Briefly:

Intraday trade: The S&P 500 index gained 0.1% on Tuesday, after opening 0.2% lower. The broad stock market will likely open higher today. Then we may see a short-term consolidation following the recent rally.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes were mixed between -0.7% and +0.2% on Tuesday, as investors hesitated following the recent record-breaking rally. The S&P 500 index retraced all of its medium-term downward correction of 20.2% recently and on Monday it reached the new record high of 2,949.52. The Dow Jones Industrial Average gained 01% and the Nasdaq Composite lost 0.7% on Tuesday.

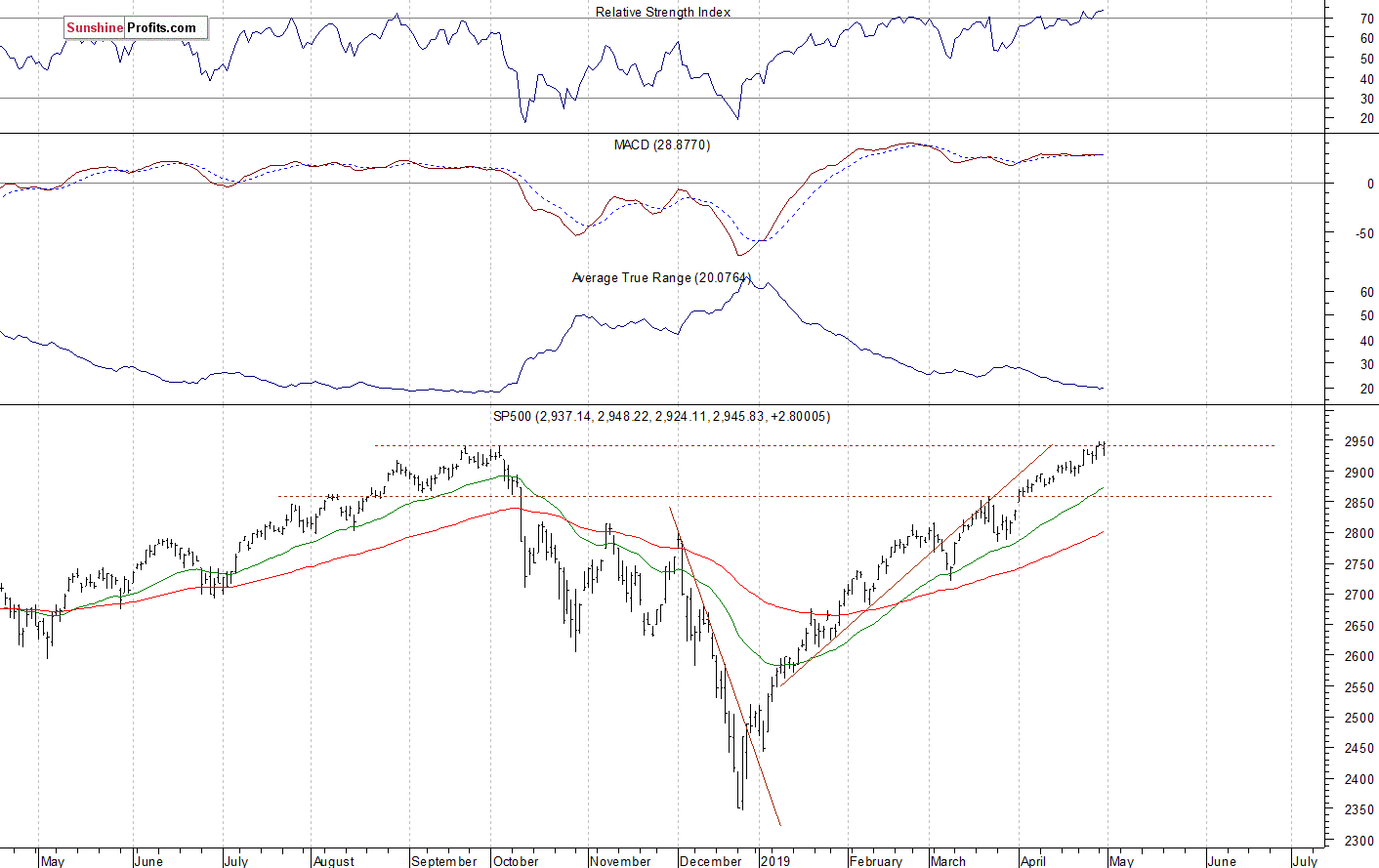

The nearest important resistance level of the S&P 500 index is now at around 2,950, marked by the new record high. The next resistance level is at 3,000. On the other hand, the support level is at 2,915-2,920, marked by the recent resistance level. The support level is also at 2,900.

