Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

The S&P 500 extends its consolidation – is this just a pause before another leg down?

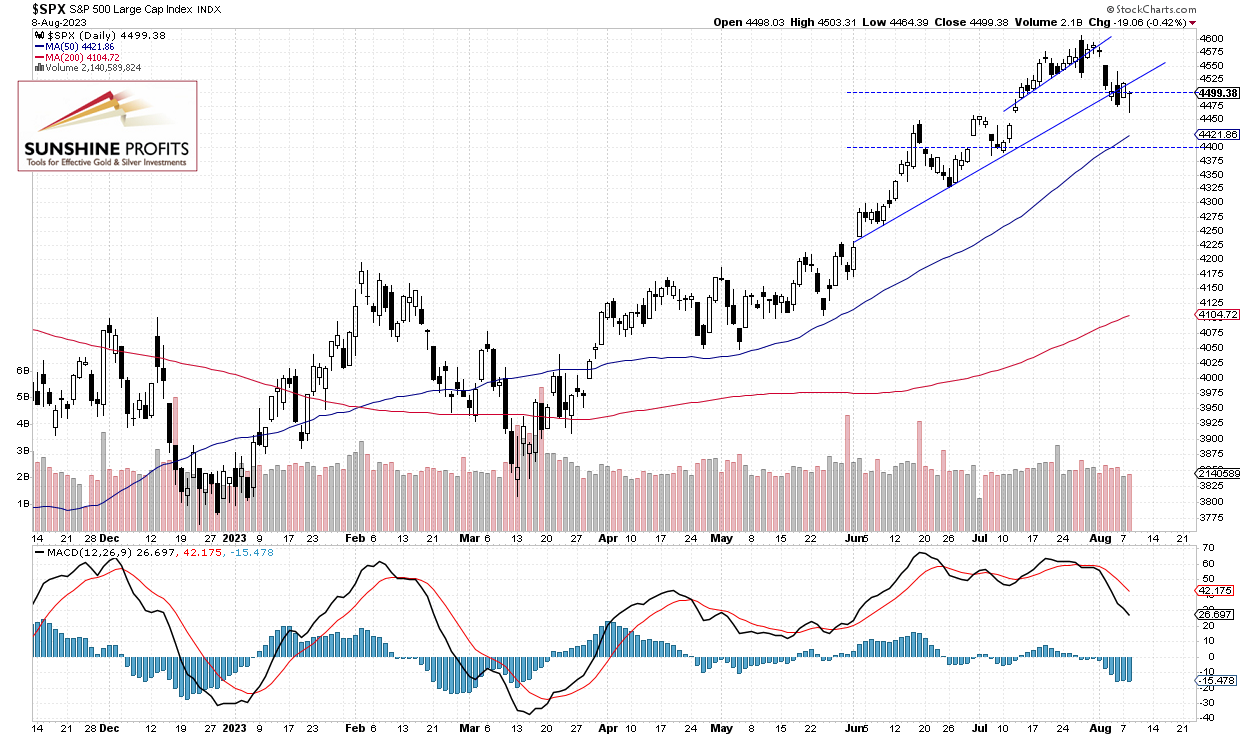

The broad stock market index lost 0.42% on Tuesday after bouncing from new local low of 4,464.39. It went back higher and closed at around 4,500 yesterday. The S&P 500 extended a short-term consolidation following the recent sell-off from July 27 new medium-term high of 4,607.07.

There is still a lot of uncertainty concerning monetary policy, some technology/AI stocks’ valuation concerns, but investors’ sentiment remains bullish. The market is now waiting for the important Consumer Price Index release tomorrow.

The S&P 500 will likely open 0.2% higher today. It continues to trade along a two-month-long upward trend line last week as we can see on the daily chart:

Futures Contract Remains Above 4,500

Let’s take a look at the hourly chart of the S&P 500 futures contract. Yesterday it bounced from the 4,500 level. The support level remains at 4,500 and the resistance level is still at 4,540-4,550, among others.

Conclusion

The S&P 500 is expected to continue its consolidation along the 4,500 level. It still looks like a correction within an uptrend. Investors are waiting for tomorrow’s consumer inflation data release which will likely lead to some volatility.

Here’s the breakdown:

- The S&P 500 remains close to the 4,500 level after bouncing off from the recent high of around 4,607.

- In my opinion, the short-term outlook is still bullish and long positions are still justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; S&P 500 futures contract): In my opinion, the short-term outlook is bullish and long positions are still justified from the risk/reward point of view (since Feb. 27).

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care