Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks faded their recent gains yesterday amid strengthening U.S. dollar and a profit-taking action. Is this a short-term topping pattern?

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

Video Technical Breakdown is a new addition to the STA, distributed on Tuesday and Thursday along with the premium analysis, to keep you, our subscribers, well-informed with everything happening on the charts.

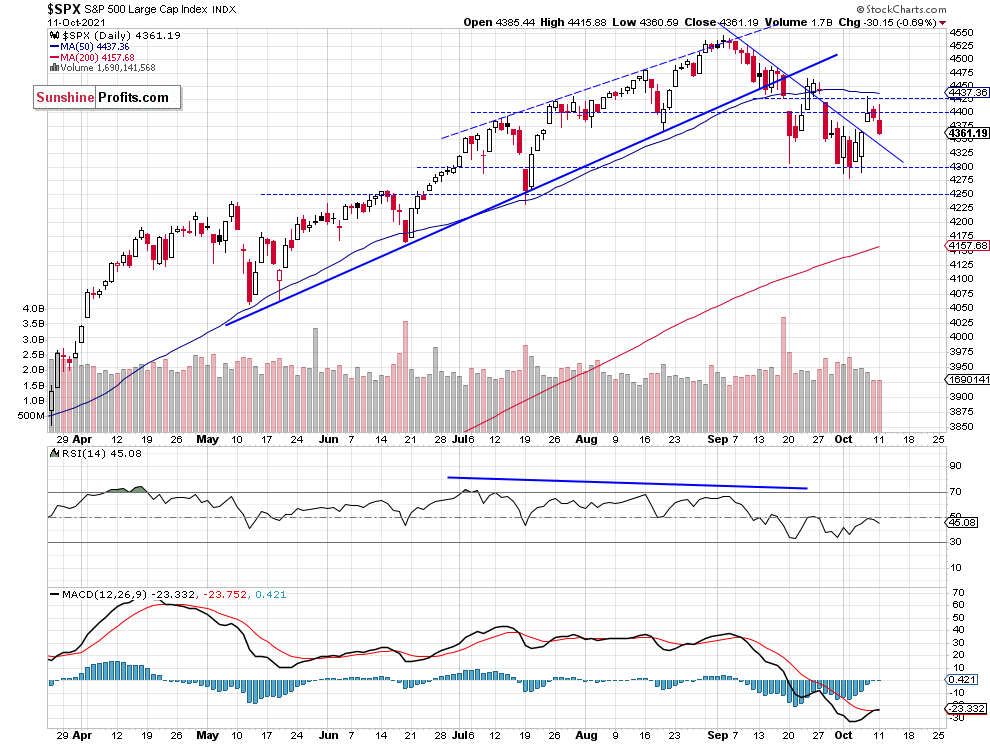

The S&P 500 index lost 0.69% on Monday, as it retraced most of its advance following breaking above the recent consolidation. The market got back below the 4,400 level and it came back closer to the previous resistance level of 4,350-4,360 yesterday. Was it just a correction within a new uptrend? This morning the main indices are expected to open 0.1-0.3% higher and we may see some more uncertainty ahead of tomorrow’s Consumer Price Index number release.

The support level is now at around 4,350 and the next support level is at 4,300-4,320, marked by the recent local lows. On the other hand, the resistance level is at 4,400-4,420. The S&P 500 remains above its month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Should You Re-Enter a Short Position Now?

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market bounced back from the 4,400 level. For now, it looks like an upward correction following the recent decline or just a consolidation. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index bounced back to the 4,400 level on Thursday. On Friday it fluctuated within a relatively narrow daily trading range despite the monthly jobs data release. But yesterday the market came down to the broken downward trend line and the recent consolidation. We may more short-term uncertainty, and the index may continue to fluctuate along the 4,400 level.

The risk/reward perspective seems less favorable right now and no positions are currently justified.

Here’s the breakdown:

- The S&P 500 broke above its consolidation last week, but for now it looks like an upward correction within an over month-long downtrend.

- Our speculative short position has been closed on the previous Friday at a much lower level.

- We are still expecting more downward pressure and a correction to 4,200-4,250 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care