The broad stock market retraced all of its December sell-off and it broke above its last year's high. There have been no confirmed negative medium-term signals so far. The index continues to trade within a medium-term uptrend, as we can see on the daily chart:

Positive Expectations, but Will Uptrend Continue?

Expectations before the opening of today's trading session are positive, because the index futures contracts trade 0.2-0.5% above their Tuesday's closing prices. The European stock market indexes are closed for a holiday. Investors will wait for some important economic data announcements today: ADP Non-Farm Employment Change at 8:15 a.m., ISM Manufacturing PMI, Construction Spending at 10:00 a.m., Crude Oil Inventories at 10:30 a.m., the FOMC Rate Decision release at 2:00 p.m. Stocks will likely extend the long-term uptrend today. There have been no confirmed negative signals so far. However, we can see some short-term technical overbought conditions.

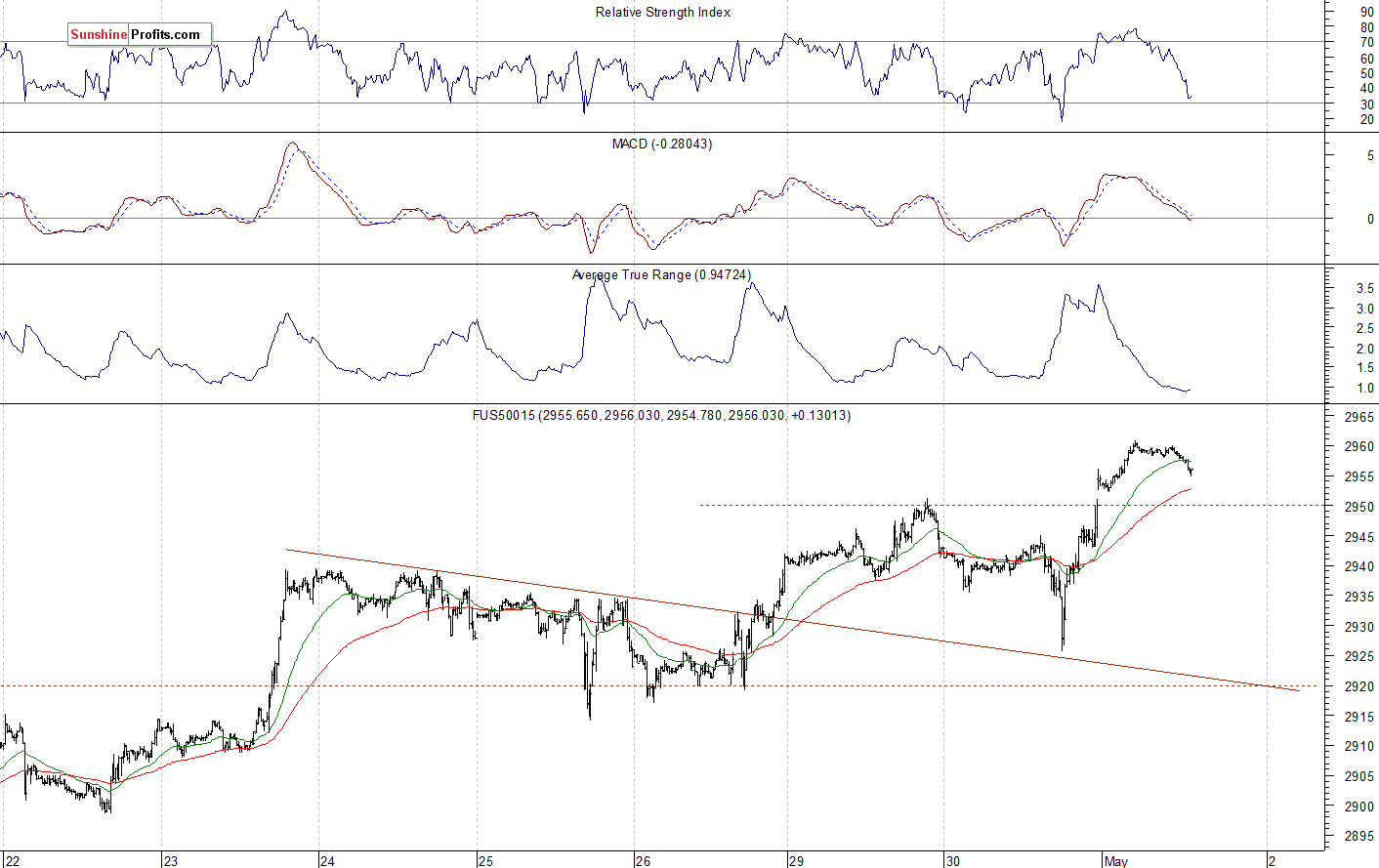

The S&P 500 futures contract trades within an intraday downtrend, as it retraces some of its yesterday's after-hours advance. The nearest important level of resistance is at around 2,960. On the other hand, the support level is at 2,940-2,950, among others. The futures contract trades along the new record high this morning, as the 15-minute chart shows:

Will Nasdaq Break Higher?

