Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook remains neutral, and our short-term outlook is neutral:

Intraday

(next 24 hours) outlook: neutral

Short-term (next 1-2 weeks) outlook: neutral

Medium-term (next 1-3 months) outlook: neutral

Long-term outlook (next year): bullish

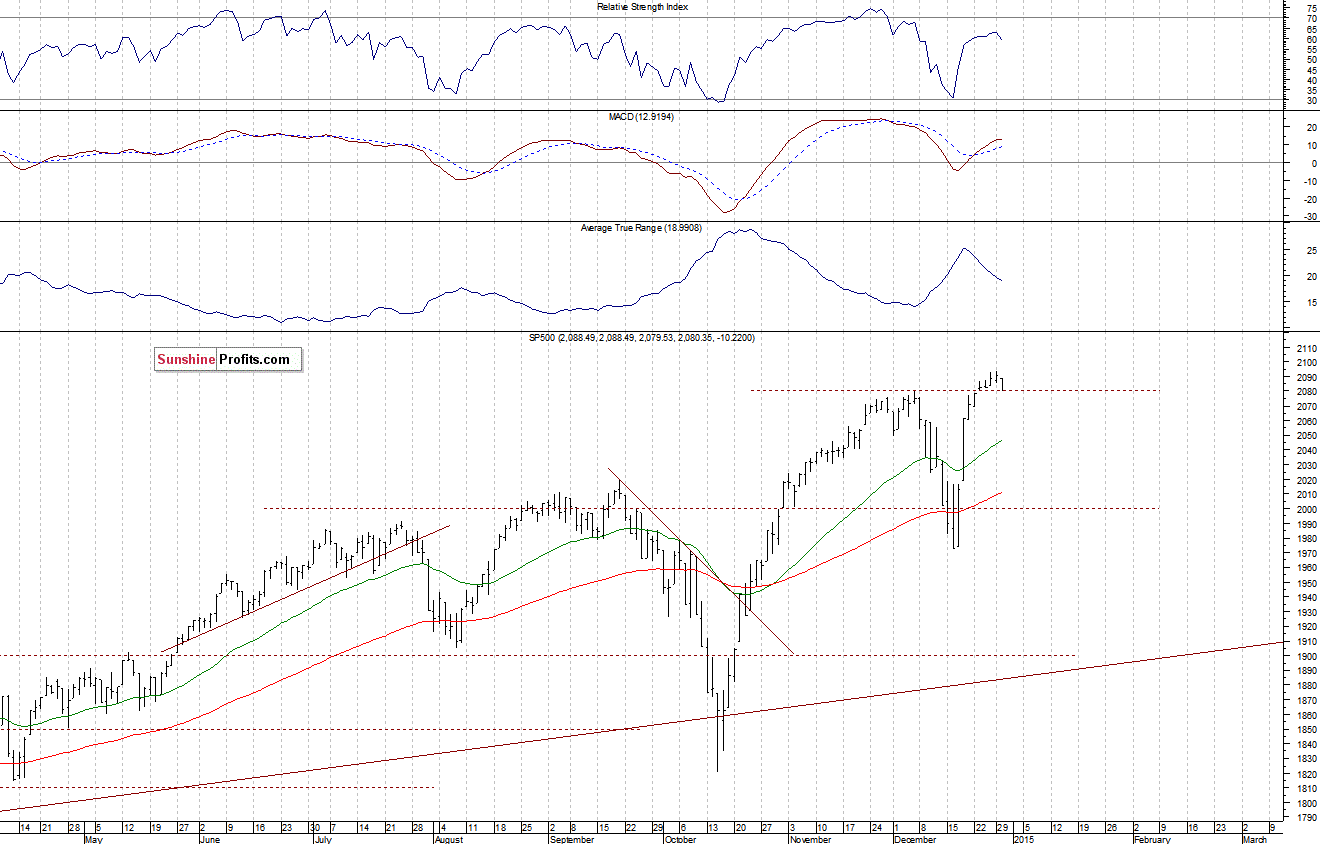

The main U.S. stock market indexes lost between 0.3% and 0.7% on Tuesday, retracing some of their recent move up, as investors took profits off the table. The S&P 500 index got closer to support level of 2,080. The next important level of support is at around 2,060-2,070, marked by recent local lows, among others. On the other hand, resistance level remains at 2,090-2,100, marked by Monday’s all-time high of 2,093.55. There have been no confirmed negative signals so far, however, we can see some overbought conditions accompanied by negative technical divergences:

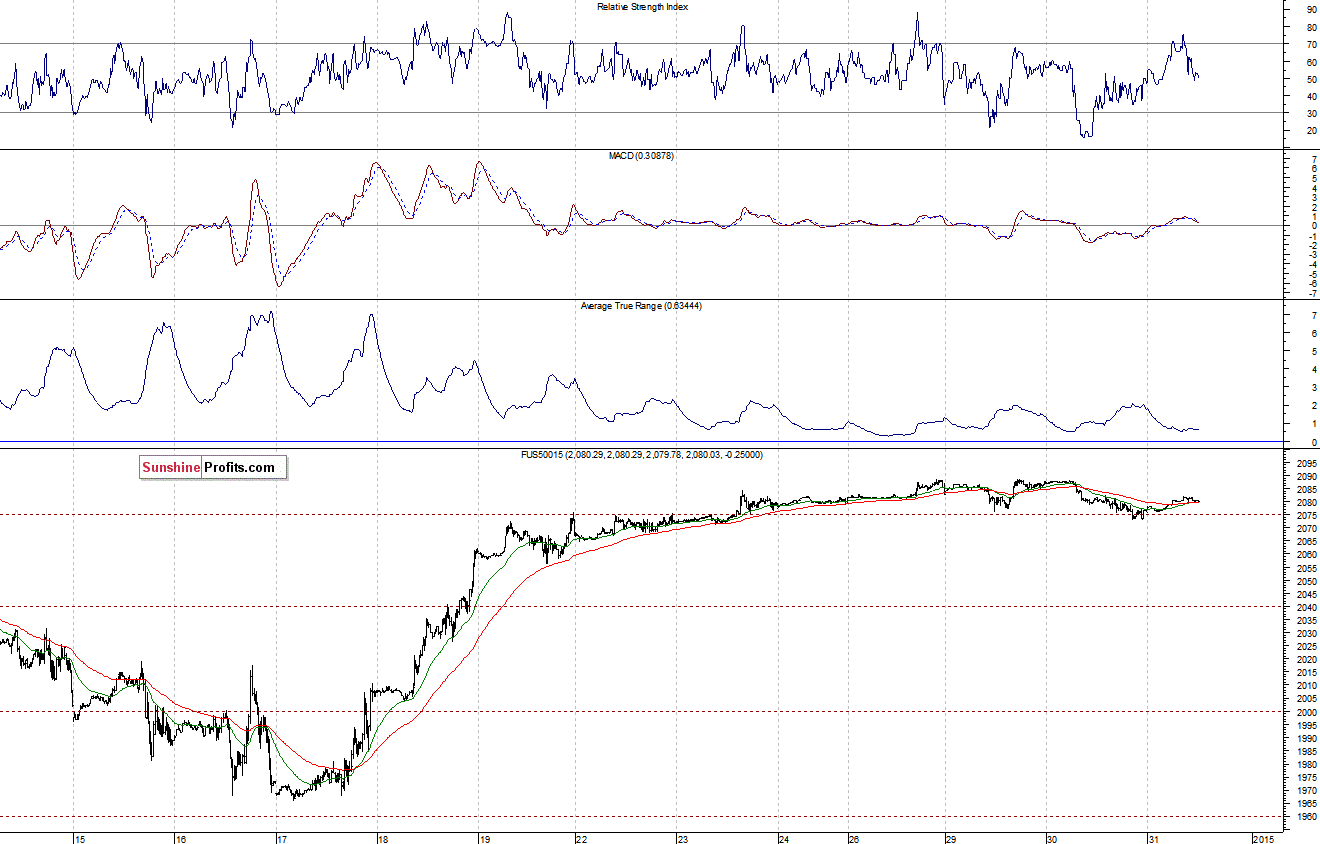

Expectations before the opening of today’s shortened trading session are slightly positive, with index futures currently up 0.1-0.2%. The European stock market indexes have gained 0.3-0.5% so far. The S&P 500 futures contract (CFD) bounced off support level of 2,070-2,075. It currently trades along the level of 2,080. The nearest important level of resistance is at around 2,090, marked by recent highs, as we can see on the 15-minute chart:

