Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Wildly bullish ride on Friday, and my already very profitable long position has become dramatically more so. Who would have thought that given the events of prior week? Those reading my analyses, have been on the right side of the market, making money.

That's surely a better proposition than to be calling for a deep correction or even crash – and there is really no shortage of bears. They're still way more numerous than the bulls if you look at the sentiment readings. On the surface, it makes it appealing to join the majority, but that's not what great minds and independent thinkers usually do.

The way I view financial analyst's role, is to make sense of many times more or less conflicting data, and present the trading calls, the outlook that brings profits to the people. Uncertain and volatile times have nothing to do with that – let it be so always. That's the cutting edge, the dividing line in my view, for being nimble and not stubborn in one's ways is what truly generates value for the readers and subscribers.

In stocks, that means being still long – and those familiar with my trading ways, know that I can and do turn on a dime, both in trading and in life. No permabull, no permabear – my pledge is to daily serve your interests.

Great parallel, but how is that really applicable to the S&P 500 right now?

S&P 500 in the Medium- and Short-Run

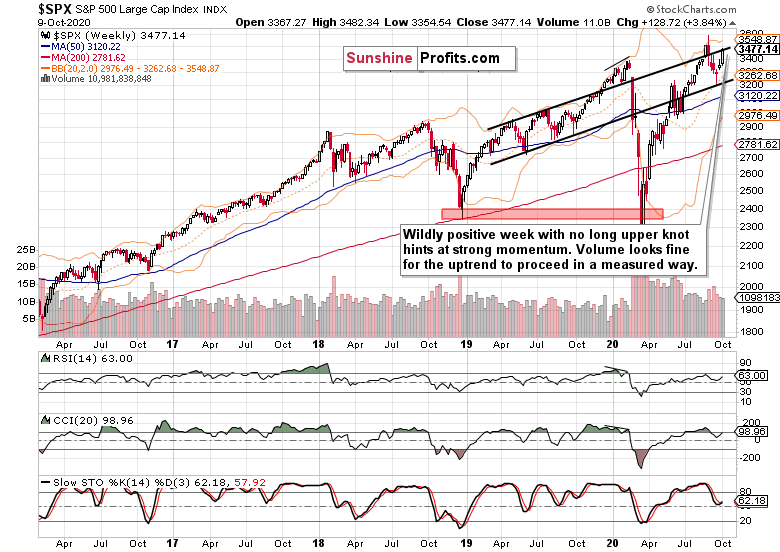

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

I wrote these words 7 days ago:

(…) The weekly price action points higher, true, but the sizable upper knot is sticking out like a sore thumb. While not all the downside appears to be in looking at this chart alone, I am not calling for a new downswing to start here. The weekly indicators remain fairly neutral, and sideways trading with bullish bias reasserting itself, is the best the bulls can look for.

The new downswing indeed didn't start, and stocks reacted with euphoria to the Trump recovery and on-off-on stimulus talks. The result was even better that I conservatively assessed as likely.

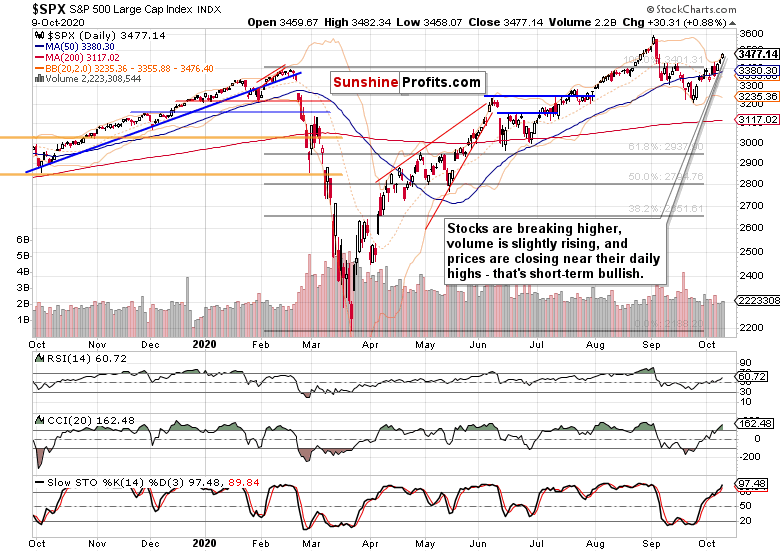

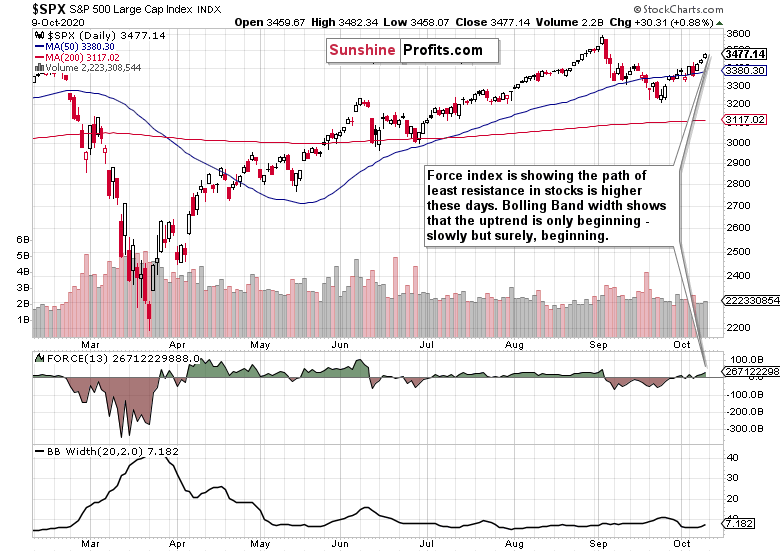

Tuesday's breakout invalidation attempt looks now to be a distant memory, and stock bulls are in the driver's seat. The daily volume is very slowly rising, and doesn't point at the buyers' exhaustion or at the bears ready to step in.

Yes, it's the upswing that is to be trusted here – and it’s in line with my call for October to end in the black. Even the September call of mine for the month to finish with a sizable lower knot ended up true. For the days to come though, I am not looking for much downside really – and that's an understatement.

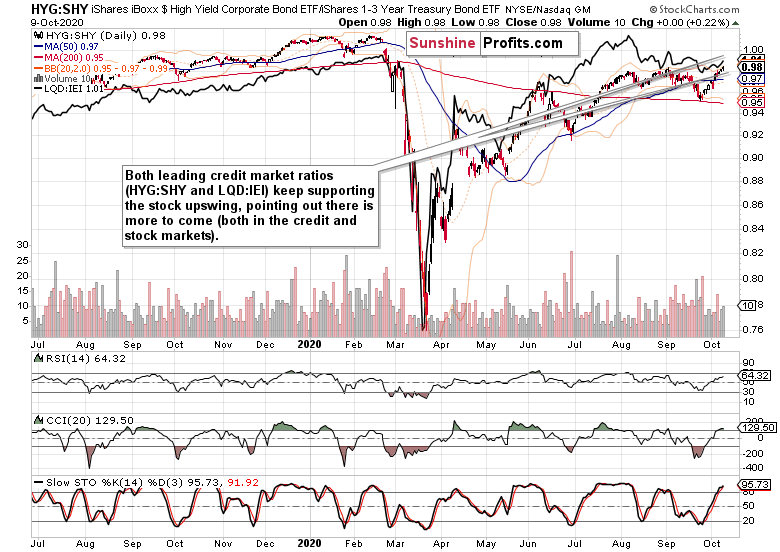

Credit Markets’ Point of View

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – are done pausing – they are moving higher for the second day in a row. That's healthy for the stock upswing to go on, to see both ratios moving in unison.

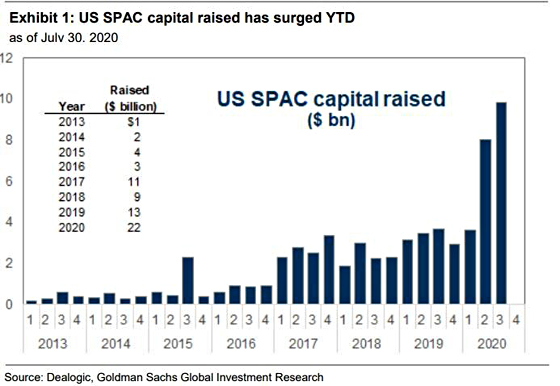

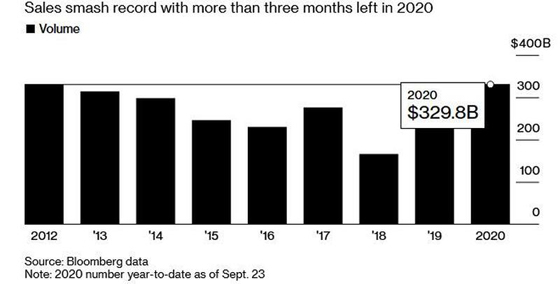

A few notes on the red hot speculation in blank check IPOs market (SPACs) that I saw David Stockman talk about and compare to corporate junk bonds:

Long live the financial engineering – or is such a hallmark a sign of a top approaching, similarly to white elephant projects such as great skyscrapers (Burj Khalifa – Dubai 2010)?

Meanwhile, high yield corporate bonds issuance has been smashing records in 2020…

This bull evidently still wants to run some more.

S&P 500 Market Internals and Technology

The fly in the very short-term ointment is the advance-decline line performance. We just saw a price upswing, yet the metric moved lower. Does it increase the odds of a downswing next? Perhaps, but that would turn out as a consolidation in an upswing only in my opinion. In other words, it would be over relatively shortly.

Force index is moving into a more positive territory – that's just what you would expect from indicators such as MACD and the like. The budding uptrend is strengthening, and that's the message of both the Force index, and the Bollinger Band width.

My other trusted indicator, ADX (it measures the strength of the trend), is more cautious here – and that fits in well the advance-decline line's message discussed just above. That's just the two of them – apart from the regularly chart-featured ones, I like PMO, MACD, Williams' Ultimate Oscillator – and I work with them in non-traditional ways too…

In short, we had a great week in stocks, but this one might not be as rich in terms of price moves.

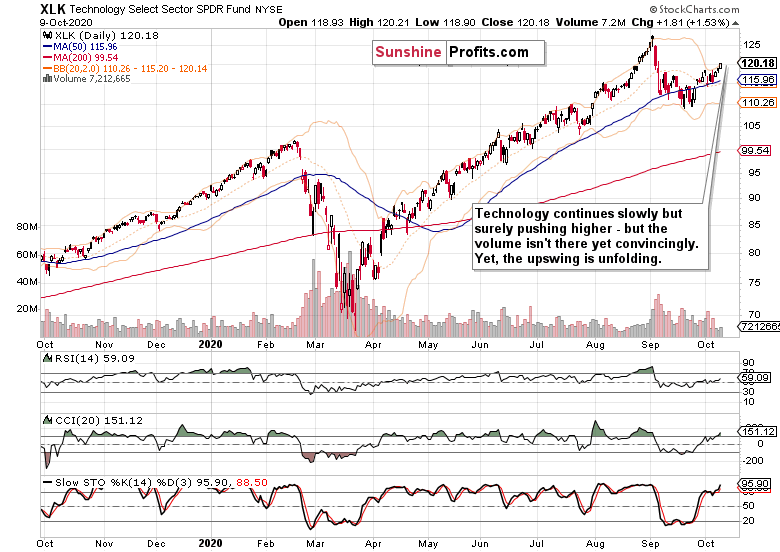

Technology (XLK ETF) is positive here – yet the volume supports short-term caution. Still, the uptrend is going on, and the question remains how fast and how far before the next breather arrives, will this leading sector take the 500-strong index.

Summary

Summing up, I look for stocks to continue in their breakout mode, but after the strong trading just in, the week in progress might turn out to be a more measured one. The array of signs though keeps supporting the bulls rather overwhelmingly. Stimulus negotiations are a wildcard, and I see much of the positive effect (the hopes) already priced into the market – be it before elections, or a bit later, the markets can bridge that. Still, it can bring a short-term negative spanner into the bulls' works should there be another show of brinkmanship. With both sides unlikely to be perceived / blamed for failure of talks, the odds are favoring more some sort of compromise than a break-up.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.