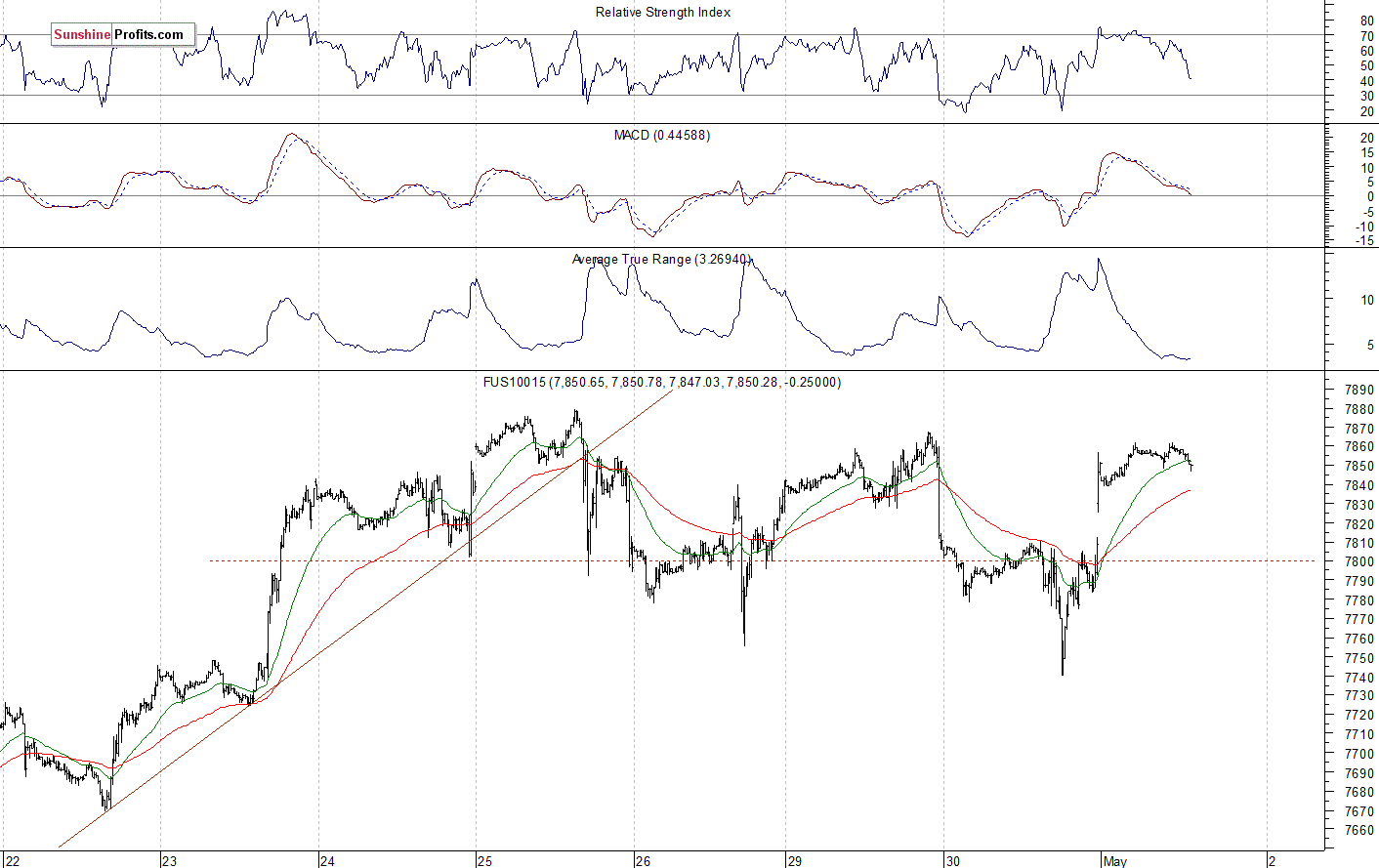

The technology Nasdaq 100 futures contract continues to trade within a short-term consolidation. It reached the new record high of around 7,880 recently. The market may take an attempt at breaking higher following yesterday's after-hours Apple's quarterly earnings release. The resistance level is at 7,850-7,900. On the other hand, the support level is at 7,750-7,800. The Nasdaq futures contract is closer to the all-time high again, as we can see on the 15-minute chart:

Apple - False Breakdown?

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock accelerated its uptrend recently and it broke above the $200 level recently. Last week the market reached another new medium-term high, but then it broke below the medium-term upward trend line. It may come back above that trend line following yesterday's quarterly earnings release:

Now let's take a look at the daily chart of Microsoft Corp. (MSFT). The stock accelerated its uptrend last week, as it reached the new record high of $131.37. Investors reacted to a better-than-expected quarterly earnings release. For now, it looks like a blow-off topping pattern. We can see some clear technical overbought conditions:

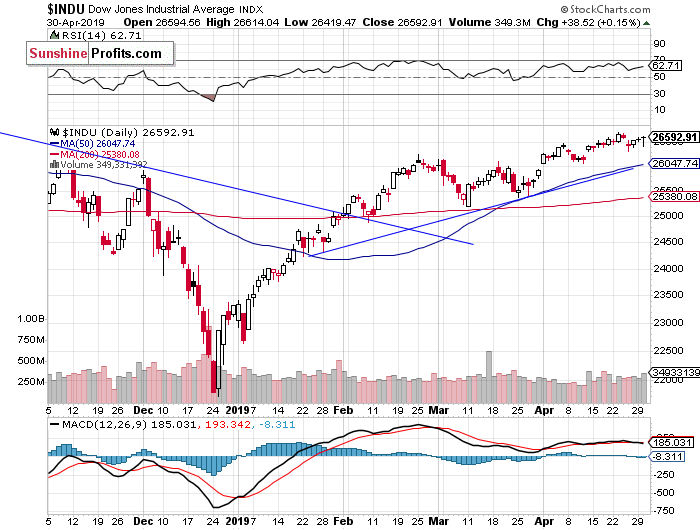

Dow Jones Still Relatively Weak

The Dow Jones Industrial Average remains relatively weaker than the broad stock market. The resistance level remains at around 26,800-27,000, marked by the last year's topping pattern and the record high of 26,951.8. Last week the blue-chip stocks' gauge reached the new medium-term high. But then it traded closer to the 26,500 mark again. There have been no confirmed negative signals so far. However, we can see some negative technical divergences:

The S&P 500 index has reached the new record high on Monday following breaking above the last week's local highs. The broad stock market extends its medium-term uptrend, as investors' sentiment remains very bullish following economic data, quarterly corporate earnings releases. However, we can see short-term technical overbought conditions that may lead to a downward correction at some point.

Concluding, the S&P 500 index will likely open higher today following yesterday's Apple's quarterly earnings release. Investors will now wait for the important FOMC Rate Decision release at 2:00 p.m.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care