Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Friday’s jobs data release wasn’t a game-changer, as the S&P 500 index did… nothing. It remained close to the record high.

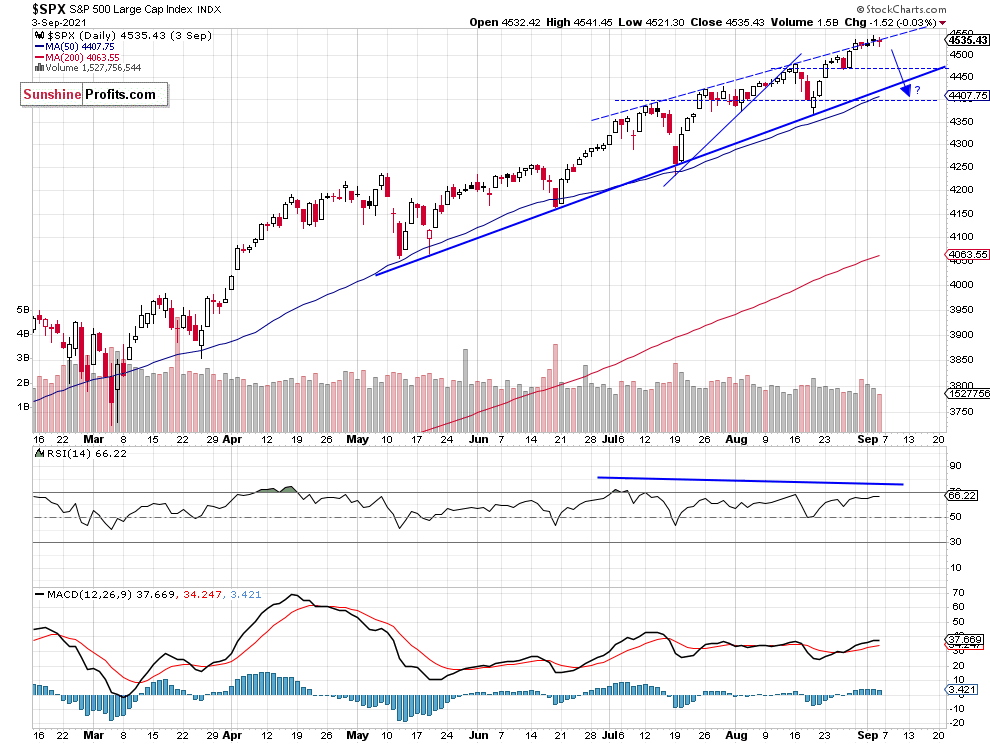

The broad stock market index lost just 0.03% on Friday (Sep. 3), as it traded along Thursday’s new record high of 4,545.85. This morning the market is expected to open slightly lower following yesterday’s holiday break. The index remains elevated after the recent run-up, so we may see some more profound profit-taking action at some point.

The nearest important support level of the broad stock market index remains at 4,500, and the next support level is at 4,465-4,470, marked by the previous Thursday’s low. On the other hand, the nearest important resistance level is at 4,550. The S&P 500 bounced from its four-month-long upward trend line recently, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Short Position is Still Valid

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. The position was profitable before the recent run-up. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index reached a new record high on Thursday. Friday’s monthly jobs data release came in worse than expected, but the market remained virtually flat at the end of the week. Yesterday, the futures contract got back to the record high, but today we are expecting a slightly lower opening of the trading session.

The market seems short-term overbought, and we may see some profit-taking action soon. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market extended its advance last week, as the S&P 500 index broke above the 4,500 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting a 5% or bigger correction from the new record high.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care