Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks retraced their Friday’s advance yesterday. Is the S&P 500 index going to break below the 4,300 level? We may see some more uncertainty.

For in-depth technical analysis of various stocks and a recap of today's Stock Trading Alert we encourage you to watch today's video.

Video Technical Breakdown is a new addition to the STA, distributed on Tuesday and Thursday along with the premium analysis, to keep you, our subscribers, well-informed with everything happening on the charts.

The S&P 500 index lost 1.30% on Monday, as it retraced its Friday’s advance. So it was just a dead-cat-bounce or an upward correction within a downtrend. For now, it looks like a consolidation following month-long declines. The market will be waiting for Friday’s Nonfarm Payrolls number release and the coming quarterly corporate earnings season. And we will likely see some more short-term fluctuations. The main indices are expected to open 0.3-0.4% higher this morning.

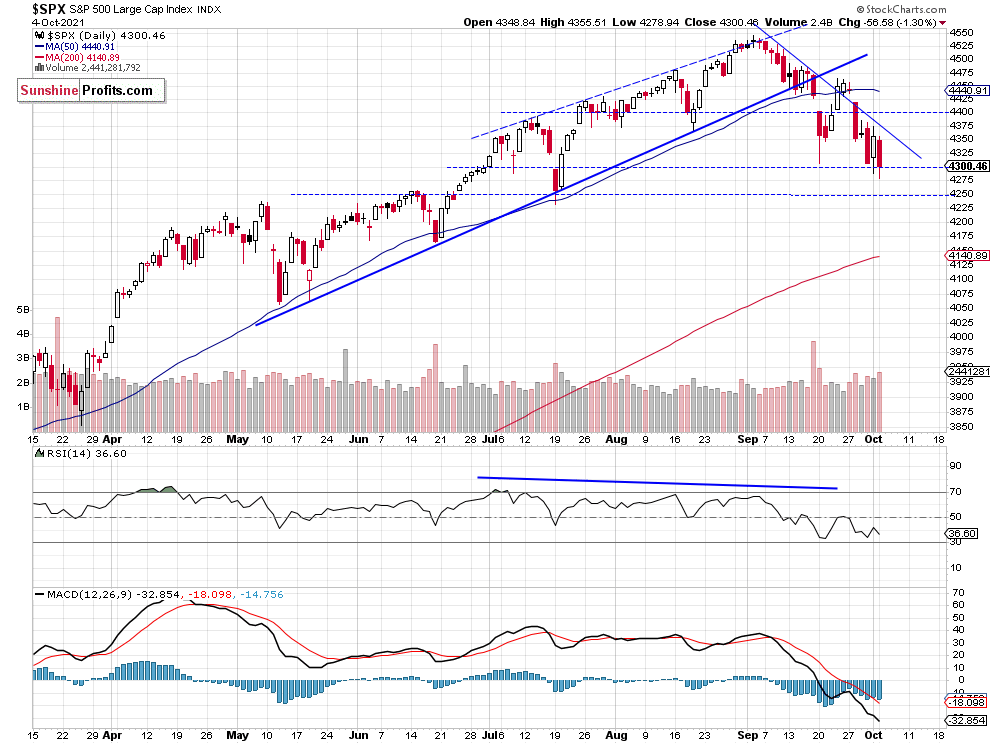

The support level remains at 4,290-4,300. On the other hand, the resistance level is at 4,375-4,400, marked by the recent local highs. The S&P 500 continues to trade below its month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Should You Re-Enter a Short Position?

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435 and closed it on Friday at the level of 4,315 with a gain of 120 points because the risk/reward perspective seemed less favorable.

The market is trading sideways since then, so it seems that it was the right decision. For now, it looks like a consolidation and it will most likely resolve in a breakdown. However, in our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

Yesterday the broad stock market retraced its Friday’s advance and the S&P 500 index fell to the 4,300 level again (4,300.46 at close). So Friday’s rally was just an upward correction or an advance within a short-term consolidation. There have been no confirmed positive signals so far. However, the risk/reward perspective seems less favorable right now and no positions are currently justified.

Here’s the breakdown:

- The S&P 500 retraced its Friday’s upward correction on Monday.

- Our speculative short position has been closed right before the opening of Friday’s cash market’s trading session.

- However, we are still expecting more downward pressure and a correction to 4,200-4,250 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care