Major averages hit both all-time intraday and closing highs on Thursday (Dec. 17), riding on vaccine optimism and hopes that a stimulus package could be passed in a matter of days.

News Recap

- The Dow Jones climbed 148.83 points, or 0.5%, to 30,303.37 for a record close. Both the S&P 500 and Nasdaq hit intraday and closing records as well and gained 0.6% and 0.8%, respectively. In typical fashion, the Russell 2000 small-cap index once again beat the other indices and gained 1.30%.

- Senate Majority Leader Mitch McConnell on Thursday (Dec. 17) said that a stimulus deal was closing in. Congress appears to be nearing a $900 million stimulus package that would include direct payments to individuals. However, the package would exclude the partisan issues of liability protections for businesses and aid to state and local governments.

- Despite the optimistic tone of the day, jobless claims disappointed for a second consecutive week. Jobless claims totaled 885,000 last week, hitting their highest levels since early September. This was also significantly worse than the expected 808,000.

- An FDA panel officially endorsed Moderna's (MRNA) COVID-19 vaccine. It could officially be cleared for emergency usage as early as Friday (Dec. 18), and be distributed as soon as after the weekend. Upon authorization, government officials plan to ship nearly 6 million doses of Moderna’s vaccine in addition to the 2.9 million Pfizer (PFE) doses already in distribution.

- Real estate, materials and health care were the best-performing sectors in the S&P 500, each gaining over 1%. Johnson & Johnson (JNJ) rose 2.6% to lead the Dow higher.

- Tesla (TSLA) gained 5.32% and will now officially join the S&P 500.

- We are in the darkest days of the pandemic. On average, the U.S. is recording at least 215,729 additional COVID-19 cases a day. More than 114,200 Americans are also now hospitalized, and over 3,400 new deaths were recorded. According to the CDC Director, Robert Redfield, US COVID-19 deaths are likely to exceed the 9/11 death toll for the next 60 days.

While sentiment has been positive over the last two trading sessions, there will still be a short-term tug of war between good news and bad news. It’s quite simple really - until a stimulus is passed and the virus is somewhat brought under control, there will be negative pressure on the markets. Even though a stimulus package passing appears to be imminent, time is running short and we may be at a fork in the road.

For now, though, hopes that a deal could pass through are sending stocks higher.

“Stimulus is still the main driver in the market right now until they get something done, and it does appear there is some motivation on that front to get something done,” said Dan Deming, managing director at KKM Financial, further stating that “the market’s benefiting from that (enthusiasm).”

Additionally, Luke Tilley, chief economist at Wilmington Trust, said that another stimulus package was needed to keep the economic recovery from stalling before the mass distribution of a vaccine.

“With the continued rising cases and mass vaccinations still a ways out, we could see some further weakness in jobs and even a flattening where we’re not even adding jobs at all ... that’s absolutely a possibility for this next jobs report,” Tilley said. “And if we were to not get another stimulus package, you’re going to have 10 to 11 million people fall off the unemployment rolls right away, and that would hit spending as well.”

The overwhelming majority of market strategists are bullish on equities for 2021 though, despite near-term risks. While there may be some semblance of a “Santa Claus Rally” occurring, the general consensus between market strategists is to look past the short-term pain and focus on the longer-term gains. The mid-term and long-term optimism is very real.

According to Robert Dye, Comerica Bank Chief Economist:

“I am pretty bullish on the second half of next year, but the trouble is we have to get there...As we all know, we’re facing a lot of near-term risks. But I think when we get into the second half of next year, we get the vaccine behind us, we’ve got a lot of consumer optimism, business optimism coming up and a huge amount of pent-up demand to spend out with very low interest rates.”

In the short-term, there will be some optimistic and pessimistic days. On some days, the broader “pandemic” market trend will happen, with cyclical and recovery stocks lagging, and tech and “stay-at-home” stocks leading. Sometimes a broad sell-off based on fear or overheating may occur as well. On other days, there will be a broad market rally due to optimism and 2021-related euphoria. Additionally, there will be days (and in my opinion this will be most trading days), when markets will trade largely mixed, sideways, and reflect uncertainty. But if we get an early Christmas present and a stimulus package passes, all bets are off. It could mean very good things for short-term market gains.

In the mid-term and long-term, there is certainly a light at the end of the tunnel. Once this pandemic is finally brought under control and vaccines are mass deployed, volatility will stabilize, and optimism and relief will permeate the markets. Stocks especially dependent on a rapid recovery and reopening, such as small-caps, should thrive.

Due to this tug of war between sentiments though, it is truly hard to say with any degree of certainty that a correction will happen or more record high rallies will occur.

Therefore, to sum it up:

While there is long-term optimism, there is short-term pessimism. A short-term correction is very possible, but it is hard to say with conviction that a big correction will happen.

This morning’s premium analysis will showcase the “Drivers and Divers” of the market. I will break down some market sectors that are in and out of favor. Dear readers, do me a favor and let me know what you think of this segment! I’m always happy to hear from you.

