Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stock prices continued to fluctuate on Friday, as the S&P 500 bounced from the 3,800 level. Is the market forming a bottom?

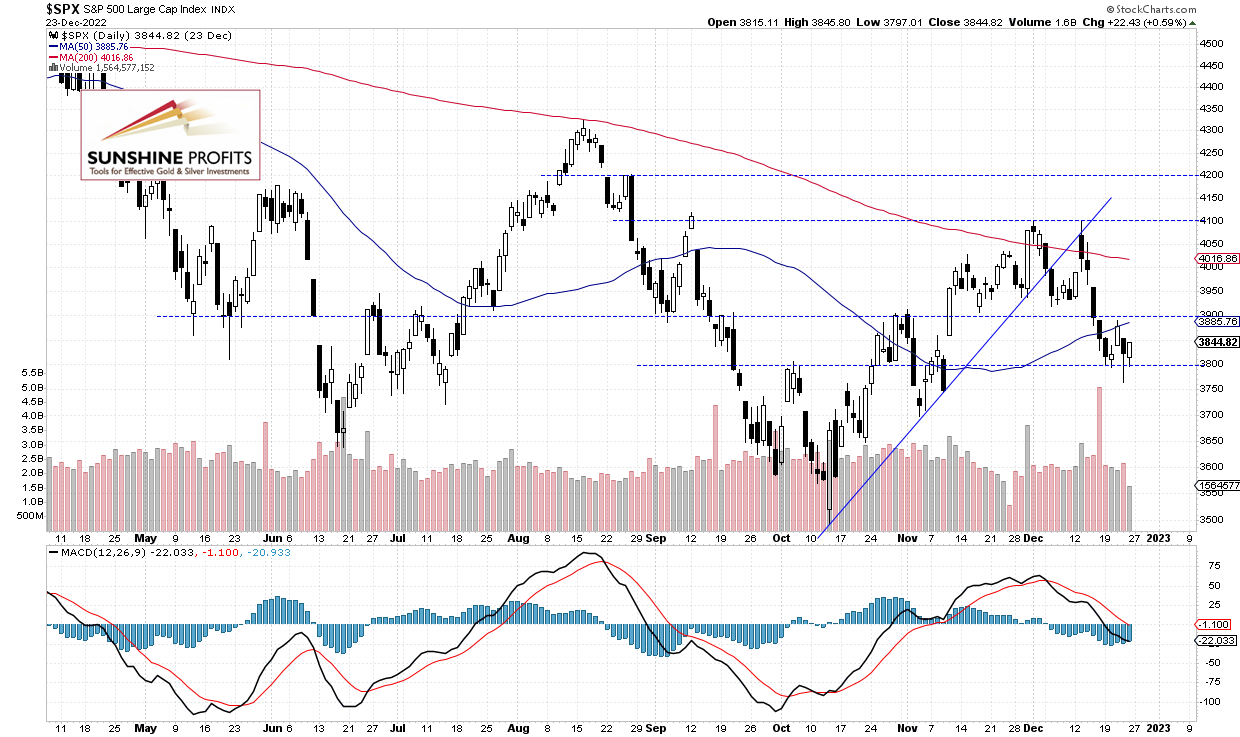

The S&P 500 index gained 0.59% on Friday, as it bounced from its Thursday’s new local low of 3,764.49. Overall it extended a consolidation along the 3,800 level, as it closed above it again. Recently the S&P 500 has been reacting to the December 14 FOMC interest rate hike, among other factors.

This morning the S&P 500 is expected to open 0.1% higher, so we may see more short-term uncertainty and a consolidation along the 3,800 level. In early December the S&P 500 index broke below its two-month-long upward trend line and recently it moved sharply lower after getting back to that line, as we can see on the daily chart:

Futures Contract Went Close to 3,900

Let’s take a look at the hourly chart of the S&P 500 futures contract. This morning it went closer to the 3,900 level, but it is retracing the overnight advance ahead of the cash market open. The resistance level remains at 3,900-3,920.

Conclusion

The S&P 500 index will likely open virtually flat today and it may see more short-term consolidation along the 3,800 level. There have been no confirmed positive signals so far. However, stocks may be forming a bottom here.

Here’s the breakdown:

- The S&P 500 index bounced from the new local low last week.

- Stocks will likely extend their consolidation, as investors hesitate following the recent declines.

- In our opinion, the short-term outlook is neutral.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care