Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stocks broke above their consolidation yesterday. Is this an upward reversal or just another upward correction? The NFP release leaves question marks.

The S&P 500 index gained 0.83% on Thursday following breaking above the recent local highs and the 4,400 price level. The market retraced most of its late September’s decline yesterday as investors awaited today’s monthly jobs data release, among other factors. The Nonfarm Payrolls release has been worse than expected at +194,000. However, the main indices are expected to open 0.1-0.5% higher this morning.

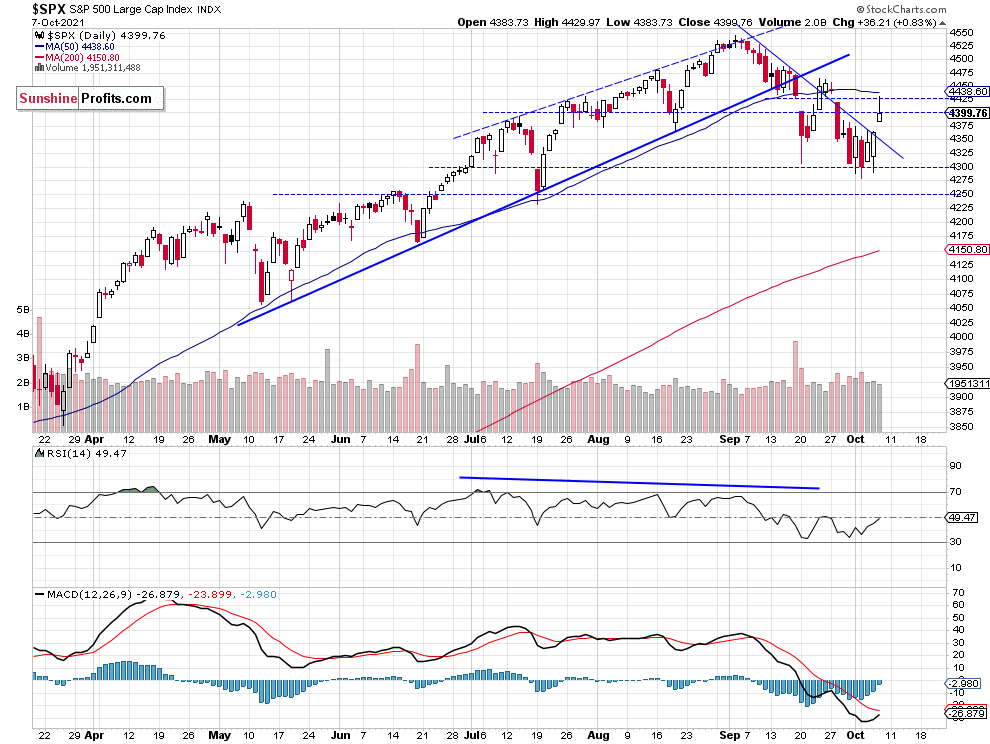

The support level is now at 4,365-4,385, marked by yesterday’s daily gap up of 4,365.57-4,383.73. On the other hand, the resistance level is at 4,430-4,450. The S&P 500 broke above its month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

S&P 500 Remains Above Medium-Term Support Level

The S&P 500 index is trading below its almost year-long upward trend line. The nearest important medium-term support level remains at 4,200-4,300, as we can see on the weekly chart:

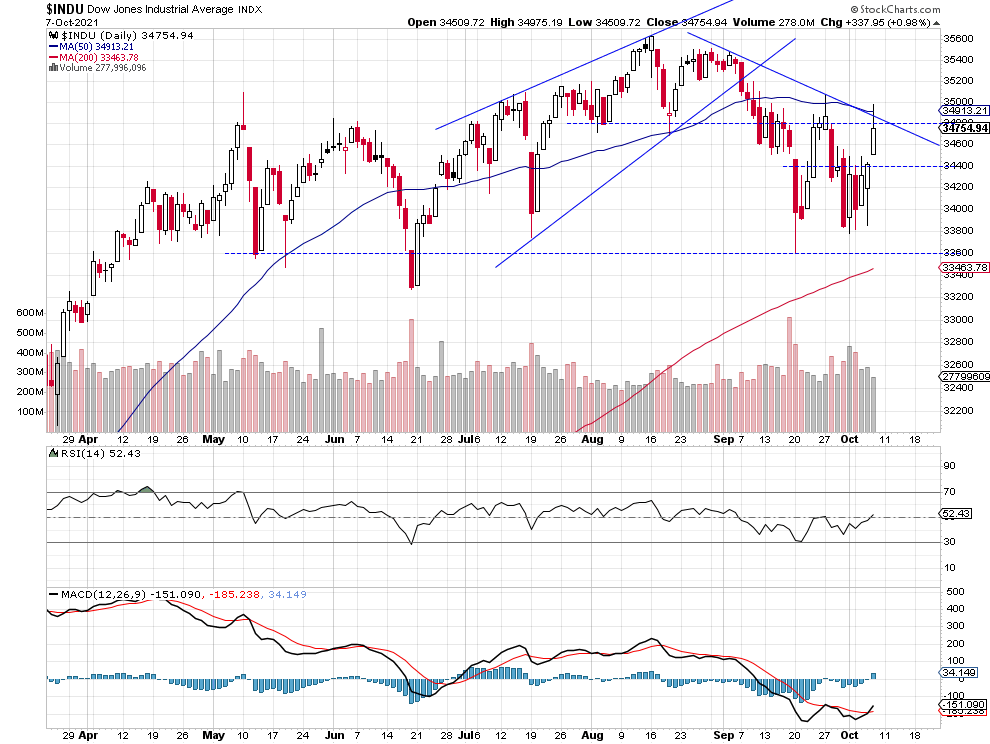

Dow Jones Got Back to Its Downward Trend Line

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index also broke above its short-term consolidation yesterday. However, it remained below a month-long downward trend line. The nearest important resistance level is at 35,000, as we can see on the daily chart:

Apple Is Back Above $142 Price Level Again

Apple stock weighs around 6.1% in the S&P 500 index, so it is important for the whole broad stock market picture. The stock broke above $142 price level yesterday but for now it looks like a correction within a downtrend or a consolidation following the September’s decline. The resistance level is now at $144, marked by the previous local highs.

Should You Re-Enter a Short Position Now?

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market is trading within a short-term consolidation and it gets back to 4,400 price level, so it seems that closing our short position on Friday a week ago was the right decision. For now, it looks like an upward correction following the recent decline or just a consolidation. In our opinion no positions are currently justified from the risk/reward point of view, but we will think about entering a new short position early next week. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index has been trading within a short-term consolidation since last Thursday. Yesterday the index broke above that consolidation and it got back above the 4,400 level. For now it looks like an upward correction following the late September’s declines.

The risk/reward perspective seems less favorable right now and no positions are currently justified.

Here’s the breakdown:

- The S&P 500 broke above its week-long consolidation, but bulls are not out of the woods yet, as the worse-than-expected jobs data release may lead to some more uncertainty.

- Our speculative short position has been closed last Friday at a much lower level.

- We are still expecting more downward pressure and a correction to 4,200-4,250 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care