Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 retraced its week-long decline yesterday and it got the highest since late September. But will the short-term uptrend continue?

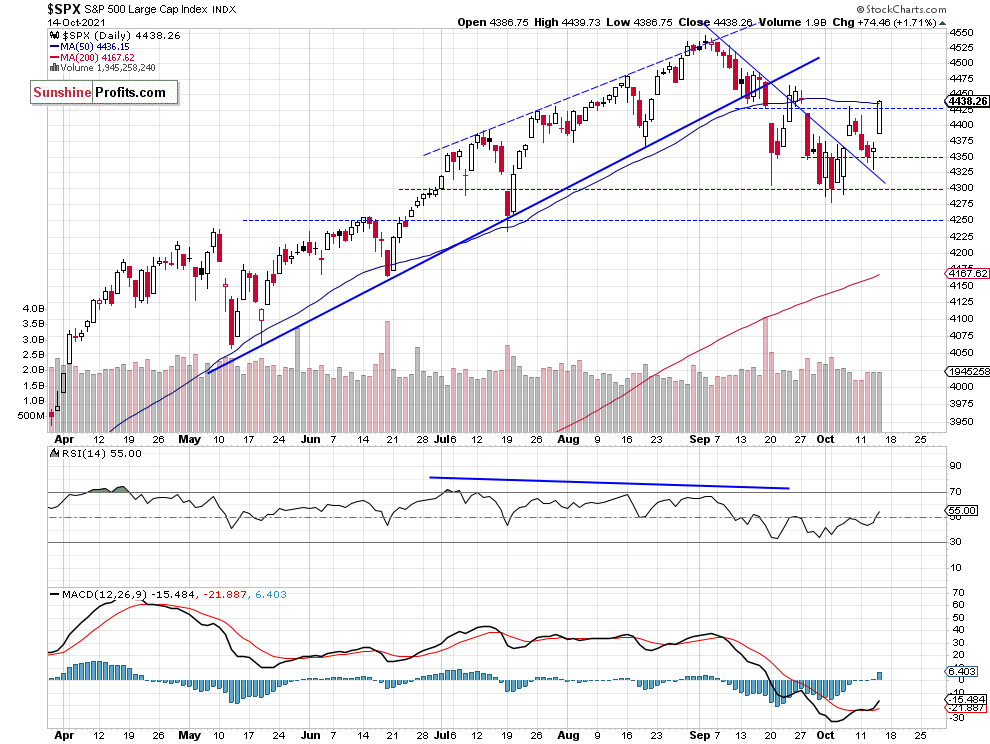

The S&P 500 index closed 1.71% higher on Thursday, Oct 14, as it rallied back above the 4,400 level following better than expected economic data releases. On Wednesday the broad stock market index fell to the local low of 4,329.92. For now, it still looks like an almost month-long consolidation following the mid-September sell-off to around 4,300. And we may see more uncertainty, as investors await the coming quarterly corporate earnings season. However, the earnings releases may support bullish case.

The support level is now at 4,400, marked by the recent resistance level. On the other hand, the resistance level is at 4,485-4,500, marked by the previous local highs. The S&P 500 extends its advance after breaking above a month-long downward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

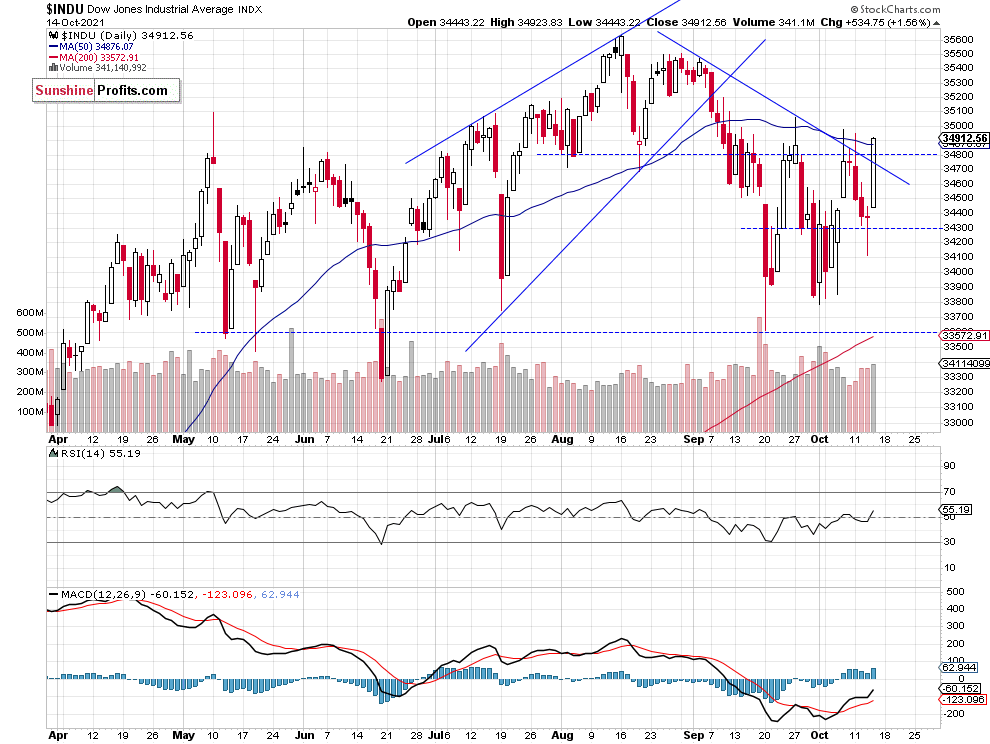

Dow Jones Breaks Above the Trend Line

Let’s take a look at the Dow Jones Industrial Average chart. The blue-chip index broke above its over month-long downward trend line as well. The nearest important resistance level is at 35,000 and the support level remains at 33,800-34,000, among others, as we can see on the daily chart:

Apple Is At the Next Resistance Level

Apple stock weighs around 6.1% in the S&P 500 index, so it is important for the whole broad stock market picture. The stock is back at the short-term resistance level of $144. The next resistance level is at around $148-150. For now, it looks like a consolidation following a month-long decline.

Futures Contract Is Closer to the Late September Local High

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market broke above its downward trend line and it got closer to the previous local high of around 4,470. It’s the nearest important resistance level. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index broke above its last week’s local high yesterday following a rally of +1.7%. Today the market is expected to open 0.2-0.6% higher so we may see a continuation of the short-term uptrend. The index will most likely reach its previous local highs. For now, it still looks like a correction within an over month-long downtrend. However, the coming quarterly earnings releases season may support bulls in the near term.

The risk/reward perspective seems less favorable right now and no positions are currently justified.

Here’s the breakdown:

- The S&P 500 extended its short-term uptrend yesterday, but it still looks like an upward correction within an over month-long downtrend.

- We are still expecting more downward pressure and a correction to 4,200-4,250 level – as far as the index is trading within its almost month-long range.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care