Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

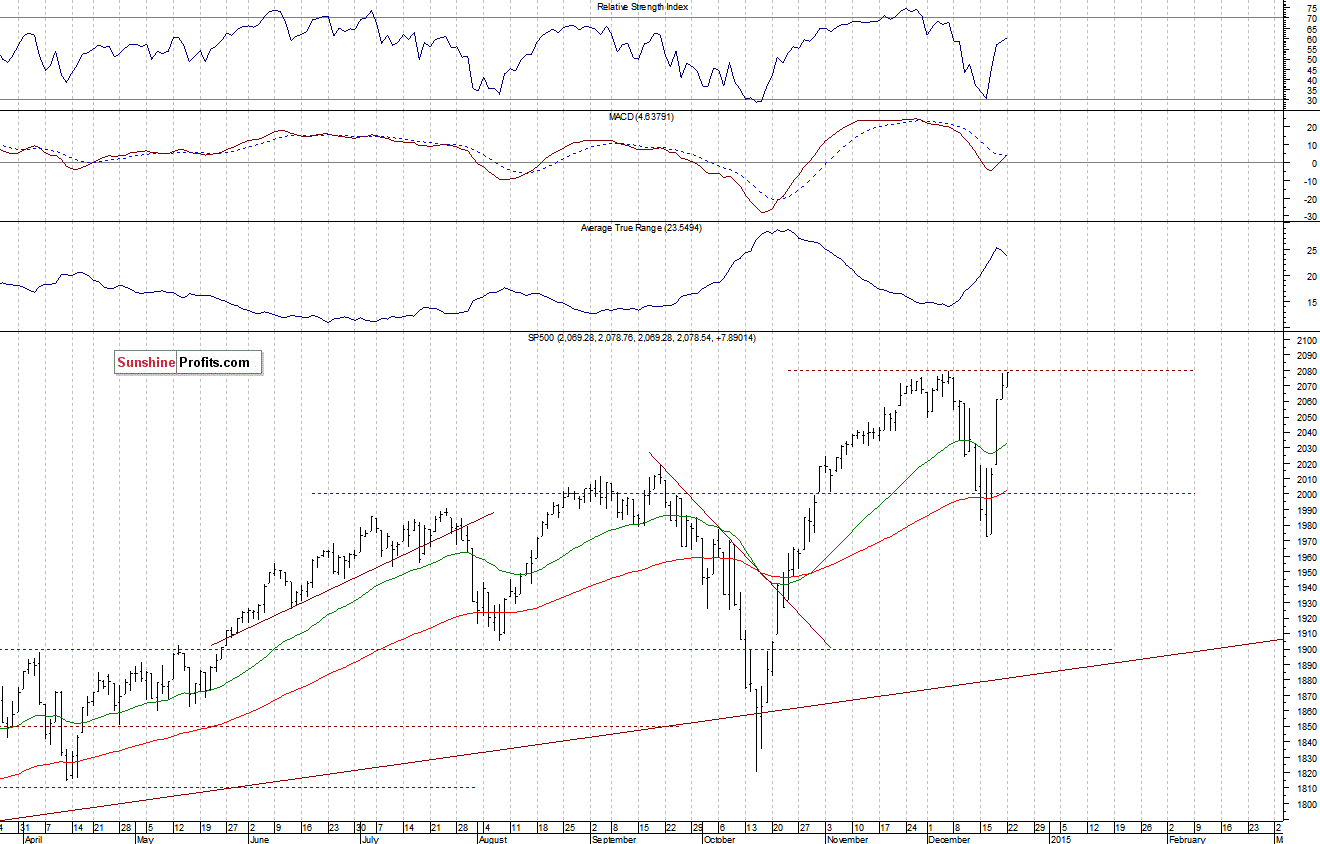

The main U.S. stock market indexes gained between 0.3% and 0.9% on Monday, slightly extending their recent move up as investors’ sentiment remained bullish. The S&P 500 index remains close to its December 5th all-time high of 2,079.47. The nearest important level of resistance is at around 2,080, and next possible resistance level is at around 2,100. On the other hand, support level is at 2,050-2,060, among others. There have been no confirmed negative signals so far, however, we can see some short-term overbought conditions accompanied by negative divergences:

Expectations before the opening of today’s trading session are virtually flat, with index futures currently up 0.1%. The European stock market indexes have been mixed so far. Investors will now wait for series of economic data announcements: Durable Orders, GDP at 8:30 a.m., FHFA Housing Price Index at 9:00 a.m., Michigan Sentiment at 9:55 a.m., Personal Income, Personal Spending, PCE Prices – Core number, New Home Sales at 10:00 a.m. The S&P 500 futures contract (CFD) continues to trade along the level of 2,070. The nearest important level of resistance is at around 2,075, as we can see on the 15-minute chart:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades along the level of 4,290. The nearest important level of resistance is at around 4,300. For now, it looks like a flat correction within an uptrend, as the 15-minute chart shows:

Concluding, the broad stock market slightly extended its rally on Friday, following a sharp rebound off last week’s lows. We can see some short-term overbought conditions, however, there have been no confirmed negative signals so far. Therefore, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts