Briefly:

Intraday trade: The S&P 500 index lost 3.2% on Tuesday, after opening 0.2% lower. The stock market will be closed today in honor of the President George H.W. Bush. Therefore, our Stock Trading Alert will be very brief.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes lost 3.1-3.8% on Tuesday, retracing some of their recent advance, as investors' sentiment quickly worsened following the renewed trade war fears. The S&P 500 index got back to 2,700 mark again and it currently trades 8.2% below September the 21st record high of 2,940.91. The Dow Jones Industrial Average lost 3.1% and the Nasdaq Composite lost 3.8% on Tuesday.

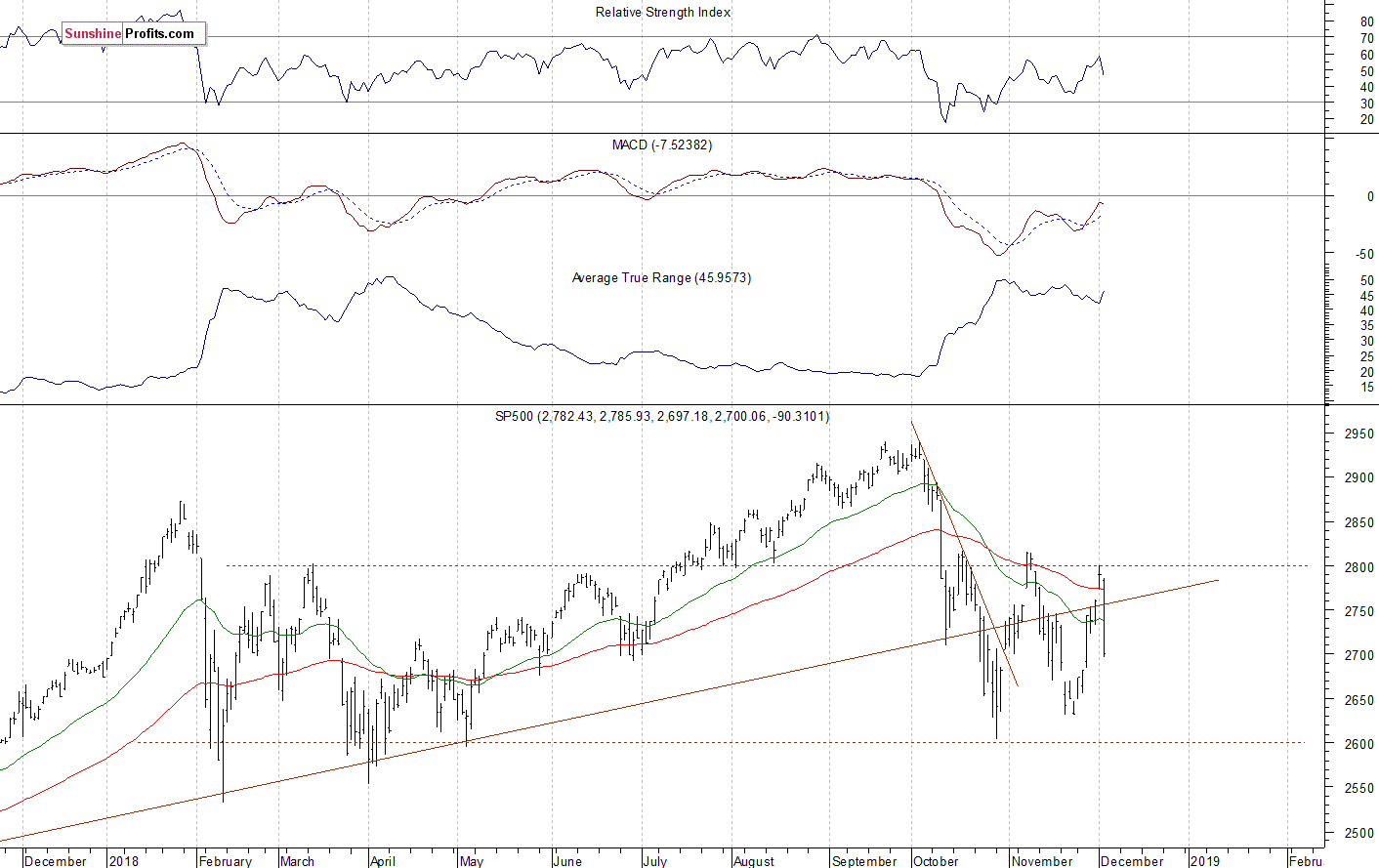

The broad stock market quickly reversed its last week's upward course following the S&P 500 index' reversal off the resistance level at 2,800. The market got back to 2,700 mark, as it retraced some of its recent rally. Yesterday we wrote that it still looks like a two-month-long consolidation following the October rout. That statement remains relevant. The market is extending its medium-term consolidation, as we can see on the daily chart:

