Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

The S&P 500 index lost almost 2% on Wednesday, as investors reacted to the Fed Minutes release, among other factors. Is this just a correction?

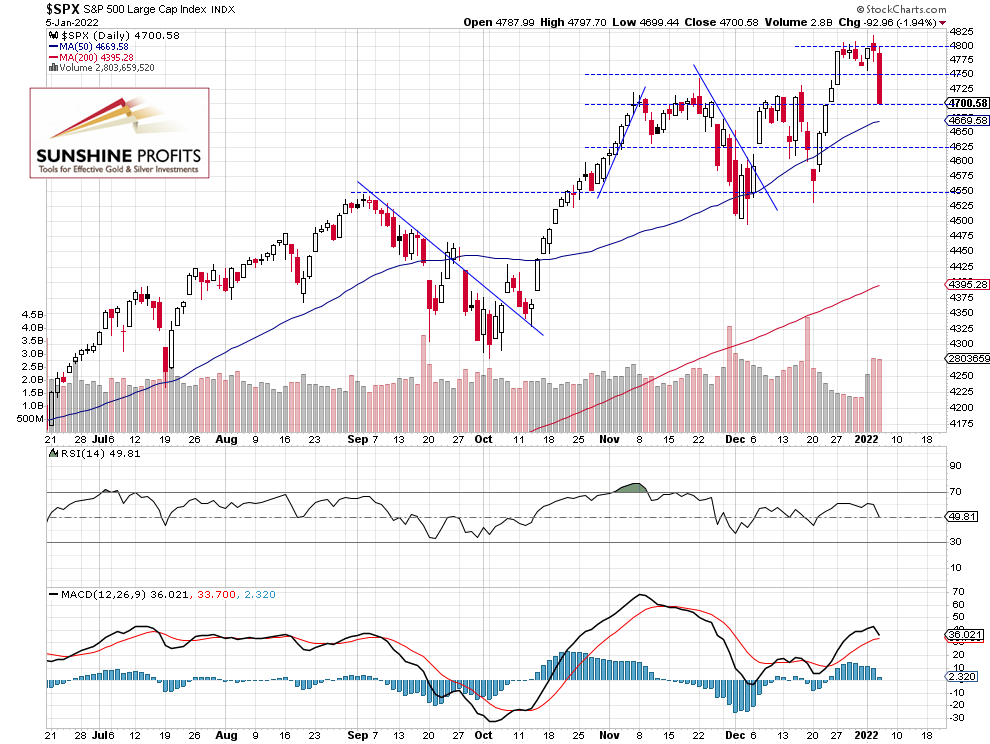

The broad stock market index sold off after breaking below the recent trading range on Wednesday. The S&P 500 fell to the daily low of 4,699.44 and it traded almost 120 points below the Tuesday’s new record high of 4,818.62. So at least in the short-term, the recent consolidation was a topping pattern. And the market got back to its November-December trading range.

On Dec. 3 the index fell to the local low of 4,495.12 and it was 5.24% below the previous record high. So it was a pretty mild downward correction or just a consolidation following last year’s advances.

The nearest important resistance level is now at 4,750, and the next resistance level remains at around 4,800-4,820. On the other hand, the support level is now at 4,650, marked by some previous local highs. The S&P 500 is close to the November’s-December’s consolidation local highs, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Futures Contract Below the 4,740 Level Again

Let’s take a look at the hourly chart of the S&P 500 futures contract. It reached the new record high on Tuesday in the morning before reversing its upward course and getting back below the support level of 4,740 yesterday. The market retraced a half of its late December rally. In our opinion no positions are currently justified from the risk/reward point of view. (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index opened virtually flat this morning, but we may see attempts at retracing some of yesterday’s sell-off. The market will be waiting for tomorrow’s monthly jobs data release.

Here’s the breakdown:

- The S&P 500 sold off below its short-term consolidation and it is within the medium-term trading range again.

- In our opinion no positions are currently justified from the risk/reward point of view.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care