In anticipation of the previous $2T stimulus package that passed on Mar 27 and in its aftermath, stocks rallied, yet it wasn't a one-way road. They had trouble overcoming the pre-stimulus highs, and actually sold off in the following week.

Today's Fed announcement contained a $2.3T loan package to support the economy. While stocks didn't sell off in its immediate aftermath, they haven't rallied profoundly in the runup to further stimulus either.

High-yield corporate debt (HYG) predictably rallied in response to the real economy support with loans, but the bulls are having issues adding to their opening gains. That's a shooting star, a bearish candle.

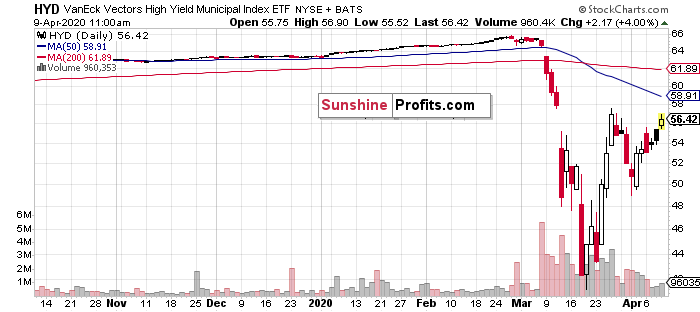

The already-supported municipal bonds haven't overcome their late-March highs after this breaking news. Selling into strength is clearly visible here as well.

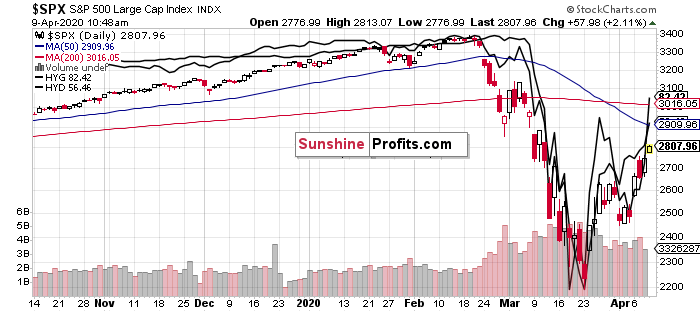

Finally, let's see the intraday S&P 500 chart overlaid with these two debt markets.

While all three moved in unison higher, there appears to be less bang for a buck in this stimulus measure than in the preceding one. Should the credit markets lead higher and drag stocks along, that would be a game changer.

But the S&P 500 is currently trading sideways around 2785, and may very well sell off in the coming days similarly to the earlier fiscal stimulus aftermath. We will monitor the evolving market reaction - for now, the short position remains justified.

Trading position (short-term; our opinion): short positions with stop-loss at 3050 and the initial downside target at 2200 are justified from the risk/reward perspective. It's a big-picture trade if you will, which means that the trade parameters are relatively distant price points. Remember that you can adjust your own position sizing so that the risk per trade meets your very personal preferences. We'll manage the open position flexibly and in line with the incoming signals supporting/refuting the projections, but the above price points are the big picture layout.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care