Consolidation After Selling Off

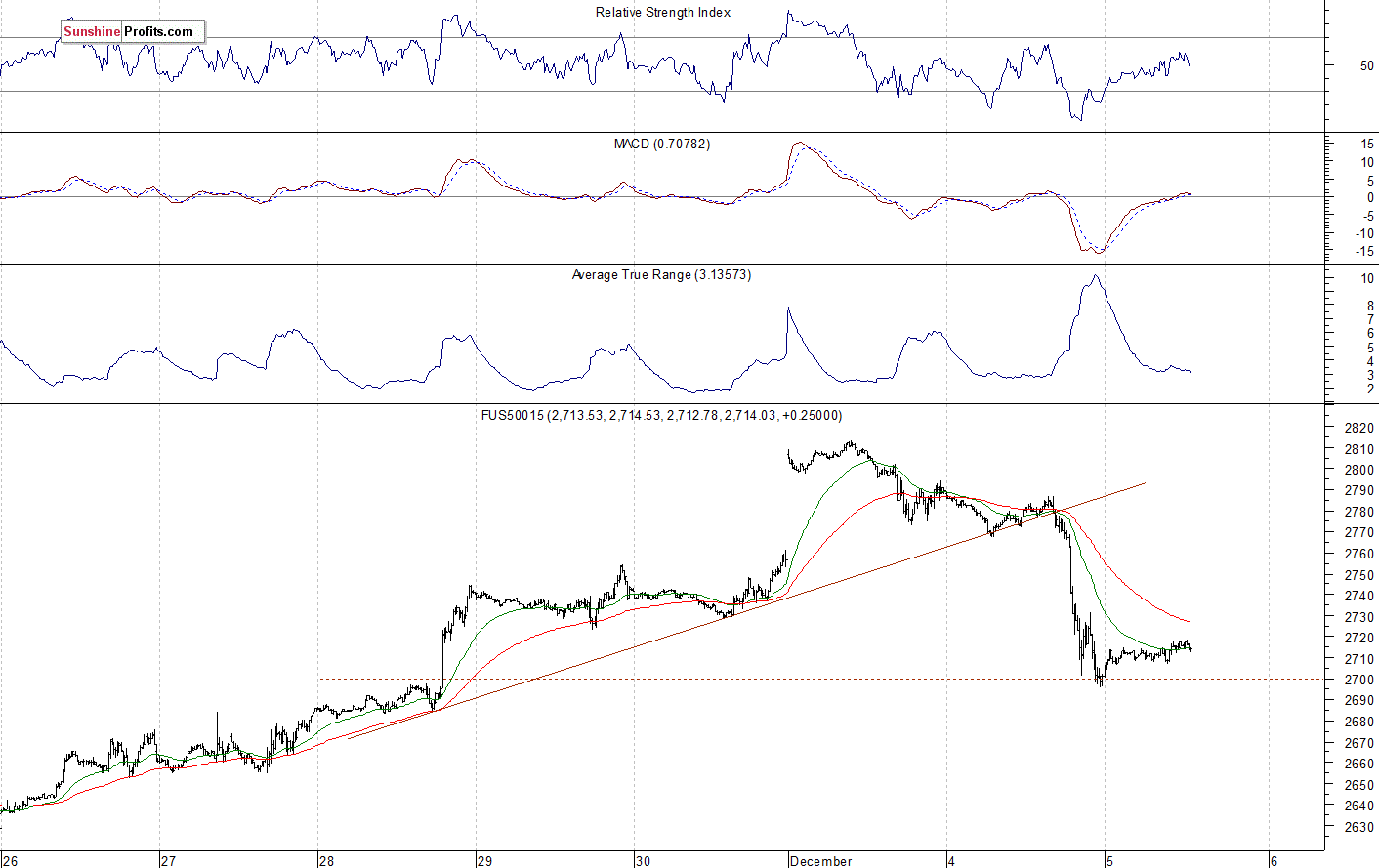

The futures trading session will be shortened today. The S&P 500 futures contract trades within an intraday consolidation following yesterday's rout. It is gaining 0.5% vs. yesterday's closing price. The nearest important level of resistance is at around 2,730, marked by some recent local highs. On the other hand, the support level is at 2,690-2,700. The futures contract broke below its short-term upward trend line, as we can see on the 15-minute chart:

Nasdaq Also Going Sideways

The technology Nasdaq 100 futures contract follows a similar path, as it fluctuates after yesterday's decline. The market broke above the level of 7,100 and it was the highest since the early November on Monday. But then it fell below 6,800 on Tuesday. The nearest important level of resistance is now at around 6,850-6,900. On the other hand, the level of support is at 6,780-6,800, among others. The Nasdaq futures contract retraced most of its recent advance, as the 15-minute chart shows:

Concluding, the S&P 500 index failed to continue its Monday's rally. The broad stock market extends its medium-term consolidation following the October decline. There may be some more short-term volatility after today's pause.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts