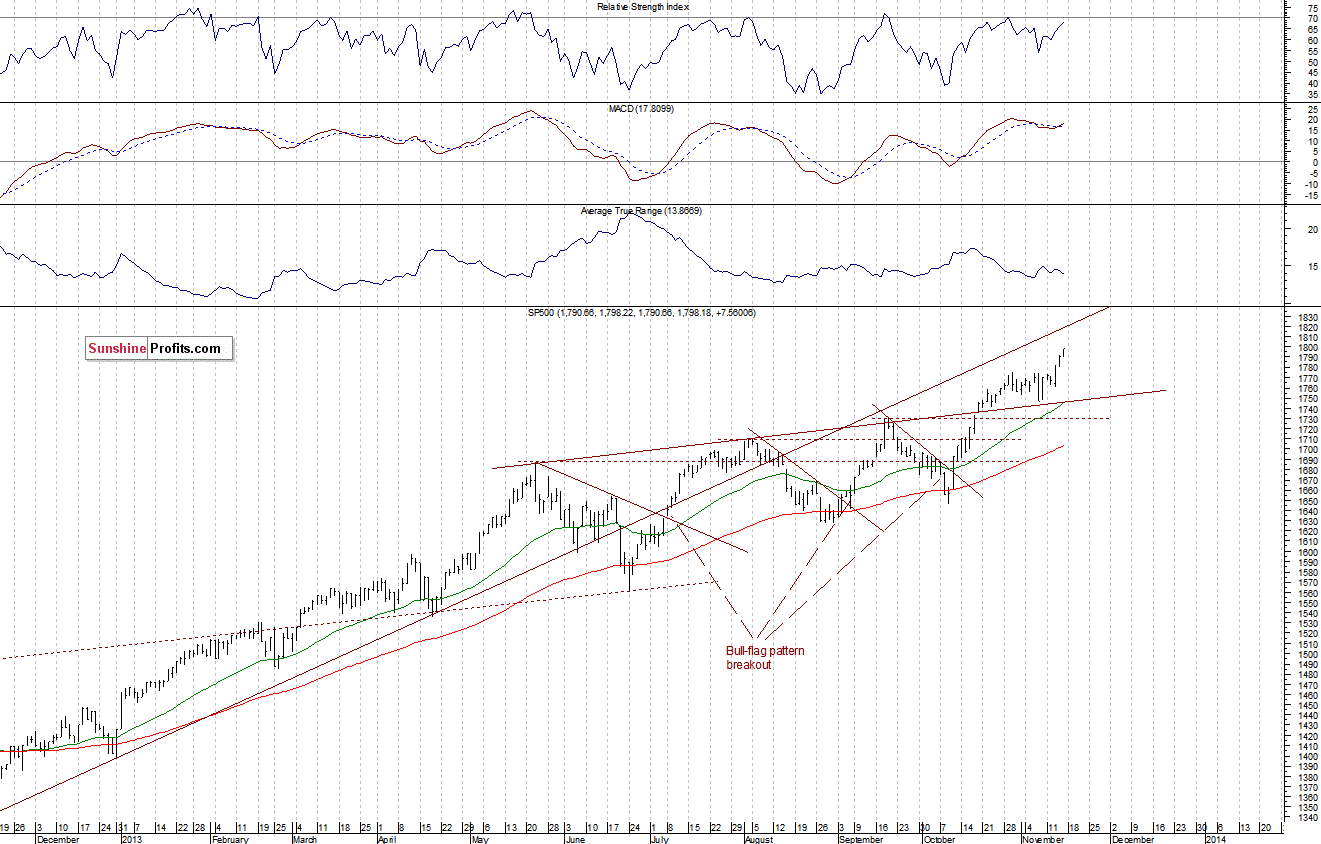

The main U.S. stock market indexes gained between 0.2% and 0.5% as stocks continued their consequent upward march. Investors keep buying stocks, hoping for more gains, driven by the Fed’s easy monetary policy. The S&P 500 index approached the level of 1,800, and the DJIA approached the level of 16,000. Both these indexes make new all-time highs recently. The broad market index broke above the late October, early November consolidation, as we can see on the daily chart:

Expectations before the opening of today’s session are slightly positive, as the European stock market indexes have gained 0.2-0.4% so far. Investors will now wait for the NAHB Housing Market Index announcement at 10:00 a.m. The S&P 500 futures contract (CFD) is in a rather narrow short-term consolidation, still close to its long-term highs. The nearest resistance is at around 1,795. On the other hand, the support is at 1,780, marked by Thursday’s intraday bottom, as the 15-minute chart shows:

Despite being wrong recently, our intraday outlook remains bearish, and our short-term outlook is bearish:

Intraday outlook: bearish

Short-term outlook: bearish

Medium-term outlook: neutral

Long-term outlook: bullish

The above analysis is the first of today's 2+ Stock Trading Alerts. Stay as updated as possible on the current events and trends on the

stock market by choosing ourStock Trading Alert subscription service

Thank you,

Paul Rejczak