Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

Monday’s run-up was a bull trap, as stocks retraced their whole advance the next day. Are we getting closer to a correction?

Stocks were extending an eleven-year-long bull on Monday, as the DJIA and the S&P 500 indexes reached new record highs. But on Tuesday the S&P 500 sold off below its recent local lows. Then the market has rebounded following a speech from Fed Chair Jerome Powell, before closing 0.7% lower.

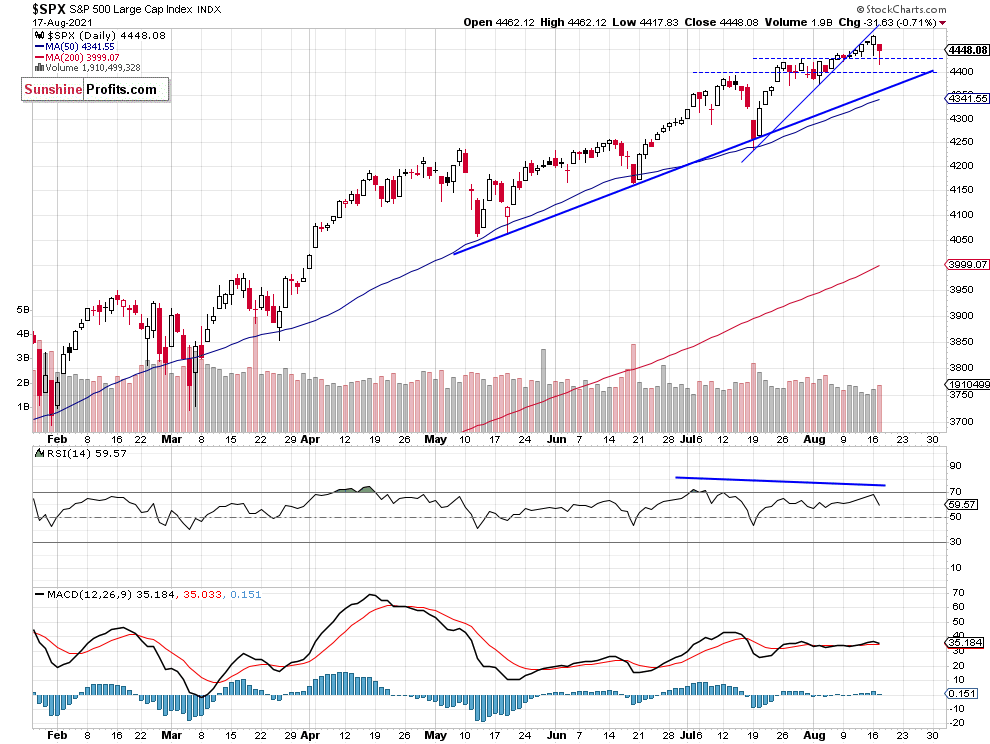

The broad stock market broke above its late July – early August consolidation recently. The nearest important support level is at 4,430. The S&P 500 index continues to trade above its three-month-long upward trend line, but it is still below the broken month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Climbs Along Medium-Term Trend Line

The S&P 500 index continues to trade along its medium-term upward trend line. The market will most likely break below that trend line and trade sideways for some time. For now, however, it just keeps moving along the line, as we can see on the weekly chart:

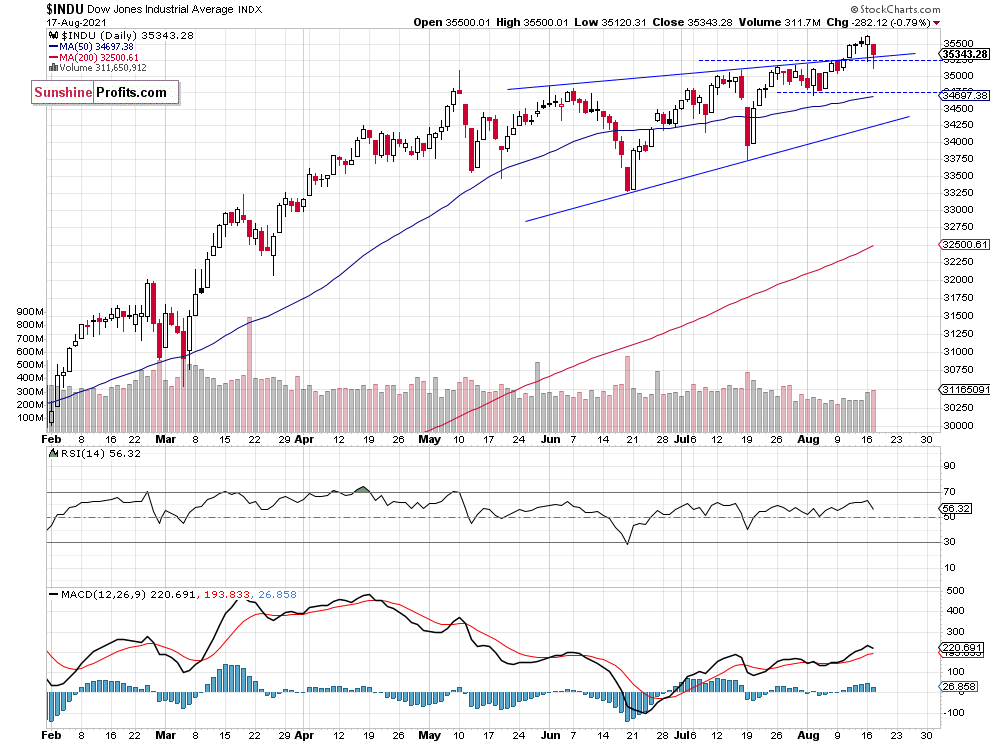

Dow Jones Retraced its Breakout Move

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index has recently broken to new record highs, and it reached above the 35,600 level. There have been no confirmed negative signals so far. But if the market gets back below 35,000-35,250 support level we may see some selling pressure.

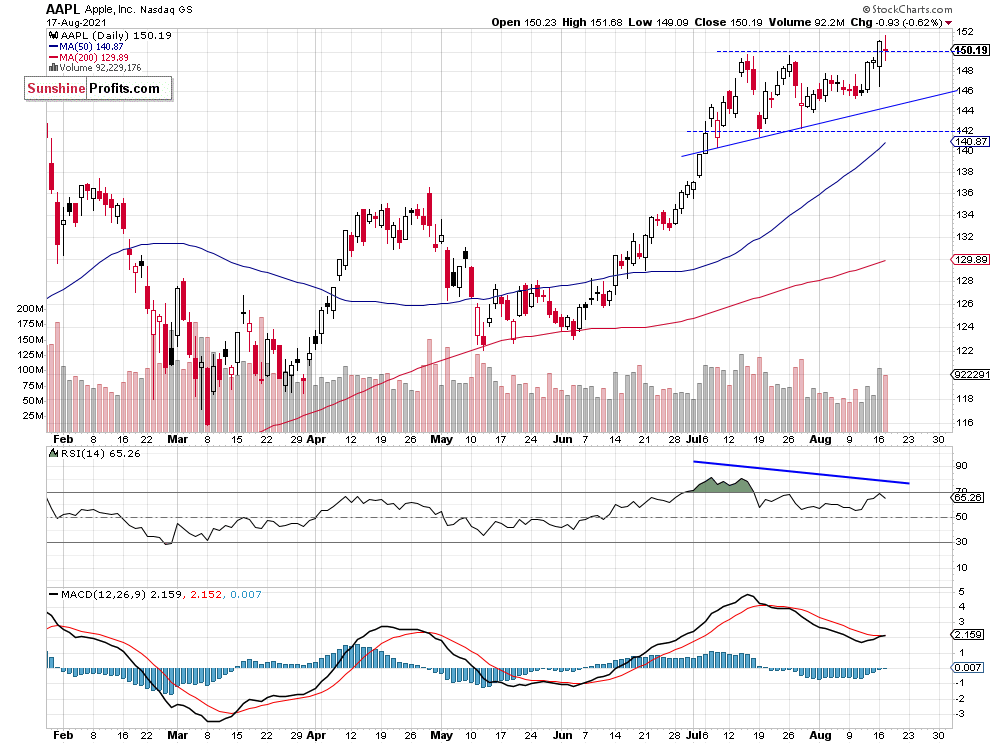

Apple Still at $150

Apple stock reached yet another new record high yesterday at the price level of $151.68. However, it closed 0.6% lower. If the stock gets back below $150 level again, that would be negative for indexes.

Conclusion

The S&P 500 index reached new record high on Monday, but yesterday it retraced the whole advance and moved below the recent local lows. If not for a speech from Fed’s Jerome Powell, the market would sell off by more than 1%. So it still looks like a topping pattern.

Here’s the breakdown:

- The market seems overbought and poised for a correction.

- Therefore, we decided to open a speculative short position last week on Thursday.

- We are expecting a 5% or bigger correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care