Stocks dropped sharply on Monday and ended November as traders took profits and monitored the progression of COVID-19. While much of Monday’s decline can be attributed to profit-taking, it was still a “sell the news” kind of day with the pandemic raging, and geopolitical tensions with China returning.

Regarding COVID-19, over 266,000 people have now died from the pandemic in the U.S., with more than 13 million confirmed cases in the country. Los Angeles County in California also imposed a new stay-at-home order before the weekend began.

Market sentiment took a further hit after Reuters reported that the Trump administration is considering blacklisting leading Chinese chipmaker SMIC and China’s national offshore oil and gas producer CNOOC.

The Dow Jones dropped 271.73 points, or .91% after dropping by as much as 400 points earlier in the day. The S&P 500 slid 0.46%, and the Nasdaq dropped 0.06%.

Travelers (TRV) and Chevron (CVX) were among the Dow laggards today, falling 3.6% and 4.5%, respectively. Cruise lines and airlines, despite performing strongly this month, also underperformed. Carnival (CCL) dipped 7.4%, and Norwegian (NCLH) slid 3.4%. American Airlines (AAL) dropped more than 5%, and Delta (DAL) fell 2%. Energy as a sector led the laggards on the S&P and dropped 5.4% - its worst day since June 24.

However, Moderna (MRNA) spiked 17%, after announcing that new trial data showed its COVID-19 vaccine candidate was more than 94% effective. The company further added that it will ask the FDA for emergency approval on Monday.

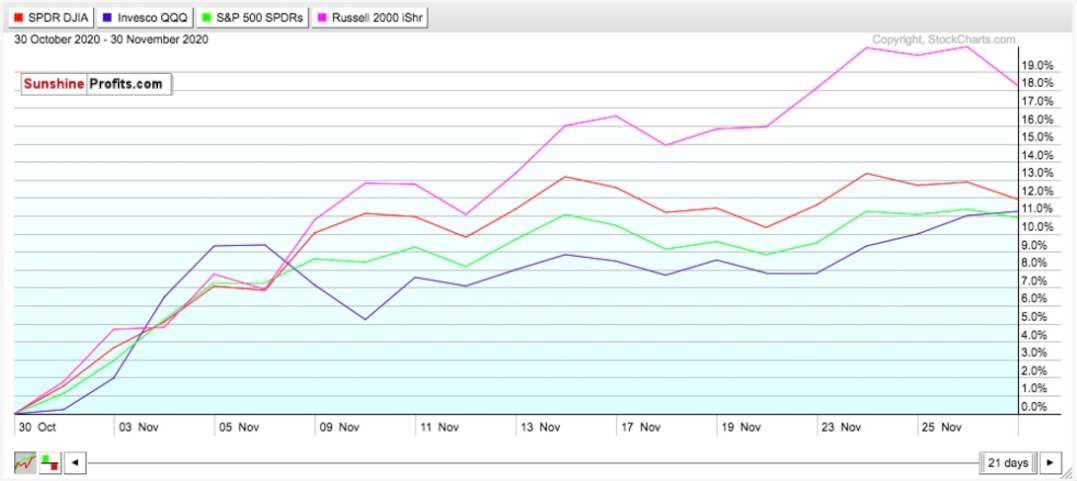

As we enter the final month of what has been a trying year, we can officially conclude that November 2020 was a month that the markets will never forget. Despite Monday’s losses, the indices posted some of their strongest monthly gains ever. The Dow rose 11.8% in November, its best monthly performance since January 1987. In November, the S&P 500 and the Nasdaq also climbed 10.8% and 11.8%, respectively, their biggest monthly gains since April. The small-cap Russell 2000 index however led the way, and had its best monthly performance ever, gaining over 18%.

Cyclical stocks led November’s rally due to the amount of positive vaccine news. Energy, which has been 2020′s biggest laggard, gained 26.6% in the month(!), while financials, industrials, and materials all gained at least 12.2% during the same time period.

Boeing (BA) and American Express (AXP) were November’s best performing Dow stocks, rising 45.9% and 30%, respectively, during the month. Chevron (CVX), JPMorgan Chase (JPM), Disney (DIS), and Honeywell (HON) also each rose more than 20% in November.

Because of the short-term tug of war between optimism and reality, it is fairly difficult to proclaim BUY or SELL calls for the near-term future. Rather, in the short-term, I feel more comfortable staying neutral and calling HOLD for broader markets. There will be optimistic days where investors rotate into cyclicals and value stocks.

In the mid-term and long-term, however, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will surely stabilize, allowing optimism and relief to permeate the markets. In fact, CNBC personality Jim Cramer said that beating COVID-19 would be like “the end of prohibition.” Stocks especially dependent on a rapid recovery and reopening should thrive.

Investors May Be Returning to Tech

Our last few calls predicted that the rotation out of tech could be short-lived. We may have been right.

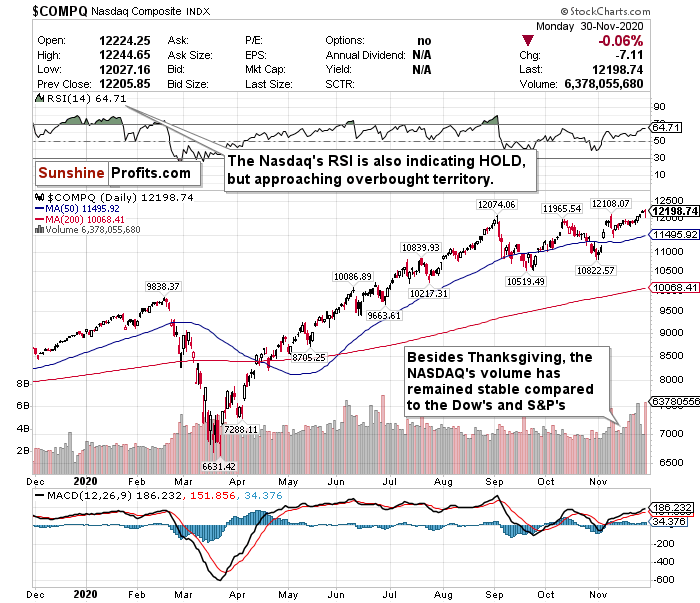

Although tech and stay-at-home stocks largely lagged behind cyclicals and value stocks during the initial vaccine rallies, this rotation appears to have stabilized. The NASDAQ outperformed both the Dow and S&P last week and closed out November with higher gains than the S&P 500. Additionally, while the Dow, S&P, and Russell sold off on Monday, the Nasdaq did not move much in comparison. Most importantly, this index has shown more stable volume compared to the Dow and S&P.

On pessimistic days, such as Monday, having NASDAQ exposure is certainly a good thing because of all the “stay-at-home” stocks that trade on the index. However, positive vaccine news always induces the risk of downward pressure on tech names - both on and off the NASDAQ.

Because there is a lot of mixed sentiment for tech names, the NASDAQ also gets a HOLD call. Its RSI value of 64.71 is little changed from where it was on Friday (Nov 27), and is even closer to an overbought level than the S&P and Dow. If “stay-at-home” names rally again over the course of the next few sessions, the RSI could officially overheat to overbought. For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

