S&P 500 opened lower yesterday, and despite the selling pressure during the session, prices held up relatively well. Having closed at 2912, the breakout above 61.8% Fibonacci retracement has been however rejected.

Given the positive market reaction to Big Tech earnings earlier this week, it was reasonable to expect a similar reaction to the Amazon (AMZN) report after the markets closed yesterday. The company's revenue managed to beat expectations, having risen 26%, yet the Q1 profit fell to $2.5bn from $3.6bn in the prior year. The market deemed it underwhelming, and the stock soundly declined in aftermarket trading, dragging the index lower along.

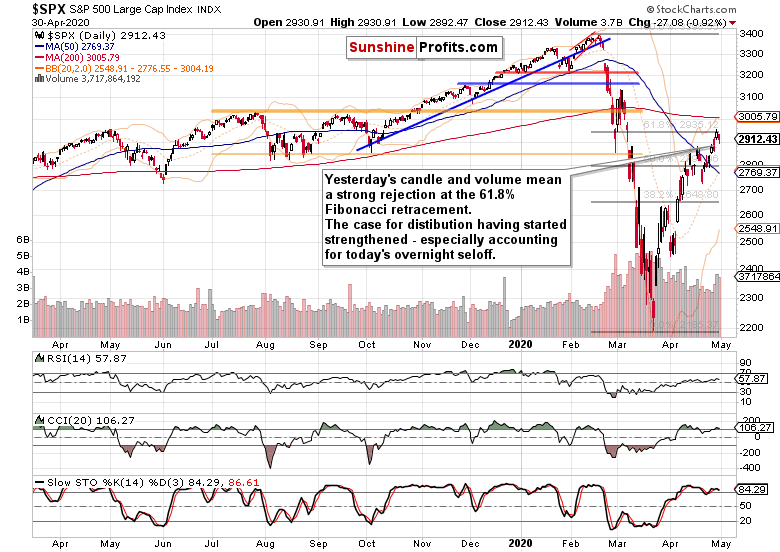

Prices declined steeply in the overnight trading, extending yesterday's moderate downswing. That's how yesterday's session looks on the daily chart:

The daily candle and volume examination leans in favor of an early stage of a downswing. The chart itself though doesn't preclude a consolidation phase coupled with a renewed run to the 61.8% Fibonacci retracement. Given the sizable volume of last two sessions though, such a run would have little change of overcoming this resistance, which is also reinforced by the zone defining the early March bearish gap.

The fly in the ointment is the reaction to Amazon earnings. This steep a selloff makes it more than likely that the bear leg has already started in earnest, without a renewed attempt to reach the 61.8% Fibonacci retracement.

All right, as the S&P 500 futures trade now at around 2835, does that mean we won't get a better price point to exit our long position? Regardless of the deterioration we have seen in many S&P 500 sectors yesterday, we're likely to be offered an opportunity to reassess the outlook and our decision (coupled with a better price point than the current one).

As a result, we're of the opinion that exiting the open long position at this moment (4:10 AM EST) isn't justified.

Trading position (short-term; our opinion): long positions (100% position size) with stop-loss at 2780 (tightening to slightly below the 50% Fibonacci retracement should short-term momentum increase) and with initial upside target at 2970. Stay tuned as finetuning the open positions is likely given the technical deterioration discussed in the regular Alert.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care