Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Stocks were little changed on Wednesday as the S&P 500 gained just 0.16% following Tuesday’s sell-off. Is the market poised to break below the recent low?

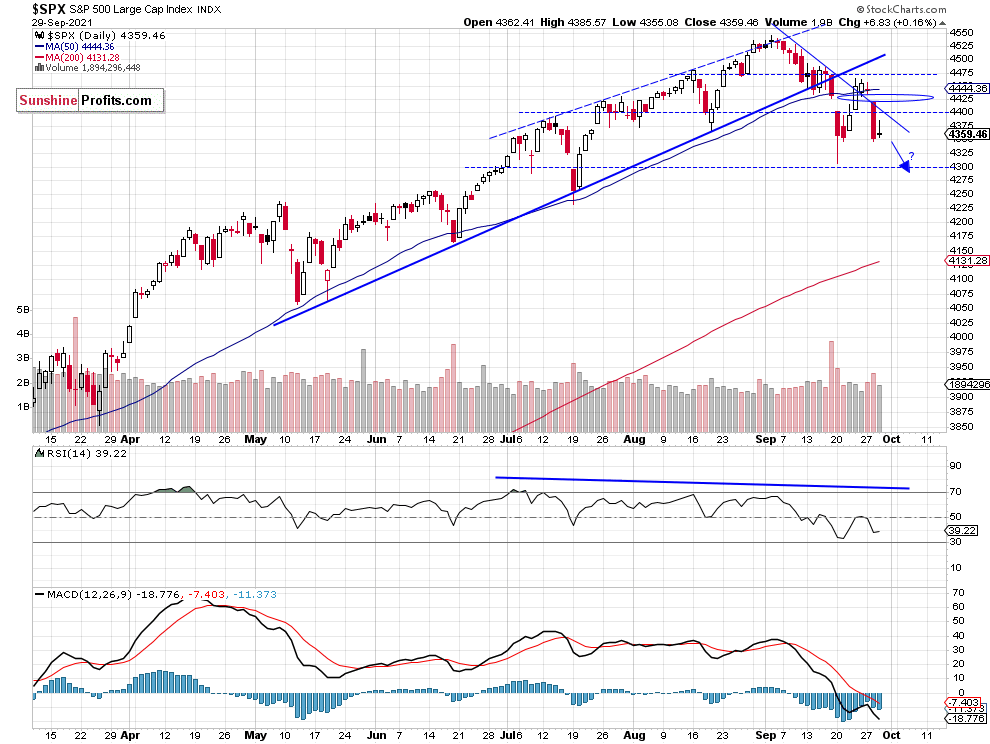

The S&P 500 index retraced most of its recent advance on Tuesday, as it lost over 2%. It followed the strengthening U.S. dollar and rising bond yields. One and a half week ago, it fell the lowest since July 20, as it reached the local low of 4,305.91. It was 239.9 points or 5.28% below the September 2 record high of 4,545.85. Then it has been bouncing and on Thursday it reached a local high of 4,465.40. So this week’s decline may look like resuming of the downtrend. Today the market is expected to open slightly higher and we may see some more short-term consolidation.

The nearest important support level of the broad stock market index is now at 4,340-4,350, marked by the recent local low. The next support level is at around 4,300. On the other hand, the resistance level is at 4,400 again. The S&P 500 got back below its month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Our Short Position Is Profitable

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. It remains profitable. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

Since last Tuesday we’ve witnessed a short-covering rally fueled by the Wednesday’s FOMC Monetary Policy release. But it was just an upward correction within a downtrend and the S&P 500 index’ mid-September short-term consolidation acted as a short-term resistance level. The market is now back below 4,400 level. It may extend its downtrend and break below the September’s low.

There have been no confirmed positive signals so far. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The S&P 500 accelerated its downtrend a week ago, as it got close to 4,300 level. It retraced some of the decline last week, but this week’s price action was very bearish again.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting more downward pressure and a correction to 4,200-4,250 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care