Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks extended their short-term rally yesterday and the S&P 500 is back at the 4,700 level again. Will we see new record highs before year’s end?

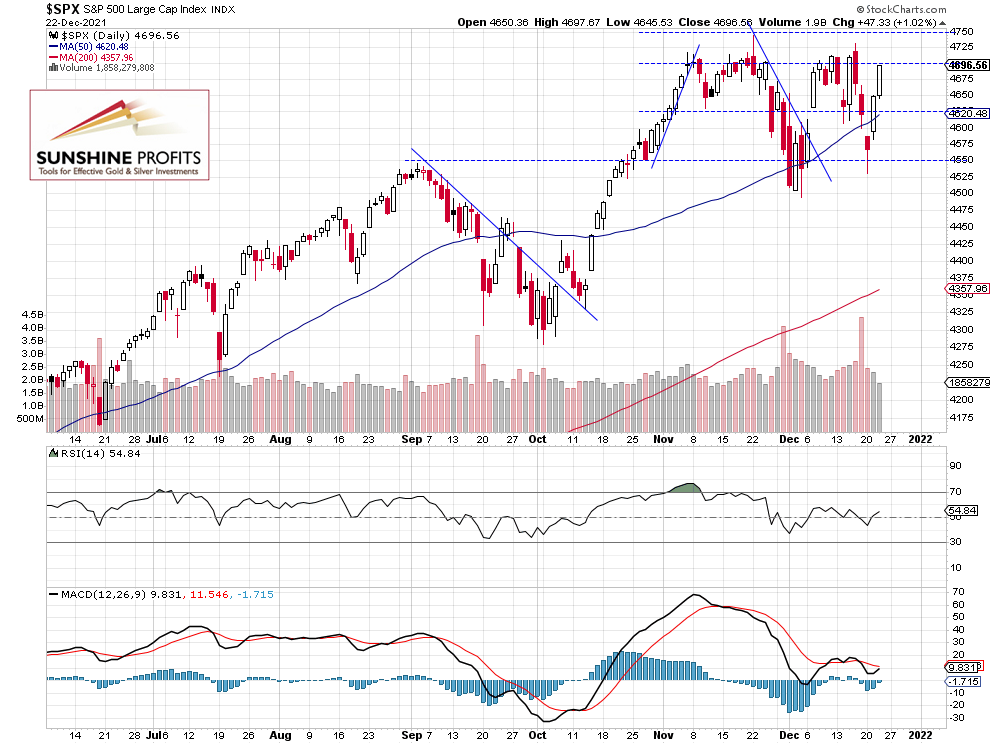

The S&P 500 index gained 1.02% on Wednesday following its Tuesday’s gain of 1.8%. The broad stock market is rallying back to last week’s local highs, as investors’ sentiment improves again. So this is the Santa Claus Rally. Will the index break above the Nov. 22 record high of 4,743.83? It became more likely after the recent advance. On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the record high. So it was a pretty mild downward correction or just a consolidation following this year’s advances.

Today the broad stock market is expected to open 0.2% higher, however we will also have the Core PCE Price Index release at 8:30 a.m. This is an important inflation gauge and the markets are thirsty for any inflation news right now.

The nearest important resistance level is now at around 4,700, marked by the previous local highs. The resistance level is also at 4,730-4,750. On the other hand, the support level is at 4,650, marked by the recent resistance level. The S&P 500 continues to trade within a two-month-long consolidation, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract – Closer to the 4,700 Level

Let’s take a look at the hourly chart of the S&P 500 futures contract. It reached the new record high on Thursday, Dec. 16, before reversing its uptrend and getting back to the early Dec. lows once again. This week the market is rallying back up and getting close to the 4,700 level. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index rallied back up this week, as it retraced the whole post- FOMC release decline. The broad stock market is more likely to reach new record highs right now. However, it still looks like a two-month-long consolidation, just closer to a breakout higher.

Here’s the breakdown:

- The S&P 500 retraced its recent declines, as volatility remained elevated.

- We are closer to breaking higher.

- In our opinion no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care