Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

The bulls pushed higher already yesterday in the end, nicely illustrating that standing aside in this market is more dangerous than withstanding its intraday fluctuations. That's the key message of my today's analysis – in similar times, keep your eyes on the big picture.

There are times to focus on the big momentum moves, and other periods when being nimble is the call of the day. Bull or bear, I've applied a good chunk of such repertoire of mine in your favor since February 2020, grabbing a grand total profit of 931 points in S&P 500 futures. That's almost 27% of the full 500-strong index value in a little over 8 months!

Zooming out, the great scheme of things unequivocally speaks in favor of more fiscal and monetary support for the economy, and given the autumn dynamics I discussed yesterday:

(…) Bottom line, the markets are justifiably expecting a deal around the corner. I don't see them throwing a hissy fit as they did in 2016 – that notion was invalidated for me with the arrival of early September storms. Throughout October (…), I've been calling for a mildly positive month – and here we are, that's the status currently.

Coiled spring once the uncertainties are removed, anyone?

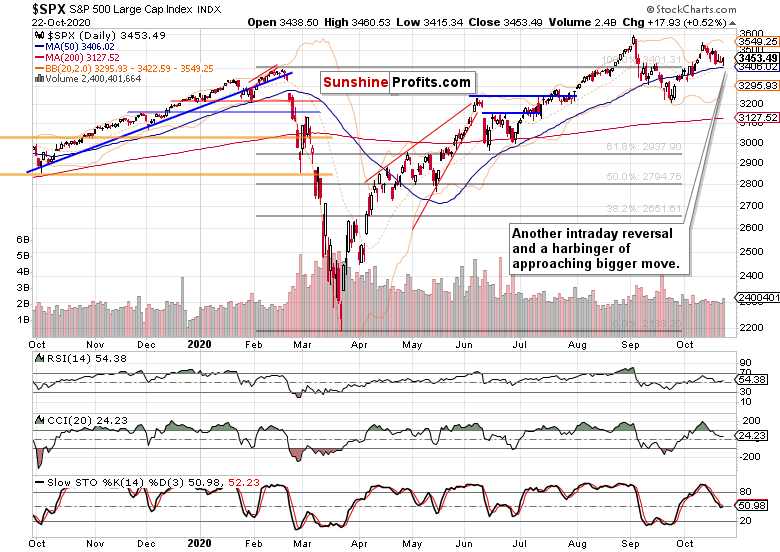

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Finally, yesterday's price progress hasn't been lost, and the bulls staged a successful intraday reversal. The upper knots whose tipping hand I mentioned yesterday, have indeed indicated the upcoming move. What I particularly like about yesterday's session, is that the volume went up, which bodes well for the coming day(s).

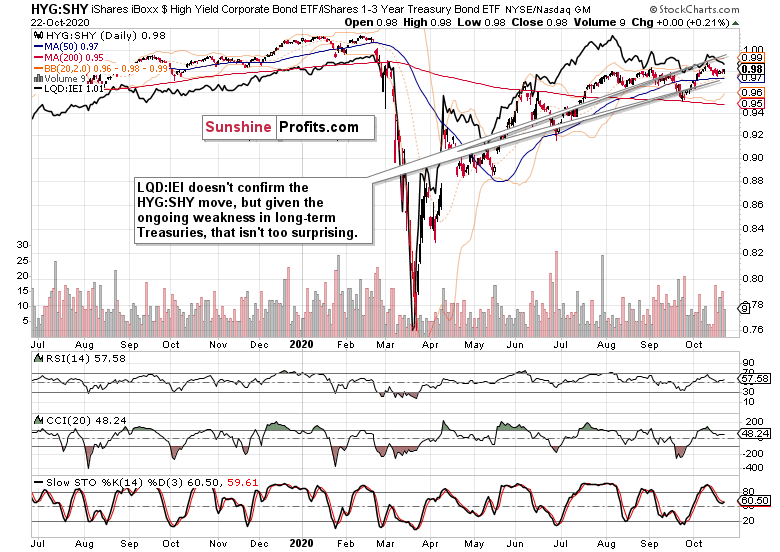

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) went up, just as could be expected during a stock market upswing. Not stealing the spotlight on its own, but a solid performance nonetheless. Yes, the very short-term sign of willingness to go higher and take stocks along was indeed there.

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have moved again in different directions. But I still ascribe the LQD:IEI move to weakening Treasuries (long-term ones, TLT ETF).

The high yield corporate bonds to all corporate bonds (PHB:$DJCB) ratio reveals that we're in a risk-on environment, regardless of where stocks trade at this moment – they have the power to catch up vigorously once uncertainties get removed.

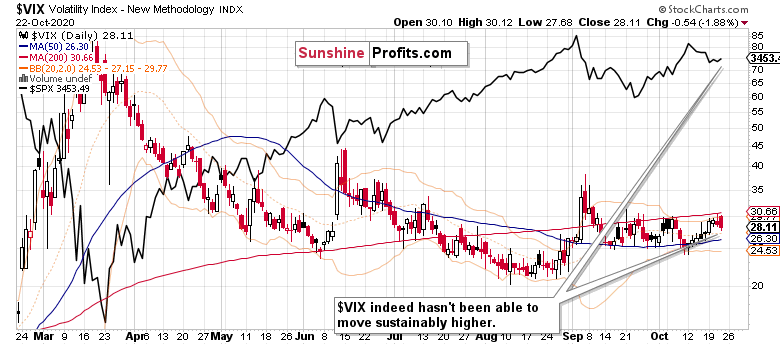

Volatility and Some Key Metals Ratios

Volatility that I doubted to rise much and sustainably, is heading lower again. The put/call ratio moved higher as the bears became more vocal. Unrightfully vocal, in my view – unjustifiably, because I see prices as moving higher next.

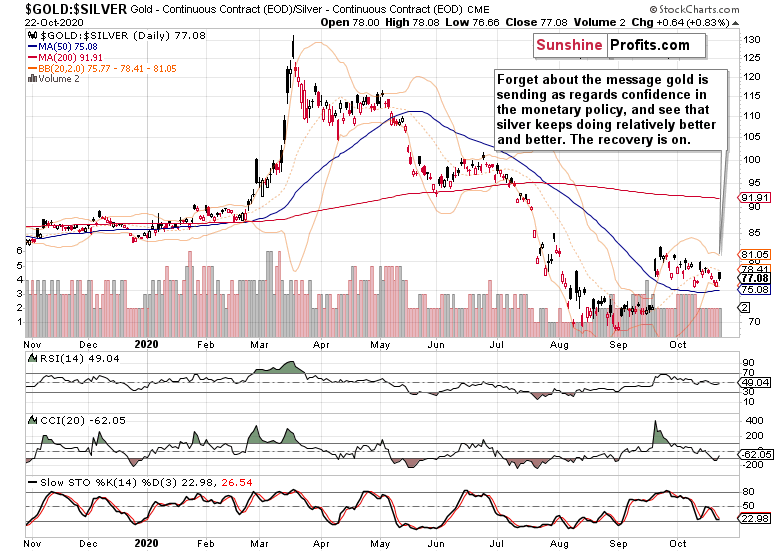

The copper-to-gold ratio speaks in favor of the economic recovery. The sensitive red metal is going higher, outperforming the stalwart king of metals. No small feat, no small feat.

The gold-to-silver ratio also confirms that we're in a recovery (I am not looking at the temporary weakness in Baltic Dry Index right now) – the white metal's posture is improving, both relatively and absolutely. More power to the stock bull run!

Summary

Summing up, the $SPX tug of war in the short run has taken a turn in favor of the medium-term probabilities that see the bulls emerging victorious. The stimulus saga is definitely closer to its end than its beginning, making the bearish case for a short-term move down in stocks less and less probable. The credit markets, precious metals, copper and technology gearing up for an upswing, continue supporting the bulls.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.