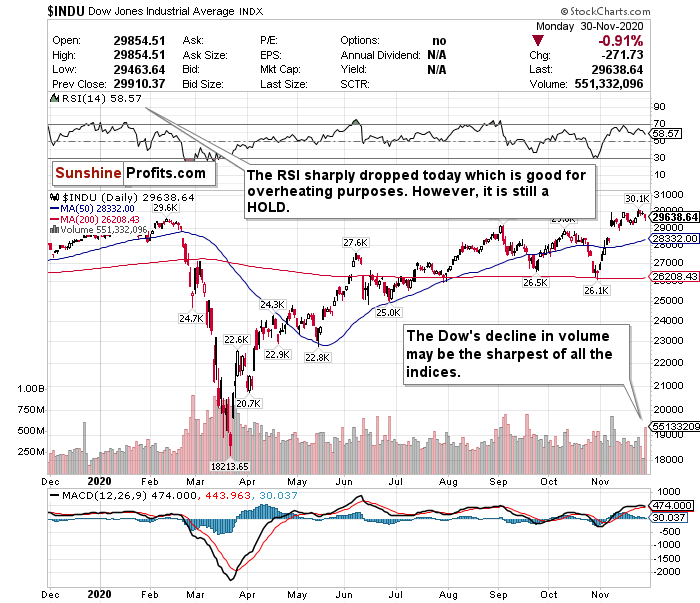

Today’s Dow Drop May Be a Good Thing

The Dow Jones may be the major index most vulnerable to news and sentiment at this time. The call on the Dow is also a HOLD, however its decline on Monday may not be a bad thing. Its RSI dropped further from the overbought level, especially compared to The Nasdaq. However, the Dow’s sharp decline in volume in comparison to the NASDAQ’s also exposes it to more vulnerability and volatility. This is what is most concerning for me personally, and for the Dow’s stability.

Despite the optimistic sentiment and strong vaccine data on “sell the news” kind of days like today, the Dow will have short-term downside pressure. This index is composed of many cyclical stocks dependent on a strong economic recovery, and any change in sentiment can adversely affect the index’s performance. But similarly to the call on the S&P, it’s hard to say with conviction that a drop in the index will be strong and sharp, relative to the gains since March, let alone November. For an ETF that attempts to directly correlate with the performance of the Dow, the SPDR Dow Jones ETF (DIA) is a strong option.

Small-caps Lagged on Monday...But Owned November

Although the Russell 2000 small-cap index underperformed the larger-cap indices on Monday, let’s be frank - it was bound to happen one of these days. But now that November is over, and we can take a breath, let’s see how ETFs for the major indices performed for the month.

For the month, the iShares Russell 2000 ETF (IWM) significantly outperformed the ETFs tracking the Dow, S&P, and Nasdaq. The Russell closed out November with its best monthly performance ever, exceeding 18% gains. Much of this can be attributed to the amount of cyclical stocks in the index that are dependent on the recovery of the broader economy.

The Russell will surge on optimistic days, and drop more on pessimistic days - like Monday. While the Dow lost 0.91% on Monday, the Russell, for example, lost 1.91% in comparison. Although in the long-term, small-caps may be the best opportunity to bet on an economic recovery in 2021, in the short-term, small-cap stocks may be the most volatile of them all and are a HOLD.

Mid-Term

China is the Best Bet in Emerging Markets Over the Mid-Term

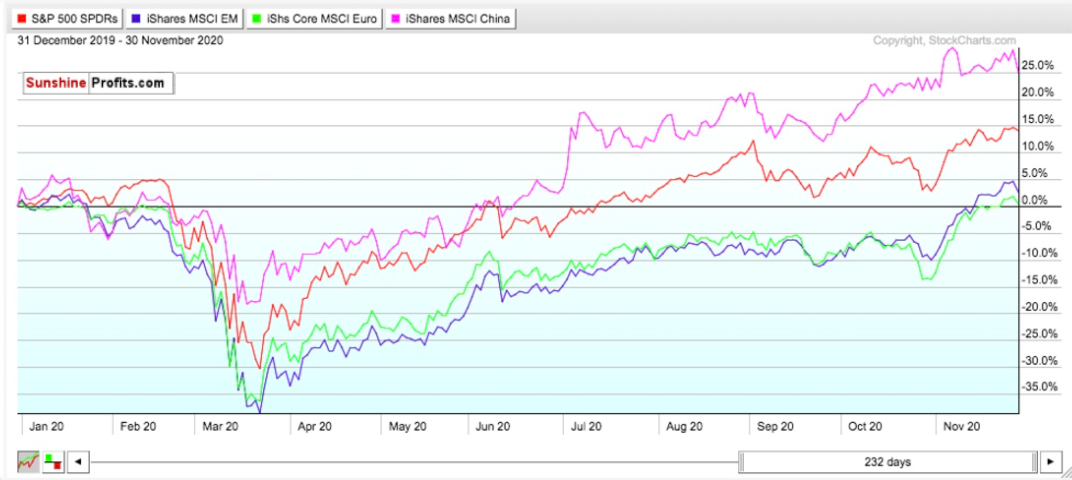

Investors remain bullish on emerging markets overall, in both the short-term and medium-term, although it really depends on the region regarding the short-term. China, for example, is by far the largest presence in emerging market indices, however, it lagged significantly behind other global indices in November. The news from Reuters on Monday about the possible blacklisting of a few Chinese companies doesn’t help matters much either.

However, look at the returns from December 31, 2019, to today and compare the performance of the iShares MSCI China ETF to the iShares MSCI Emerging Markets ex-China ETF, SPDR S&P ETF, and iShares Core Europe ETF. The comparison is staggering. The closest ETF that compares to the China ETF is the SPDR S&P ETF - and the China ETF outperformed that by over 10%. Additionally, the Europe ETF and Emerging Markets ex-China ETF have barely traded above the flat line.

Simply put, China has handled the pandemic better. Because of the country’s size and strength, it’s hard to consider it an emerging market any longer. China and other countries in the region are clearly demonstrating that they were better prepared to handle COVID-19’s economic shocks, and are better prepared to handle this second/third surge in the pandemic. In fact, China’s GDP has managed to grow from where it was at this point last year - despite its record plunge at the start of the pandemic.

For broad exposure to Emerging Markets, you will want to BUY the iShares MSCI Emerging Index Fund (EEM), for exposure to China you will want to BUY the iShares MCHI ETF (MCHI), and for exposure to a regional economic power without the geopolitical risks of China, you will want to BUY the iShares MSCI Taiwan ETF (EWT). Consider the iShares MSCI Indonesia ETF (EIDO) as well for another growing regional economy.

….and the Dollar May Have More Room to Fall

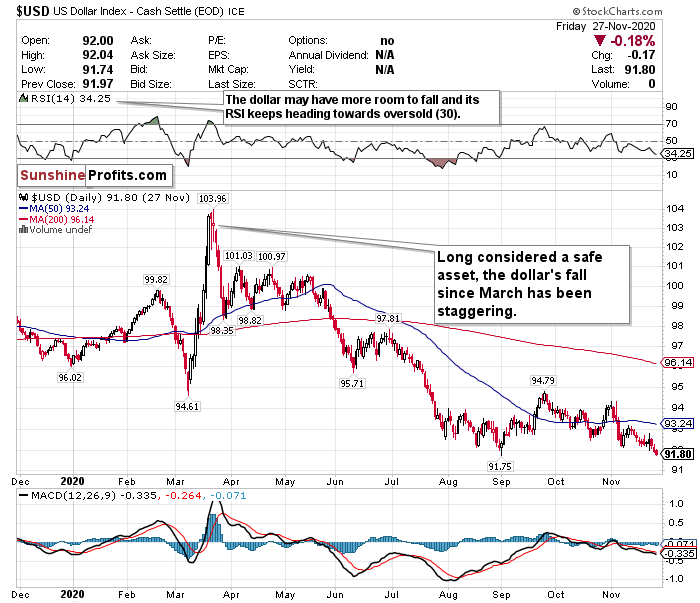

The US Dollar did not move much on Monday, but still remains at its lowest level in seven months, and the lowest level compared to a basket of currencies in over two years. The dollar’s plunge in excess of 10.5% since peaking in March has been staggering.

Many believe that the dollar could fall further as well due to a multitude of headwinds.

Although markets declined on Monday, in the broader scheme of things, investors believe that COVID-19 will be dealt with in 2021. If the world returns to relative normalcy within the next year, investors may be more “risk-on” and less “risk-off.” Which means that the dollar’s value will decline.

Additionally, because of all of the economic stimulus that has been pumped into the markets up to this point, combined with record low-interest rates, the dollar’s value has been hurt and could be further hurt. Strategists at Goldman Sachs predict a further 6% decline over the next 12 months, ING analysts forecast as much as a 10% drop, and most notably Citigroup predicts a shocking 20% drop in 2021.

