Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Yesterday's S&P 500 price action gave the bulls a few intraday reasons for optimism, but they went away before the closing bell. Not that we would have seen a bearish turn though – the push higher will have to come (and will come, I would add) another day. The cup and handle approximation hasn't been invalidated, but it's the fiscal policy trepidations that are driving the prices in the short run.

Does it look to you that the stimulus negotiations are getting a pretty high share of the media coverage? The self-imposed Pelosi deadline has come and gone, getting extended. I smell that she is interested in reaching a deal, a deal not forgetting about the Blue states and cities. With Trump willing to accept a larger price tag than originally, this uncertainty might be indeed removed before the elections.

Not that it would matter in the larger scheme of things, but for stocks in the short-run, it does. And they are more pessimistic here than warranted in my view. Let's check out why I think so.

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yes, yesterday's price progress has been lost late in the day, and stocks are under pressure in today's premarket, but that doesn't worry me way too much. I view that rather as the stock market forcing the hand to get the deal it expects and wants. Yesterday's volume certainly hasn't been reversalish one bit – just a daily consolidation in the stimulus horse trading that it is.

I repeat, there is no need to reconsider the medium-term outlook here. It's a matter of time before the differences get bridged one way or the other.

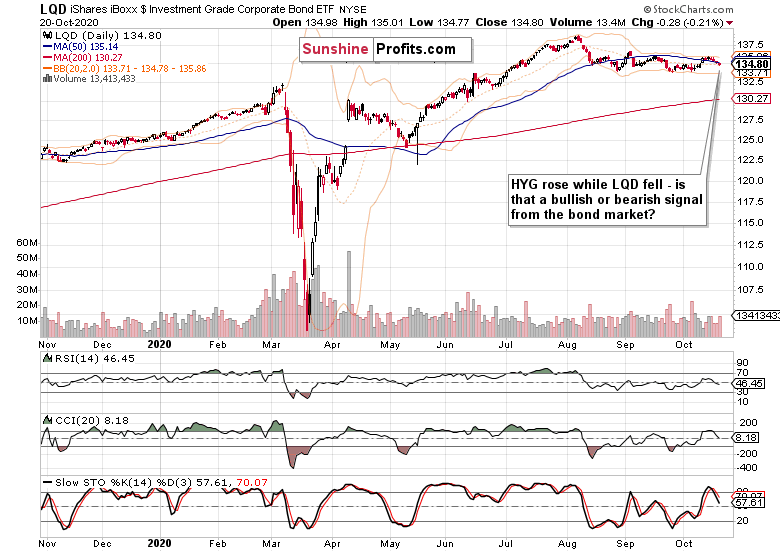

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) provide the best reason for why this is a storm in a tea cup – mere posturing. The intraday gains weren't given up, far from it, and that forms a very short-term sign of willingness to go higher and take stocks along. It's hard not to walk off with this impression if you look at the other debt markets.

Investment grade corporate bonds (LQD ETF) have declined yesterday, which would be by itself worrying to a degree – unless you look at Treasuries, and realize that the rising yields among quality debt instruments (LQD and TLT) reflect market conviction that a deal indeed approaching.

Yeah, the stimulus deal fight is as fake as wrestling. Makes for a nice show, though. Guess who has the kind of shorter end of the stick here…

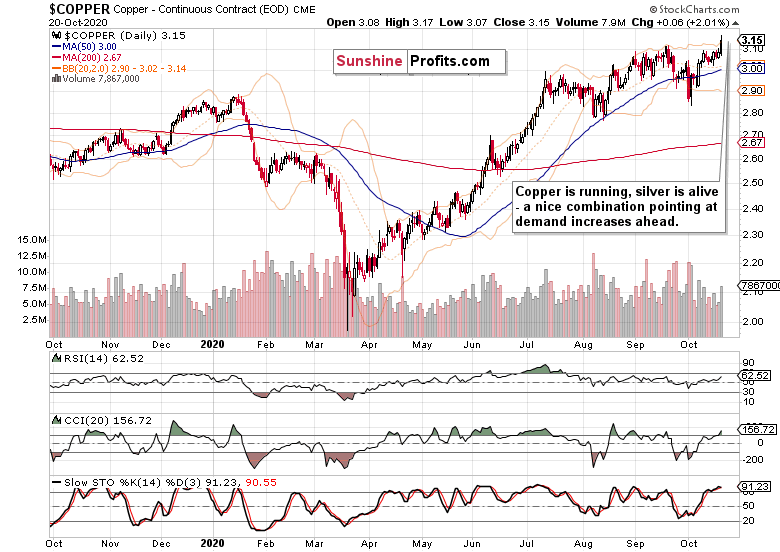

USD and Copper Speak

It's the dollar in the end, and I see its yesterday's decline as a vote of confidence in a (more costly than the Republicans wanted, but way too short of the Democratic expectations) deal at hand.

Stocks will like it, and if you look at the market breath $SPX indicators, you'll notice smart bets being already placed indication it's time to take out the S&P 500 shopping list, and make some choices.

That's certainly and still the direction I am leaning towards, disregarding the Big Tech suppression of Joe / Hunter Biden legally obtained emails on Ukraine, or the hardly unexpected mail-in ballot woes in Pennsylvania (and where else, I ask)…

The red metal has cast its vote, and it is in favor of more demand, of the economic recovery. Economically sensitive metals are doing fine (yes, that includes iron too), bond yields are rising, and junk bonds aren't really going down.

The stock bull run goes on, and will comfortably survive the elections – and thrive.

Summary

Summing up, the $SPX bears could have stepped in yesterday, but didn't – they didn't win yesterday's tug of war. Very telling, and totally fitting my yesterday's message here in the summary about one stimulus "deadline" passing after another. The case for stocks getting under pressure quite fast, has turned much less probable.

The bullish medium-term outlook remains intact, and the stimulus negotiations look today more likely to positively surprise than they did a day ago – and this has been telegraphed by commodities or smallcaps already. With the dollar failing to take the cue, the stock bulls' position has relatively improved in the short run.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.