Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective (S&P 500 index).

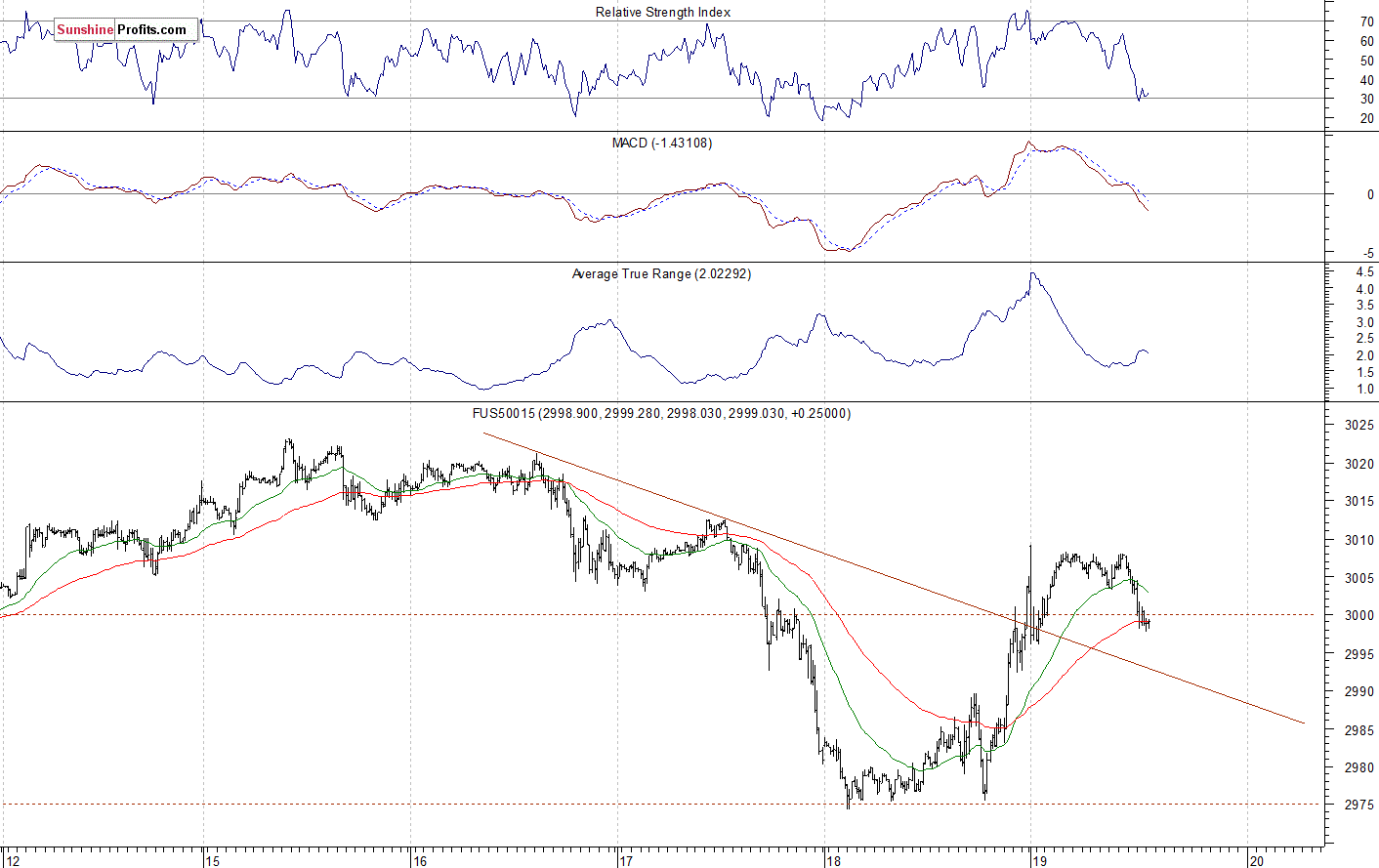

Intraday outlook: The broad stock market will likely open virtually flat today. Then we may see some more short-term fluctuations along the 3,000 level.