As the world’s reserve currency, this plunge in value is concerning both in the short-term and mid-term for the U.S. economy. A declining dollar means the strengthening of other foreign currencies such as the Yen or Yuan. Although US Treasuries have somewhat recovered, this could mean bad things for their values as well.

The plunge of the dollar has been so severe that it is currently trading below both its 50-day and 200-day moving averages. Furthermore, its 200-day moving average is considerably higher than its 50-day, further illustrating the sharp decline.

While the dollar may have more room to fall, according to its RSI, it is approaching oversold territory. Although the dollar’s RSI did not move much on Monday, pay close attention to it over the coming weeks. If the USD’s RSI drops below that oversold 30 level, there may be an opportunity to buy the currency at a bottom or near bottom. However, for the time being, there may be more room for the world’s reserve currency to fall and...

For now, where possible, HEDGE OR SELL USD exposure.

Pay Very Close Attention to Inflation

Pay very close attention to the possible return of inflation within the next 6-12 months. The Fed has said it will allow the GDP to heat up, and it may overshoot in the medium-term as a result. Although JP Morgan and Goldman Sachs have cut their GDP growth estimates for Q1 2021, pay close attention to what happens in Q2 and Q3 once vaccines begin to be rolled out on a massive scale. It is only inevitable that inflation will return with the Fed’s policy and projected economic recovery by mid-2021.

If you are looking to the future to hedge against inflation, look into TIPS, commodities, gold, and potentially some REITS.

In the mid-term, I have BUY calls on the SPDR TIPS ETF (SPIP), the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), the SPDR Gold Shares ETF (GLD), and the iShares Cohen & Steers REIT ETF (ICF).

Long-Term

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the vaccine/treatment front poses significant optimism for 2021 and beyond. Although jobless claims underwhelmed last week for the second week in a row, and are at their lowest point in 5 weeks, the long-term outlook for equities, namely value stocks, and cyclicals, could be very positive.

Summary

November has ended, and we are thankfully in the home stretch of 2020. This has been a year filled with turmoil and pain, one that will hopefully end with happiness and optimism. But COVID-19 will not disappear before 2021 begins and may be here with us a little bit longer. But if November showed us anything, it showed us that there is finally a light at the end of the tunnel. Until COVID-19 is brought under control or is eradicated, there will be a continuous tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments, and are investment vehicles that look 6-12 months down the road. However, it is very plausible that there could be some short-term uncertainty and volatility mixed in. But please remember how sharp and swift the rally was after the crashes in March. Since the markets bottomed on March 23rd, the Nasdaq is up 84%, the S&P is up 66%, and the Dow is up around 63%. In the long-term, markets always end by going up, and are focused on the future rather than the present.

Moderna’s news on Monday was encouraging. We know that several vaccine candidates work now - but once they get formal clearance, are they scalable? Can they be safely and effectively mass distributed?

If everything goes well with the vaccines, and the virus can be somewhat contained, the short-term volatility may be worth monitoring for opportunities before the eventual mid-term and long-term reality turns positive and stable in 2021.

To sum up all our calls, in the short-term I have a HOLD call for:

- the SPDR S&P ETF (SPY),

- Invesco QQQ ETF (QQQ),

- SPDR Dow Jones ETF (DIA), and

- iShares Russell 2000 ETF (IWM).

However, I am more bullish for these ETFs in the long-term.

I suggest avoiding the US Dollar in the mid-term, and gaining exposure in the emerging markets.

I have BUY calls on:

- The iShares MSCI Emerging Index Fund (EEM),

- the iShares MSCI China ETF (MCHI),

- the iShares MSCI Taiwan ETF (EWT), and

- the iShares MSCI Indonesia ETF (EIDO)

Additionally, because I foresee inflation returning as early as mid to late 2021…

I also have BUY calls on:

- The SPDR TIPS ETF (SPIP),

- the Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

- the SPDR Gold Shares ETF (GLD), and

- the iShares Cohen & Steers REIT ETF (ICF)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist