Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

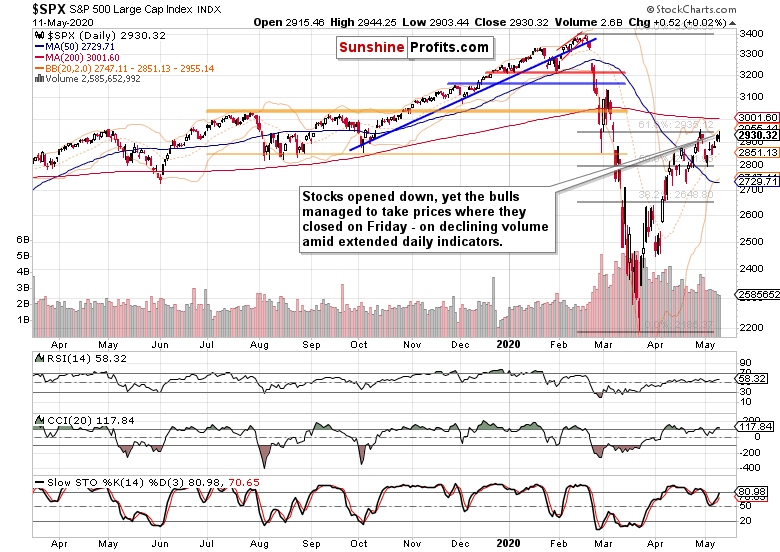

Another day, another close at the 61.8% Fibonacci retracement. As yesterday's session was preceded with quite a test of the bulls' resolve, does it mark strength of the buyers, or their last gasp push?

S&P 500 in the Short-Run

Let's start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Yesterday's bearish gap at the open was closed, and the bulls have been adding to their gains throughout the day. Stochastics continues to be positioned constructively for the upswing to continue, but the CCI shows signs of weakness - just as the volume examination thanks to yesterday's lower reading increasingly does.

Having said that, short-lived moves either way wouldn't be at all surprising here, as the index looks for short-term direction. Can the outlook be refined once we look at the credit markets?

The Credit Markets' Point of View

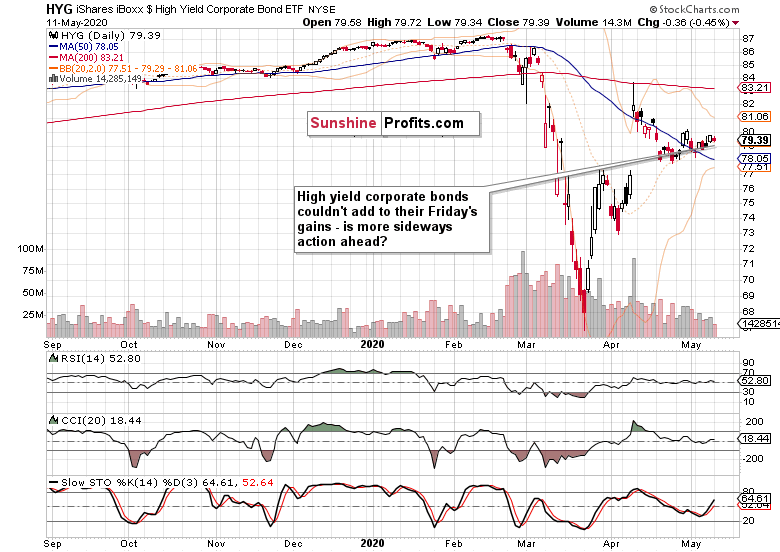

High yield corporate debt (HYG ETF) didn't lead stocks higher yesterday, and actually closed not too far from where it opened on Friday. The same is true about its ratio to short-dated Treasuries (HYG:SHY). As the early May move lower was rejected, yesterday's downswing is mostly likely a sign of ongoing consolidation in the ETF.

Unless the instrument breaks out above its late April highs, the stock uptrend would be best viewed with caution. For now however, and judged solely by the chart, more upside in the HYG ETF appears to be the path of least resistance.

The upswing in the ratio of high yield corporate bonds to investment grade corporate bonds (HYG:LQD) would support higher stock prices. Right now, it's attempting to overcome the late March and April intraday tops - highlighting the return of risk-on environment. But isn't getting extended? This chart reflects the headwinds the bulls are likely to face on their journey north.

Let's move to the key S&P 500 sectors next.

Key S&P 500 Sectors and Ratios in Focus

Technology (XLK ETF) didn't roll over to the downside, quite to the contrary. Erasing opening losses, the leading sector closed at new monthly highs. But it has suffered a setback in the last hour of trading. Both the upper knot and increasing volume serve as warning signs for the sessions ahead. Not necessarily right for the upcoming one, but should we see more selling into strength, it would be reasonable to start questioning the technology upswing.

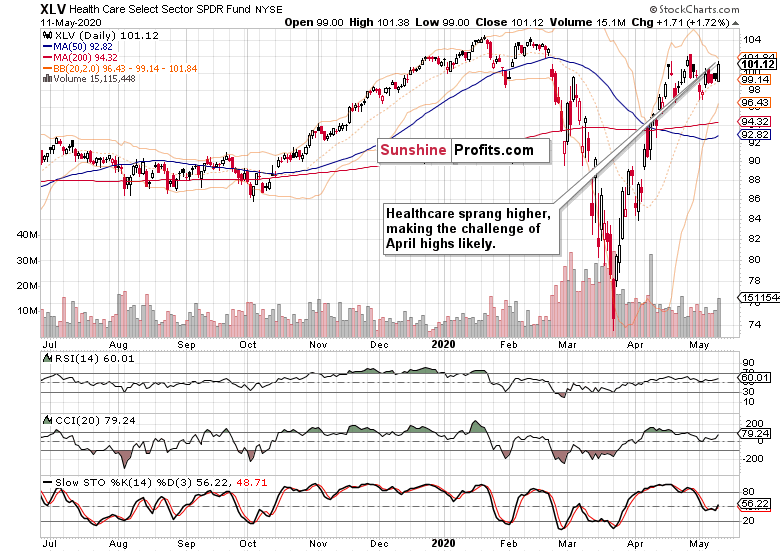

Healthcare (XLV ETF) rose strongly, closing near the daily highs. Coupled with the positive turning points in the daily indicators, the volume would support taking on the April highs over the coming sessions.

Financials (XLF ETF) are relatively lagging, trading well below their late April highs - quite a lot lower that the HYG ETF does compared to its previous highs. Regardless of Stochastics' buy signal, the daily indicators aren't positioned all that favorably for an upswing.

What would an upturn in financials need? Junk corporate bonds overcoming their local highs. Will they do that once the Fed has its vehicles ready to start actually buying them instead of offering forward guidance to such effect? Wasn't actually the Friday's action merely an attempt to frontrun the Fed, and yesterday's weak performance a reflection that we haven't seen a proof of their start in earnest? Will they deliver that in tomorrow's Powell speech?

Financials don't appear to be buying the rumor heavily, and that's an understatement. Their upcoming performance will shed valuable light on the S&P 500 prospects.

Neither energy, nor materials slash industrials had a good day yesterday. The early bull market trio seems to be running into headwinds. While they're not rolling over, they aren't enthusiastically leading higher. Unless reversed, that's likely to turn into a headwind for the stock market advance over the coming sessions.

Summary

Summing up, stock bulls closed again at the 61.8% Fibonacci retracement, but the internals of the stock upswing appear to be deteriorating. Credit markets are not performing as strongly as expected on a very short-term basis, while technology and healthcare are the sectors left to carry the torch. The smallcaps haven't continued with their Friday's chase of higher prices either. This spells an increasing likelihood of the stock upswing being put to test over one of the nearest sessions. We'll keep monitoring the evolving attempt to push higher still, assess its health and take appropriate trading decisions.

Trading position (short-term; our opinion): no positions are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care