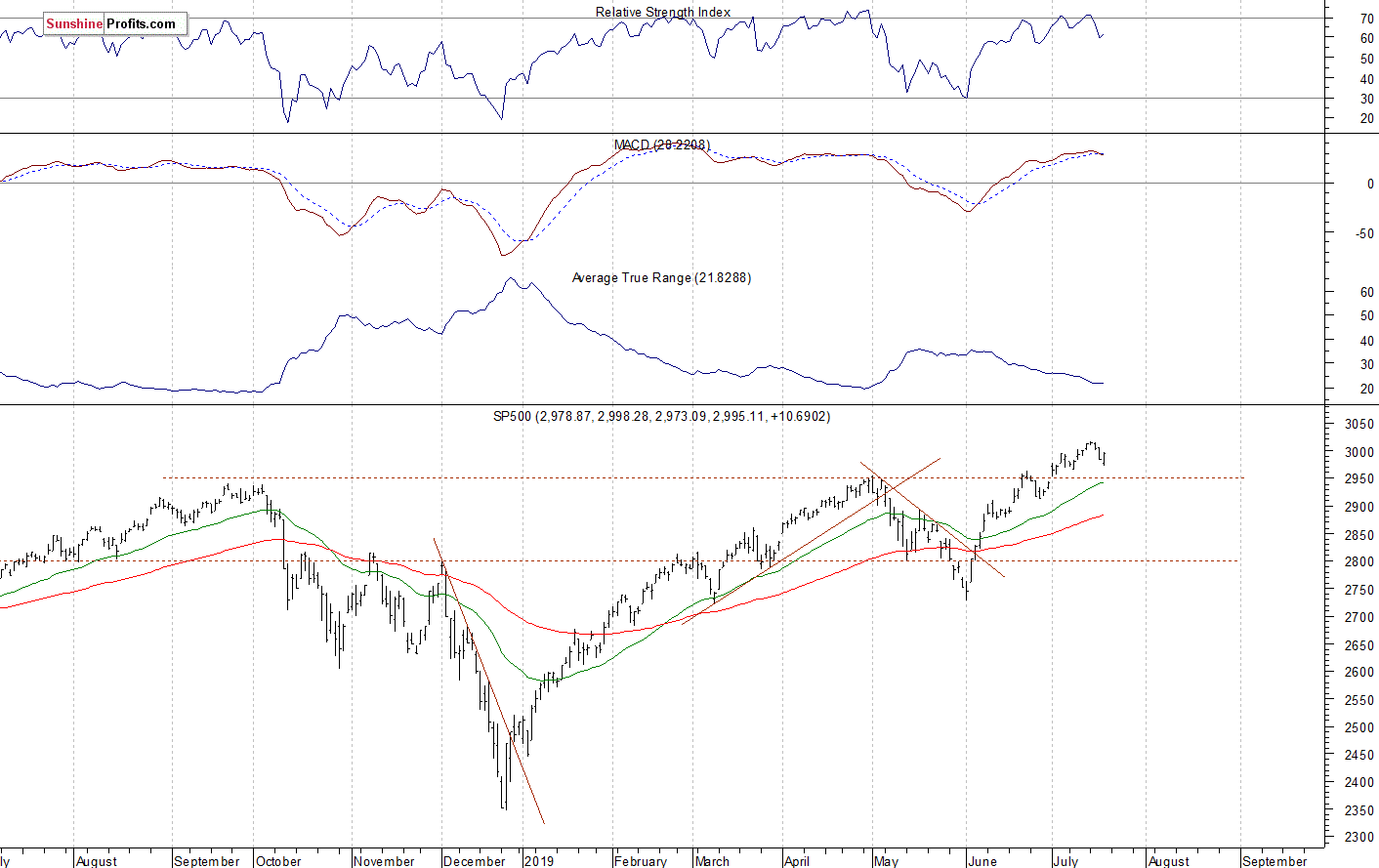

The U.S. stock market indexes were mixed between 0.0% and +0.4% on Thursday, as they retraced some of their Wednesday's decline. The S&P 500 index reached the new record high of 3,017.80 on Monday. It gained around 290 points from its early June local low of 2,728.81. Yesterday it got closer to the 3,000 mark again, following an intraday drop below 2,975 level. The Dow Jones Industrial Average was unchanged and the Nasdaq Composite gained 0.3% on Thursday.

The nearest important resistance level of the S&P 500 index is now at 3,000, marked by the recent support level. The next resistance level is at around 3,015-3,020, marked by the record high. On the other hand, the support level is at 2,980-2,985, marked by last week's Wednesday's daily gap up of 2.981.90-2,984.62. The next support level is at 2,965-2,970, marked by the early July local lows.

The broad stock market broke above its short-term consolidation recently and it broke above the 3,000 mark. Is this a real bullish breakout above the last year's September-October topping pattern? The S&P 500 extended its half-year-long run-up:

Flat Expectations Mean More Uncertainty

The index futures contracts trade between -0.1% and +0.1% vs. their Thursday's closing prices, so expectations before the opening of today's trading session are virtually flat. The European stock market indexes have been mixed so far. Investors will wait for the Preliminary UoM Consumer Sentiment number release at 10:00 a.m.

The S&P 500 futures contract trades within an intraday downtrend, as it retraces its overnight advance. The nearest important resistance level is at 3,010-3,020, marked by the short-term topping pattern. On the other hand, the support level is at 2,985-2,990. The futures contract is slightly below the 3,000 mark this morning, as we can see on the 15-minute chart:

Nasdaq 100 Bounces Off 8,000

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday downtrend. It remains below the 8,000 resistance level. The support level is now at 7,900. The Nasdaq futures contract is close to the recent local highs, as the 15-minute chart shows:

Microsoft - New Record High Ahead?

Let's take a look at the Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock broke slightly above the resistance level of $200 recently. We still can see a short-term consolidation, as the market fluctuates below the early May local highs. The resistance level remains at $210-215, and the support level is at $195-200:

Now let's take a look at the daily chart of Microsoft Corp. stock (MSFT). The stock is expected to open at the new record high following yesterday's better-than-expected quarterly earnings release. It may break above the $140 mark. Then we will likely see some short-term profit-taking action:

Dow Jones Bounces Off 27,000 Support

The Dow Jones Industrial Average reached the new record high of 27,398.68 on Tuesday. Then it retraced some of the recent rally. For now, it looks like a downward correction. However, we still can see technical overbought conditions:

The S&P 500 index reached the new record high on Monday, as investors' sentiment remained bullish following the recent advances. But Wednesday's trading session was bearish, as investors took profits off the table. The index got back below the 3,000 mark again. For now, it looks like a downward correction. We could see some more sideways trading action, as investors react to quarterly corporate earnings releases.

Concluding, the S&P 500 index will likely open virtually flat today. We could see more short-term fluctuations along the 3,000 mark.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective (S&P 500 index).

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care