Briefly:

Intraday trade: The S&P 500 gained 1.0% on Tuesday, after opening 0.7% higher. The market will probably open virtually flat to slightly higher today. We may see some short-term fluctuations following the recent advance.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

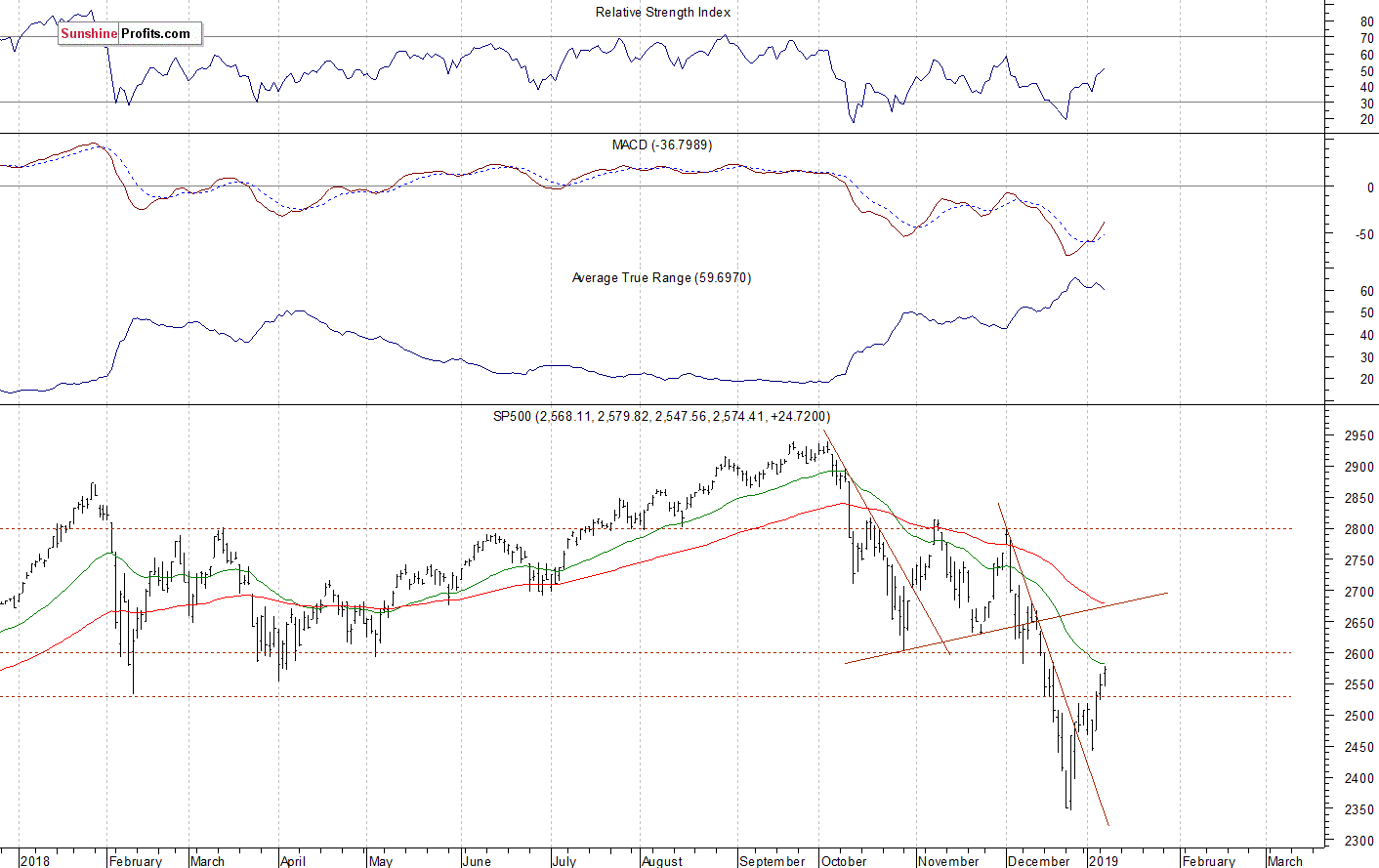

The U.S. stock market indexes gained 1.0-1.1% on Tuesday, extending their short-term uptrend, as investors' sentiment remained bullish following better-than-expected monthly jobs data release. The S&P 500 index continued its recent rebound off the December the 26th medium-term low of 2,346.58. It traded 20.2% below September the 21st record high of 2,940.91 on that day. Then the market rallied and retraced some of the downtrend. It got back above 2,500 mark on Friday and then it got closer to 2,600 yesterday. Both the Dow Jones Industrial Average and the Nasdaq Composite gained 1.1% on Tuesday.

The nearest important level of resistance of the S&P 500 index is now at 2,580-2,600, marked by the previous local lows. The resistance level is also at 2,635-2,640, marked by December the 14th daily gap down of 2,635.07-2,637.27. On the other hand, the level of support is at 2,550, and the next support level remains at 2,500, marked by some recent local highs.

The broad stock market broke below its two-month-long trading range in the mid-December, as the S&P 500 index fell below the level of 2,600. Then the market accelerated lower and it broke below the level of 2,400. The downward correction reached 20.2% from the September all-time high, surpassing January-February correction of around 12%. Is this a long-term bear market? It still looks like a medium-term downward correction, but the index remains slightly below the October-December consolidation, as we can see on the daily chart:

Slightly Positive Expectations

Expectations before the opening of today's trading session are slightly positive, because the index futures contracts trade 0.1% above their yesterday's closing prices. The European stock market indexes have gained 1.0-1.1% so far. Investors will wait for some economic data announcements today: Crude Oil Inventories at 10:30 a.m., the FOMC Meeting Minutes at 2:00 p.m. The broad stock market may fluctuate following its recent rally. The index got closer to the resistance level of 2,600 and we may see some uncertainty there.

The S&P 500 futures contract trades within an intraday consolidation, as it remains close to its short-term local highs. The nearest important level of resistance is at around 2,585. The resistance level is also at 2,600. On the other hand, the nearest important support level is now at 2,550-2,560, among others. The futures contract remains above its three-day-long upward trend line, as the 15-minute chart shows:

Nasdaq Closer to 6,600

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. It got closer to the level of 6,600. So it gained almost 800 points from December the 26th local low of around 5,820. We can see some short-term overbought conditions. However, there have been no confirmed negative signals so far. The Nasdaq futures contract trades along the level of 6,600 this morning, as we can see on the 15-minute chart:

Big Cap Tech Stocks Getting Overbought or Just Trending?

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock sold off on Thursday, as it reached the new medium-term low of $142. We saw clear short-term oversold conditions and the stock retraced some of its recent decline on Friday. However, there have been no confirmed positive signals so far. But it is slightly above the month-long downward trend line again:

Now let's take a look at Amazon.com, Inc. stock (AMZN) daily chart. The stock accelerated its downtrend in the late December and it reached the new medium-term low of $1,307. Since then it is consequently advancing. Yesterday the market reached its three-month-long downward trend line. We may see an attempt at breaking higher:

Dow Jones Also Higher

The Dow Jones Industrial Average broke below its two-month-long consolidation in the mid-December and then it accelerated much lower. The blue-chip stocks' gauge fell below the level of 22,000. It slightly extended the downtrend recently before sharply reversing higher and getting back closer to 24,000 mark. So was it an upward reversal or just a correction within a downtrend? The market remains slightly below its October - December trading range:

The S&P 500 index extended its downtrend in the late December, before reversing higher. The broad stock market was more than 20% below its September's record high on December the 26th. Is this a new long-term bear market or just medium-term downward correction? For now, it looks like a correction. However, there have been no confirmed medium-term positive signals so far. The market retraced some of its recent decline, but it continues to trade below the important resistance levels.

Concluding, the S&P 500 index will likely open virtually flat to slightly higher today. The market may slightly extend its short-term uptrend again. However, we may see some profit-taking action as stocks get closer to the medium-term resistance levels.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts