Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Stocks went closer to their recent highs again, but more uncertainty is expected.

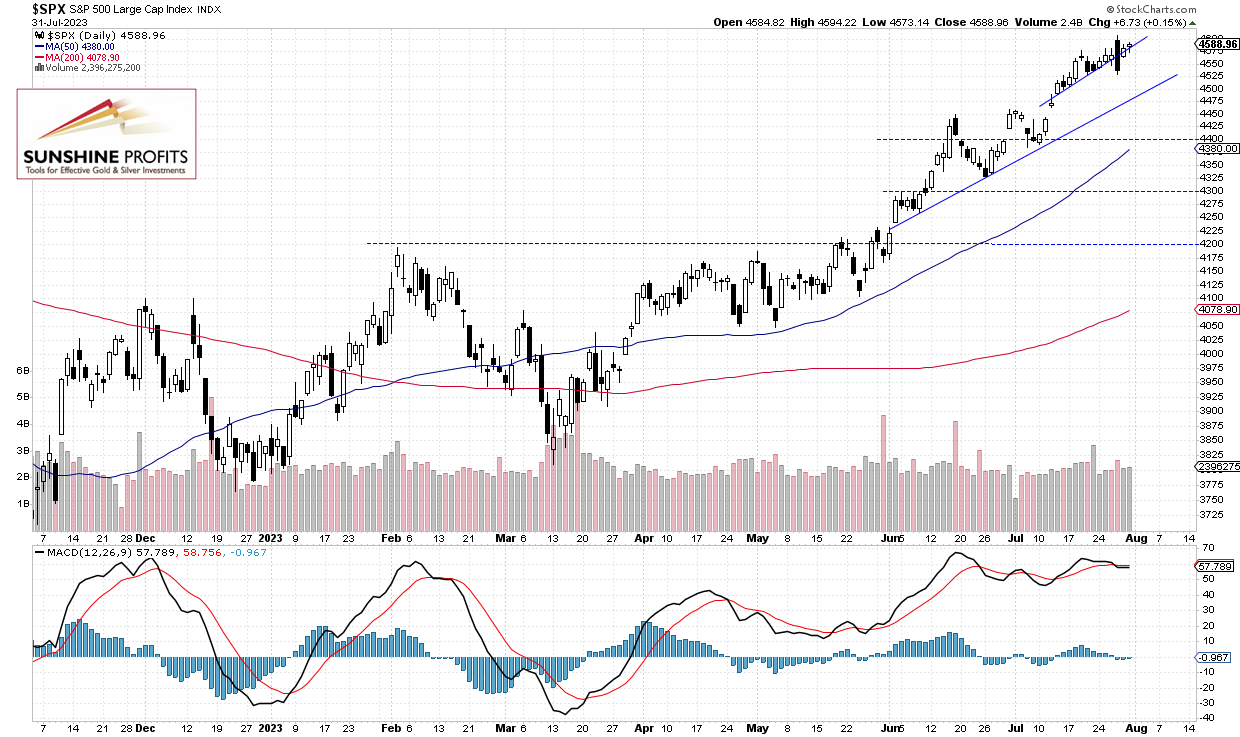

The S&P 500 index gained 0.15% on Monday following its Friday’s advance of around 1% as it retraced most of the Thursday’s intraday retreat from new medium-term high of 4,607.07. The market keeps extending a consolidation along the 4,550-4,600 level.

There is still a lot of uncertainty concerning monetary policy, some technology/AI stocks’ valuation concerns, but the investors’ sentiment remains bullish. Investors are waiting for more quarterly corporate earnings releases.

Stocks are expected to open 0.4% lower today, so the S&P 500 will further extend its consolidation. The market remains above a two-month-long upward trend line as we can see on the daily chart:

Futures Contract Remains Close to 4,600

Let’s take a look at the hourly chart of the S&P 500 futures contract. It continues to trade along the 4,600 level. The nearest important resistance level is at around 4,620-4,635, marked by last week’s local high. On the other hand the support level is at 4,580-4,600.

Conclusion

The S&P 500 index will open lower this morning. The broad stock market may extend a sideways trading action following Thursday’s retreat. It still looks like a consolidation and a relatively flat correction within an uptrend. The market will be waiting for more quarterly earnings releases, including Thursday’s reports from AMZN and AAPL.

Here’s the breakdown:

- The S&P 500 extends its consolidation as it trades below the 4,600 level.

- Investors will wait for more quarterly earnings releases.

- In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care