Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

It was the bulls' turn yesterday to waste the good opportunity that they had. But is the case lost, and they won't push the S&P 500 higher one of these days? I still think they will – regardless of being unable to accomplish that yesterday. Today though? I am not so sure.

You know, some things are almost a surefire bet regardless of their appearance in the interim. This is one of those cases when it pays to ignore the white noise of the day, and focus on the big picture. There are countless examples of very similar situations such as the rise and fall of nations, empires, or campaigns such as in advertising, healthcare or even military.

Talking confrontations and cultures, it's a bit like watching the rightful and sympathetic struggle to set oneself free against the backdrop of travelling in time or in cultural values. Take the 9 and a Half Weeks movie where the heroine in the end breaks free after a long struggle and shattered illusions – courage to say enough is enough, is celebrated. I say bravo!

Compare that to three decades later and 50 Shades of Gray – its celebration of submission and dissolution. No boundaries, no standing for oneself, just sinking deeper and deeper. The markets are smarter, and assessing their footprint helps uncover hope being born (April 2020), despondency reigning supreme (March 2020), hubris before the fall (February 2020), or complacency (autumn stretching into winter 2019).

Now, markets are about to call the (stimulus negotiations) bluff. Deal will be signed – it's a question of time and mechanics. And face saving for good measure. I have a feeling that the absence of a deal is actually having a worse effect on the Democrats, if the early voting data are anything to go by (and I personally think they are).

Bottom line, the markets are justifiably expecting a deal around the corner. I don't see them throwing a hissy fit as they did in 2016 – that notion was invalidated for me with the arrival of early September storms. Throughout October after my return since the "Administrative Announcement", I've been calling for a mildly positive month – and here we are, that's the status currently.

Coiled spring once the uncertainties are removed, anyone?

S&P 500 in the Short-Run

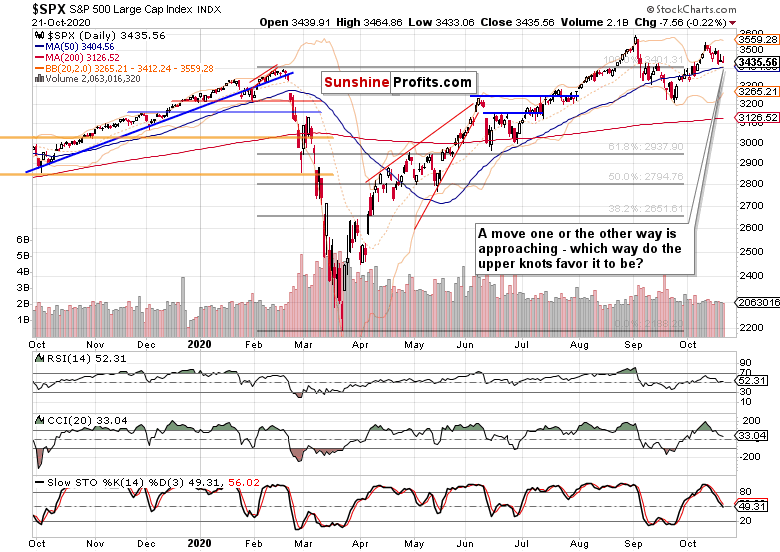

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yes, yesterday's price progress has been again lost in the day, but the bulls keep on fighting their individual fights. The match is pretty even still but the upper knots tip the hand. The current price congestion will give in, and it's my opinion that to an upside move.

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF) still give the best reason for why the stimulus is a storm in a tea cup – a foregone conclusion. The intraday gains weren't given up, far from it, and that forms a very short-term sign of willingness to go higher and take stocks along. It's hard not to walk off with this impression if you look at the other debt markets – investment grade corporate bonds (LQD ETF) weakening. And Treasuries…

Declining as the other high quality debt – long-term Treasuries (TLT ETF) are twisting the Fed's hand. And they are not the only ones.

TIPS, these inflation-protected government bonds, are joining in the pressure applied.

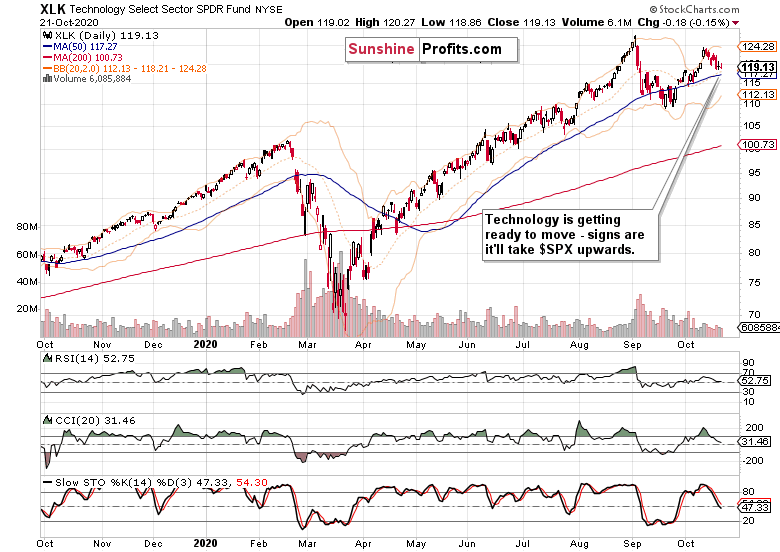

USD and Technology Speak

It's the dollar though that has the loudest voice here. It's in hot water, acting actually weaker than I looked for it to act this month. But given that I called off the October storms arrival as soon as I could (first days of this month), the dollar woes aren't that surprising.

Instead of a daily spike here and there amongst largely sideways trading (which could have been the go-to scenario), the greenback is weakening and its bullish divergencies in the making are being lost. That tells a lot about the short run.

Technology (XLK ETF) is getting ready to rise again, volume is contracting, and the downswing is conspicuously absent. These are the hallmarks of an upside move in the making, one that is hard to time to the day exactly. And that goes for the S&P 500 index as well, where I see the risk of missing out on the "surprising" move as a bigger risk that suffering several dozen points of directionless volatility on a daily basis.

Summary

Summing up, the $SPX tug of war in the short run doesn't take away from the medium-term probabilities of seeing the bulls emerging victorious. As time is running out before both the stimulus "deadlines" and the elections themselves are history, the bearish case for a short-term stock move down, is shrinking in prominence – and the credit markets, dollar and copper still favor the bulls.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.