Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

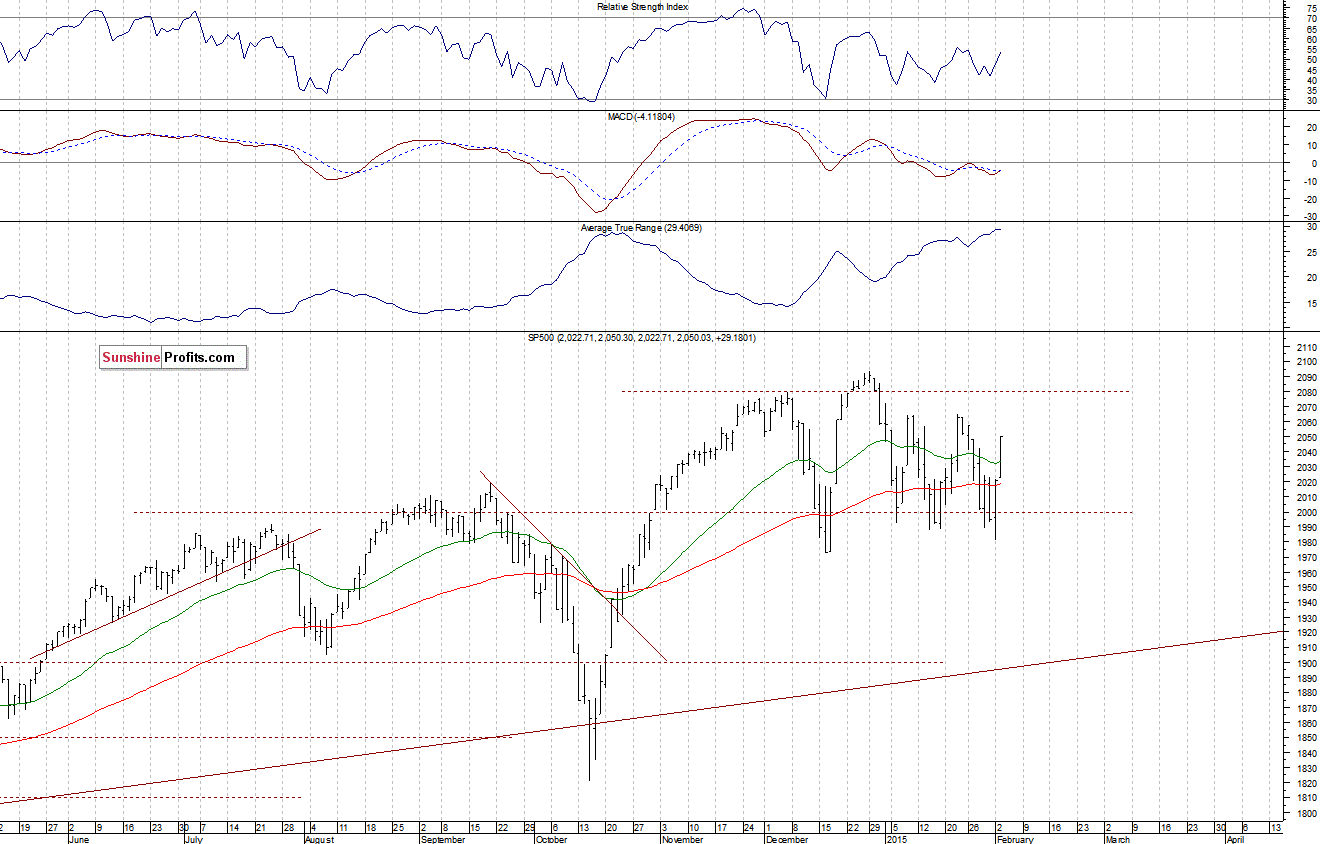

The U.S. stock market indexes gained between 1.0% and 1.8% on Tuesday, extending their short-term move up, as investors reacted to oil prices advance, among others. The S&P 500 index remains within its three-month long consolidation, still with no clear medium-term direction. The nearest important support level is at 2,020-2,025, marked by previous local highs, and the next support level is at 1,980-2,000. On the other hand, resistance level is at 2,060-2,065, marked by January local highs, as we can see on the daily chart:

Expectations before the opening of today's trading session are slightly negative, with index futures currently down 0.1-0.2%. The European stock market indexes have lost 0.5-0.7% so far. Investors will now wait for some economic data announcements: ADP Employment Change number at 8:15 a.m., ISM Services at 10:00 a.m. The S&P 500 futures contract (CFD) is in an intraday consolidation following yesterday's move up. The nearest important support level is at around 2,025-2,030, and resistance level is at 2,045, among others:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it is in an intraday consolidation. For now, it looks like a flat correction following short-term uptrend. The nearest important resistance level is at around 4,220-4,230, and level of support is at 4,200, as the 15-minute chart shows:

Concluding, the broad stock market extended its Monday's rebound yesterday. It moved higher within three-month long consolidation following last year's October-November rally. We still prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts