Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 index closed the highest in history on Thursday. Will stocks reach new record highs today?

Today’s Stock Trading Alert will be shorter than usual. We apologize for inconvenience.

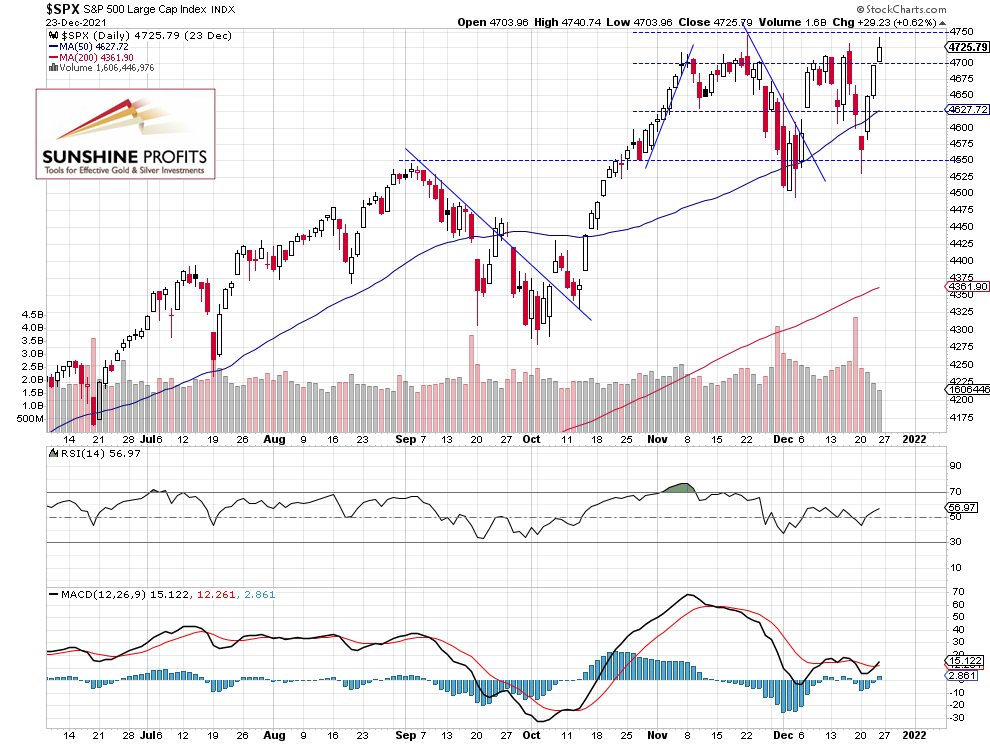

The S&P 500 index gained 0.62% on Thursday after breaking above the 4,700 level again. The broad stock market’s gauge is expected to open 0.3% higher this morning. We will most likely see an attempt at breaking above the November 22 record high of 4,743.83. On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the record high. So it was a pretty mild downward correction or just a consolidation following this year’s advances.

The nearest important resistance level is now at around 4,740-4,750, marked by the previous local highs. On the other hand, the support level is at 4,650-4,700, marked by the recent resistance level. The S&P 500 is very close to its late November record high, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Conclusion

The S&P 500 index will most likely reach the new record high this morning, following last Thursday’s advance of 0.6%. However, it still looks like a two-month-long consolidation, just closer to a breaking higher.

Here’s the breakdown:

- The S&P 500 retraced its recent declines, as volatility remained elevated.

- We are closer to breaking higher.

- In our opinion no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care