Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stock prices extended their downtrend yesterday, but the sentiment wasn’t bearish at the end of the day.

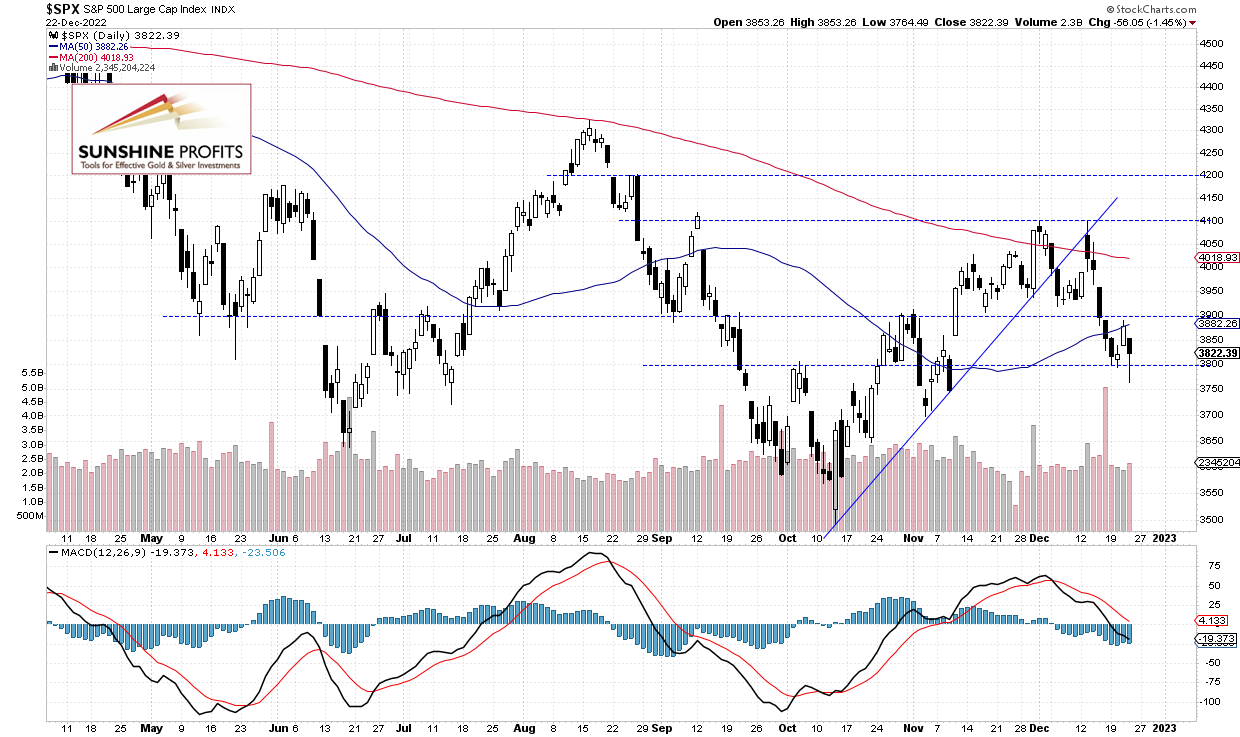

The S&P 500 index lost 1.45% on Thursday after breaking below the 3,800 level and reaching new local low of 3,764.49. Overall it extended a consolidation along the 3,800 level, as it closed above that support level. Recently the S&P 500 has been reacting to last week’s Wednesday’s FOMC interest rate hike, among other factors.

Today the S&P 500 will likely open 0.1% lower following mixed economic data releases. In early December the S&P 500 index broke below its two-month-long upward trend line and it moved sharply lower after getting back to that line last week, as we can see on the daily chart:

Futures Contract Continues Sideways

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it broke slightly below the 3,800 level. The market continues to trade along the 3,850 level.

Conclusion

The S&P 500 index is expected to open slightly lower. We may see some more short-term uncertainty following the recent declines. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index extended its downtrend yesterday.

- Stocks will likely continue to fluctuate ahead of a holiday weekend.

- In our opinion, the short-term outlook is neutral.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care