Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

A bull flag, still a bull flag… That's what the S&P 500 price action is telling, validating the points I've been making throughout the prior week. But how does Friday's weaker high yield corporate bonds performance fit into the picture?

Are they serious or only bluffing? I have an answer, and will take your through my strong opinions on the matter. I'll lay out the case, in no uncertain terms, objectively and faithfully, the way you're used to from myself – because you, the people, deserve the daily best of me and nothing less.

A new week is here, and no signs of stimulus deal gaps being bridged. But stocks don't appear to care – they look to me banking on the deal being reached within weeks. The real economy is not on the ropes, not down and out – the stock market is sending its own verdict that the differences will be overcome one way or another.

What might not always be the best strategy in life (and I personally think it isn't for I am a big believer in tackling matters head on, in taking the bull by the horns), however appears to be the sensible plan for trading the stock market right now.

S&P 500 in the Medium- and Short-Run

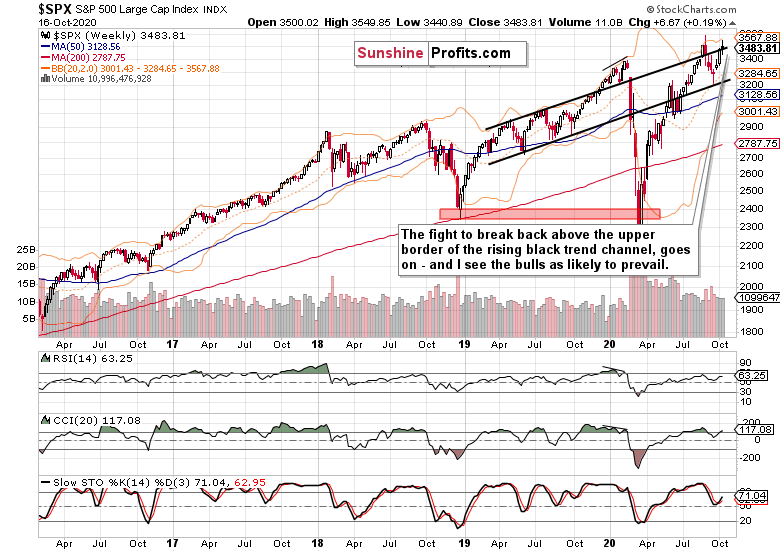

I’ll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

After the large white candle characterizing the week ending Oct 11, I called for the next week to be rather lean. And it indeed was, becase stocks didn't sustain their breakout above the upper border of the rising black trend channel last week. Did they reverse down though?

No, I think they've merely consolidated after sharply recovering from the similarly sharp September selloff. The volume doesn't hint at a reversal really – the weekly indicators remain fairly neutral to positive.

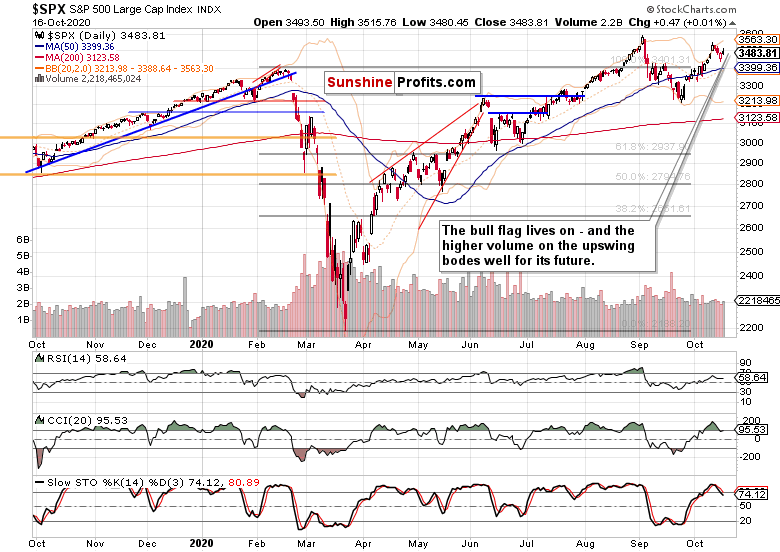

The daily chart concurs with the mildly bullish but still bullish assessment. The price upswing from the depths of the bull flag (bull flag in progress, remember – the hypothesis can still get invalidated down the road even though that doesn't seem as likely currently) hasn't been overwhelmigly rejected by the S&P 500 selloff in the last 75 minutes of Friday's regular session.

While the bulls may bid their time a little longer here (the daily indicators don't exactly favor a sharp upswing immediately), they're made of steel just as I told in my Sep 11 article Rocky S&P 500 Recovery From the Sharp Correction Goes On – they'll overcome the challenges and close above the early September highs well before 2020 is over.

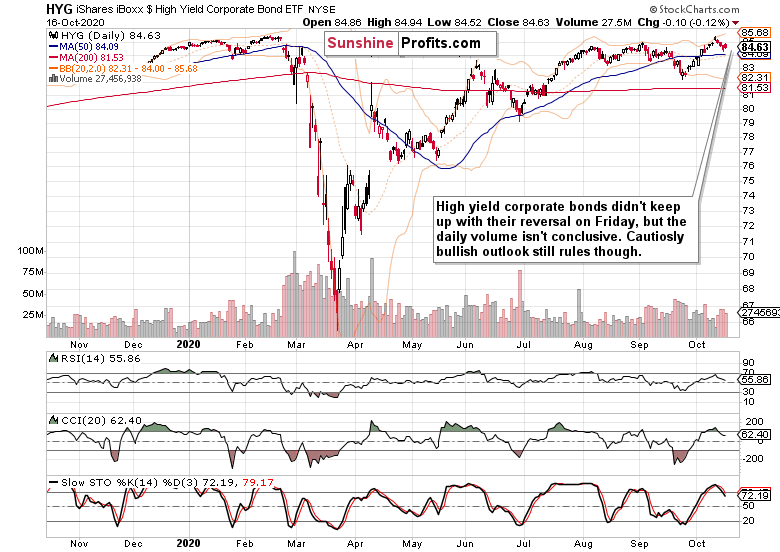

Credit Markets’ Point of View

High yield corporate bonds (HYG ETF), that's the fly in the (short-term) ointment. Not exactly stumbling, but hesitating – noticeably hesitating on a daily basis.

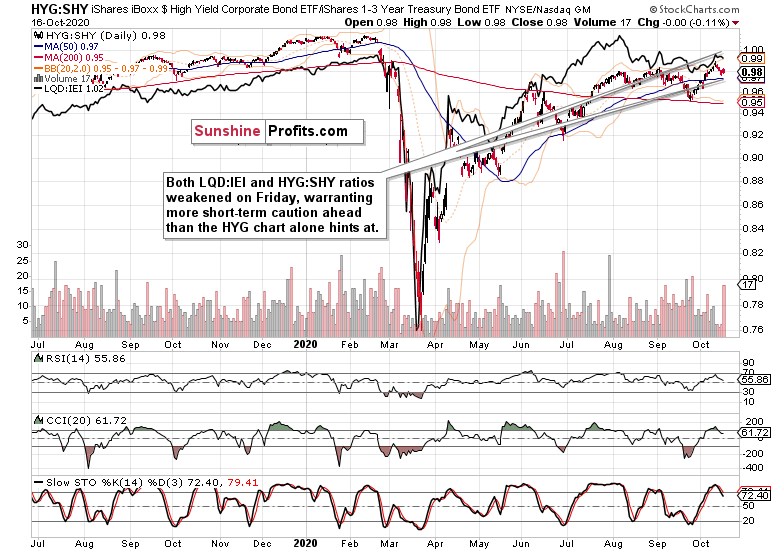

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – have ticked lower on Friday. That's a short-term non-confirmation even though both individual ETFs' chart posture remains largely constructive.

Time to trust it, or to call its bluff as meaningless daily white noise?

Long-term Treasuries (TLT ETF) are again declining. This fact, plus the action in precious metals, oil and commodities regardless of the daily decline in copper, that's why I am not taking the daily headwinds in credit markets as a harbinger of stocks rolling over. I told you, the bulls are stronger – and will prevail.

The Dollar Weighs In

Such were my Friday's take on the dollar:

(…) Talking fundamentals, they're clearly reflected in the dollar's struggles. I don't think the budding divergences would take the greenback far and lastingly – stocks certainly don't seem to get under too much pressure due to spiking dollar.

The greenback doesn't reflect rising fever in the world economy or national stock markets. It's actually moving lower today already, which is in tune with the prevailing tone of my today's analysis.

Summary

Summing up, I am not reading too much into the late Friday's setback in stocks or the weaker corporate debt markets. This is not a risk-off environment we're in – prices are muddling through with a general bullish bias. The charts are not hinting at a game changer right here, right now. Copper has weakened, but will run again – precious metals and oil are acting really constructive. Then, Treasury yields are far from spiking.

In spite of the sentiment in stocks inching closer to extreme greed again, in spite of the put/call ratio dipping a tad dangerously lower again, it's the bulls who are on the move. Technology is in the pool position again, Russell 2000 is doing great and emerging markets are on fire. In short, S&P 500 is a little underperforming these weeks in what is a brief patch of risk-on-risk-off hesitancy.

The bullish $SPX outlook in the medium-term remains justified, and the short-term price action will confirm that in my view before too long. After September storms, I do look for the month of October to close in black.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.