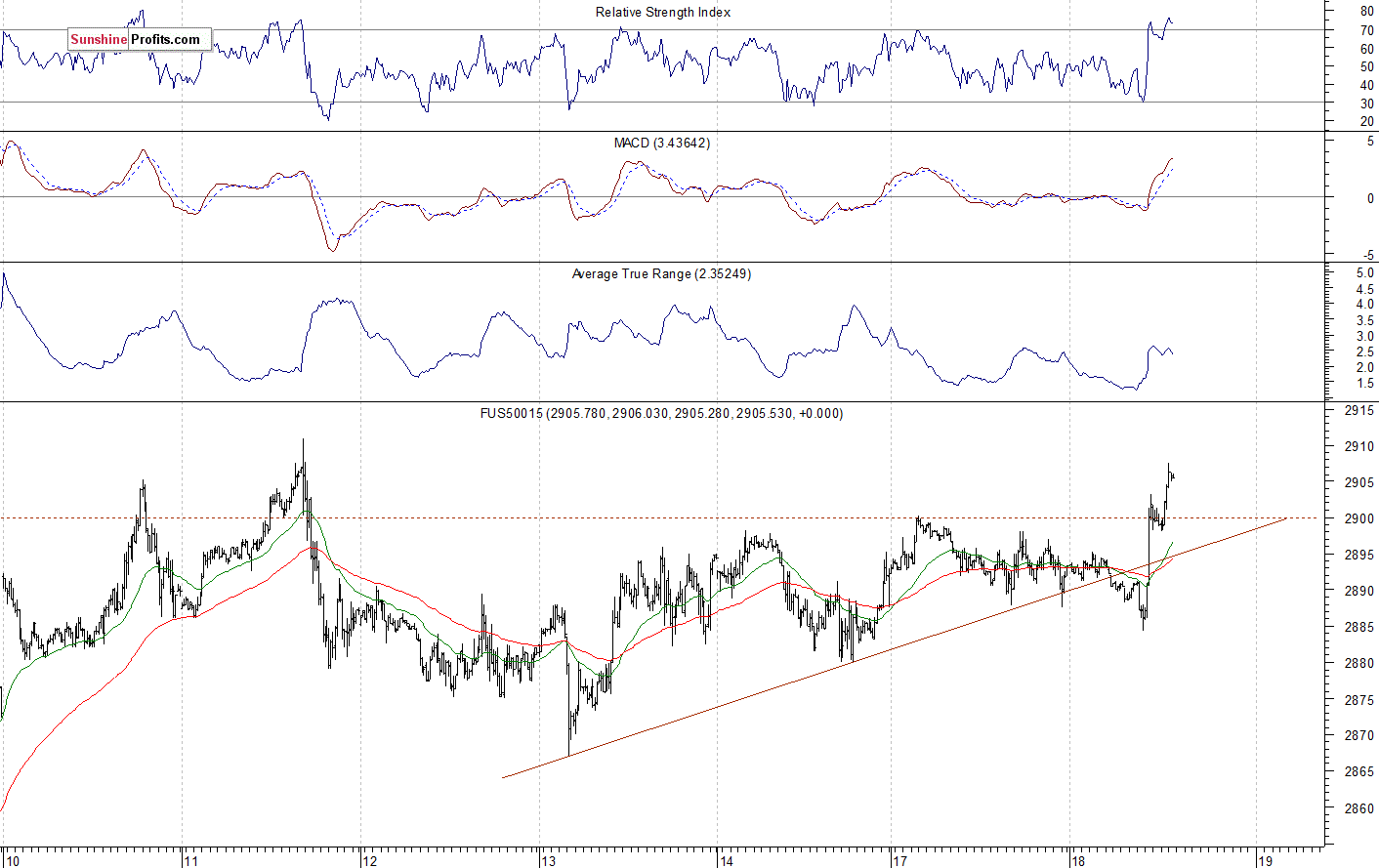

The S&P 500 futures contract trades within an intraday uptrend, as it breaks above the recent local highs. The market is now slightly above the 2,900 mark. On the other hand, the support level is at 2,885-2,890, marked by some short-term local lows. The futures contract is above the 2,900 mark again, as the 15-minute chart shows:

Nasdaq Also Higher

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday uptrend. The market slightly extended its rally this morning and it broke above the 7,600 mark. The nearest important resistance level is now at 7,650-7,700. The Nasdaq futures contract got back to the previous local high, as we can see on the 15-minute chart:

Apple, Microsoft Continued Sideways

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock got back to the resistance level of around $200, following breaking above the downward trend line in the early June. For now, it looks like an upward correction. However, if the stock gets back above $200, we could see more buying pressure:

Now let's take a look at the daily chart of Microsoft Corp. (MSFT). The stock accelerated its uptrend in late April. Since then, the market was trading within a consolidation. In the early June it broke below the support level, but then it got back higher. It reached the new record high of $134.24 on Tuesday a week ago, before reversing its intraday uptrend once again:

Dow Jones Remains Slightly Above 26,000

The Dow Jones Industrial Average has been relatively weaker than the broad stock market since February. The resistance level remained at around 26,800-27,000, marked by the last year's topping pattern and the record high of 26,951.8. Recently the blue-chip stocks' gauge followed the broad stock market, as it accelerated the downtrend. The market broke below its important 200-day moving average, but then it got back higher. For now, it looks like a flat correction within an uptrend:

The S&P 500 index traded within a short-term consolidation last week, as investors took short-term profits off the table following the early June rally. Will the broad stock market get back to the record high? There have been no confirmed negative signals so far.

Concluding, the S&P 500 index will likely open higher today. Then we could see some more short-term fluctuations ahead of tomorrow's important Fed's Rate Decision release.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care