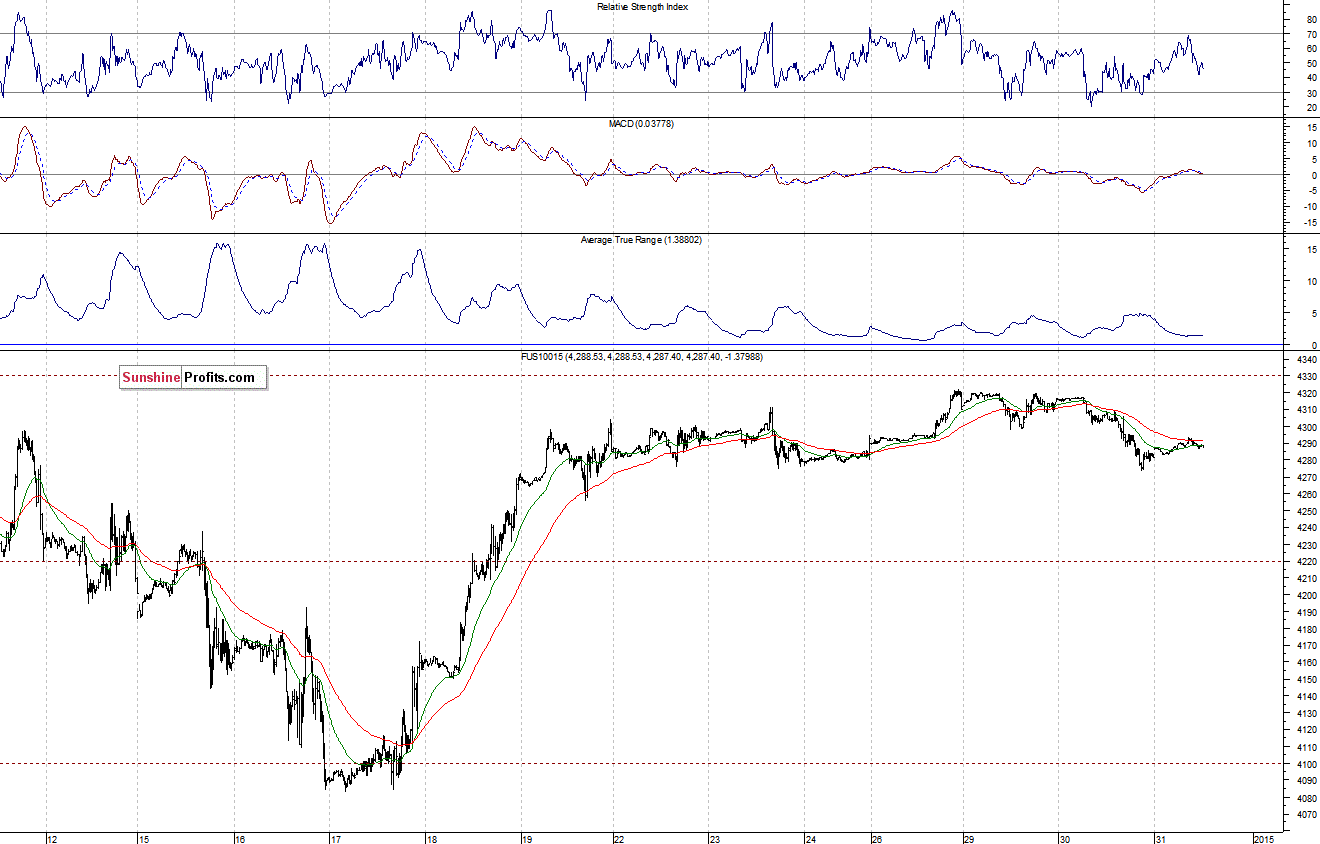

The technology Nasdaq 100 futures contract (CFD) bounced off support level of 4,270-4,275, marked by some previous local lows. It continues to fluctuate slightly below resistance level of 4,300, as the 15-minute chart shows:

Concluding, the broad stock market retraced some of its recent move up, as the S&P 500 index bounced off resistance level at 2,090-2,100. We can see some short-term overbought conditions, however, there have been no confirmed negative signals so far. Therefore, we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts