Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Stock prices initially rallied in response to the CPI release yesterday, but they retraced most of the advance. Today all eyes are on Fed.

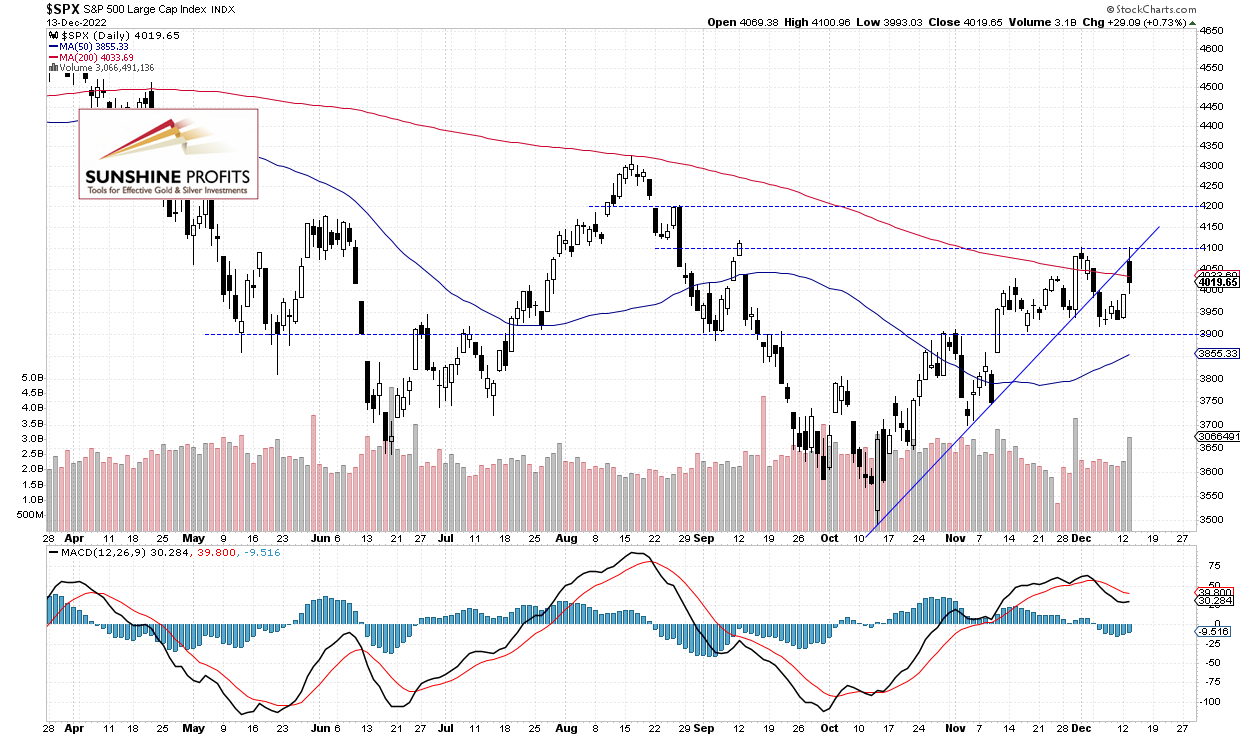

The S&P 500 index gained 0.73% on Tuesday after getting back to the 4,100 level following lower than expected Consumer price Index release. So the broad stock market extended its over month-long consolidation.

This morning the S&P 500 will likely open 0.1% lower and we may see a short-term uncertainty ahead of the FOMC Rate Decision release at 2:00 p.m. There will likely be some wild swings following that release and the Fed Chief Powell Press Conference at 2:30 p.m.

It still looks like a weeks-long consolidation within an uptrend. Last week the index broke below its two-month-long upward trend line, but yesterday it came back to that line again, as we can see on the daily chart:

Futures Contract – New Local High and a Retracement

Let’s take a look at the hourly chart of the S&P 500 futures contract. It reached a new local high of around 4,180 yesterday, but this morning it’s trading along the 4,050 level.

Conclusion

The S&P 500 index will likely continue sideways this morning. Investors will wait for the Fed’s release at 2:00 p.m. and we may see some more short-term volatility. The stock market continues to trade within an over month-long consolidation.

Here’s the breakdown:

- S&P 500 index bounced from the 4,100 level again.

- Stock prices will react on today’s Fed’s Rate Decision release.

- In our opinion, the short-term outlook is neutral.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care