Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Stocks retraced some of their recent rally – is the uptrend over?

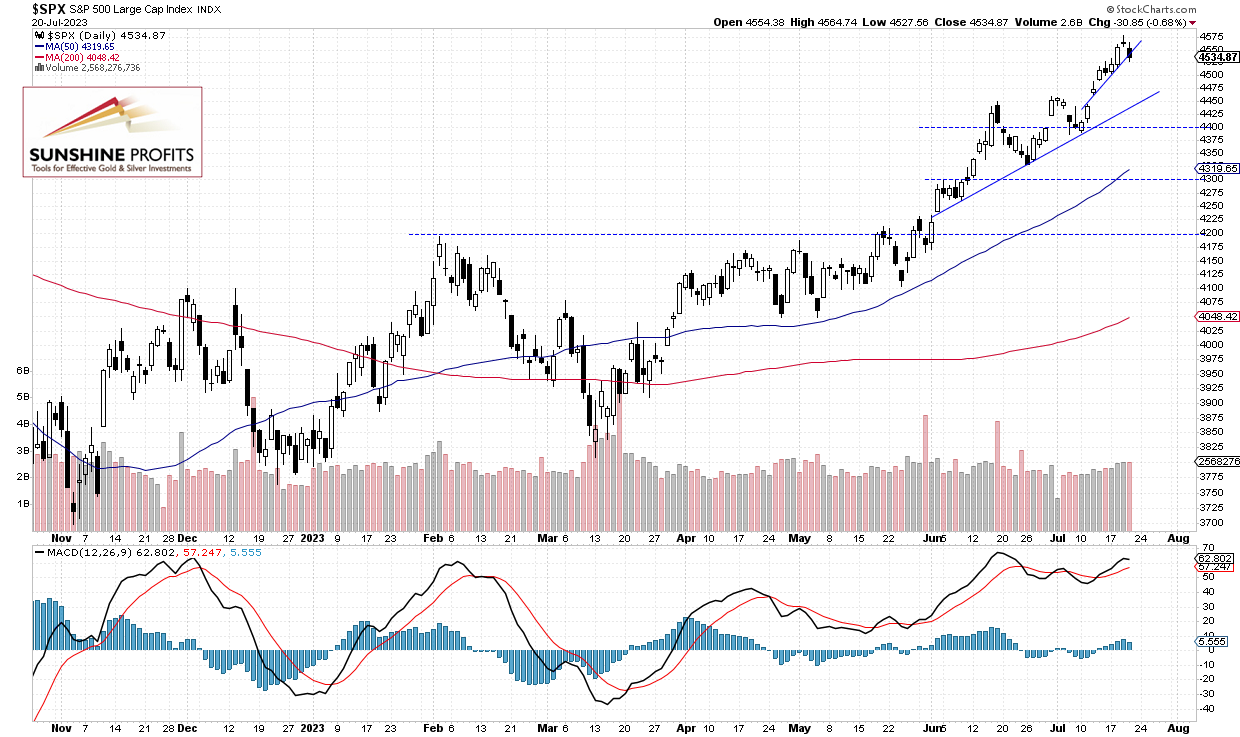

The S&P 500 index lost 0.68% on Thursday as it retraced some of the recent advance after bouncing from its Wednesday’s new medium-term high of 4,578.43. Recently stocks were gaining ahead of quarterly earnings releases, among other factors. On Wednesday the S&P 500 was the highest since early April of 2022. There is still a lot of uncertainty concerning monetary policy, some technology/AI stocks’ valuation concerns, but the investors’ sentiment remains bullish. The market is waiting for more quarterly corporate earnings releases.

Stocks will likely open 0.4% higher this morning, so the S&P 500 may fluctuate above the 4,500 level. The market is still above an over month-long upward trend line as we can see on the daily chart:

Futures Contract Remains Close to 4,600

Let’s take a look at the hourly chart of the S&P 500 futures contract. Recently it rallied above the 4,600 level and yesterday it retreated to around 4,550. The nearest important support level remains at 4,560, marked by the recent resistance level.

Conclusion

The S&P 500 is expected to open higher this morning and it may fluctuate following the recent rally. There have been no confirmed negative signals so far. For now, it looks like a flat correction within an uptrend.

Here’s the breakdown:

- The S&P 500 retraced some of the recent advances; it may see more consolidation.

- There have been no confirmed negative signals.

- In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care