Driving

Materials (XLB)

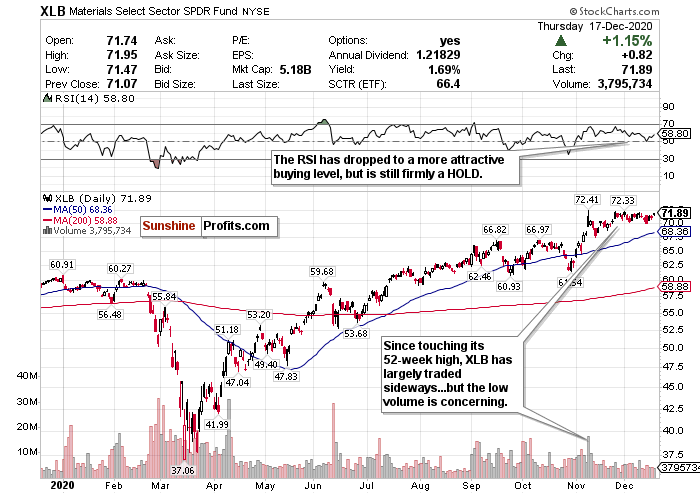

The materials sector, as represented by the XLB ETF, has largely traded sideways since hitting its 2020 high in November. But there are several macro-level tailwinds that could benefit materials in the mid-term and long-term.

The materials sector, as represented by the XLB ETF, has largely traded sideways since hitting its 2020 high in November. But there are several macro-level tailwinds that could benefit materials in the mid-term and long-term.

With vaccines beginning to be rolled out globally, we could be returning to normal in 2021 sooner than we think. Materials companies could be some of the biggest beneficiaries of this - especially with further economic stimulus seemingly imminent and a plummeting US dollar. Historically, dovish economic policies and a weak US dollar have largely benefitted materials.

However, ever since peaking at $72.41 a share, the ETF’s volume has plummeted, and largely stayed low.

I believe that this sector could pull back further or stay in a sideways pattern for the rest of the month, although if a stimulus deal passes, the sector may surge. We are getting closer to a package being approved, but until that actually happens, it’s all sentiment and wordplay. I simply don’t foresee a consistent rally occurring without a stimulus deal. However, if one is struck before the end of the year, I do foresee the materials ETF exceeding its 52-week high and going on a nice run.

For the time being though, there is too much uncertainty to make a conviction call. Therefore, this is a HOLD for the short-term. However, I am considerably more bullish on materials in the long-term and would BUY on a pullback.

Energy (XLE)

The only thing predictable in this unpredictable market is this: energy is uncertain! This is a sector largely dependent on sentiment, with several question marks. It can lead and lag the market every other day for weeks at a time.

On one hand, if you are bullish, all of this vaccine news bodes well for a full economic reopening by the second half of 2021. That means travel, and therefore fuel demand, could surge back to pre-pandemic levels. Energy is still largely undervalued and optimism on further US stimulus in addition to the vaccine(s) could bode well for the sector.

On the other hand, there are very real short-term concerns, as well as mid-term and long-term ones. There are fresh concerns over global fuel demand as countries, states, and cities across the world tighten coronavirus restrictions. Germany and the Netherlands have just entered a new lockdown, while the UK government imposed tighter COVID-19 measures on London. In New York City, Mayor Bill De Blasio also warned that the city is on the path towards a second full shutdown, while the state’s Governor, Andrew Cuomo, could implement one after the weekend. OPEC also lowered its projections for global fuel consumption in Q1 2021 by 1 million barrels a day as well.

Meanwhile, in the long-term, 2021 could witness further movements away from fossil fuels towards clean and sustainable energy. For example, pension funds worldwide have been divesting from oil in droves.

This is a very difficult sector to make a bullish call on. There are still simply too many headwinds to be overly euphoric. While energy is still largely undervalued, the volume and sentiment are not stable.

We have also seen this year that when energy rallies, it eventually pulls back. Judging from the chart, that inevitable pullback could possibly come again.

While there is vaccine optimism now that there wasn’t before, conditions are largely the same on the ground with regard to COVID-19 and travel demand. Therefore, my call is to take profits and SELL.

Financials (XLF)

The financial sector has traded largely sideways since hitting its 52-week high. I also have some serious concerns, and believe this sector will not benefit from a dovish Fed.

Interest rates - a huge driver of banking revenue - are truly muddled by bullishness. While this sector has obviously performed better than the US dollar, rates this low that will not change until possibly 2022-2023 may not be good for the sector. The Fed has not been shy about keeping these rates low either, and will let the GDP heat up. Until rates start rising again, profit margins will continue to narrow.

Although higher quality loan applications, and an influx of new investors have helped certain banking stocks, I don’t believe it will be enough for mid-term and long-term strength. Without rising interest rates, it’s hard to truly justify gains, despite some optimistic tailwinds.

The theme of mixed sentiment continues for this sector. However, because so much of the sector’s revenue depends on interest rates, and those will not go anywhere for at least the foreseeable future, I have this at a SELL. Take the profits while you can!

Diving

Communication Services (XLC)

The major averages hit all-time highs, yet the Communication Services ETF declined - not shocking. I really don’t like this sector and I will explain why. Although the Communication Services ETF touched a 52-week high recently, the gains have not been as stable or as robust compared to other sectors, but this is generally par the course for communications stocks. This is a sector that continuously underperforms other sectors both in the short-term and long-term.

While traditionally this is a good sector to find value in, right now I just don’t see it. I see downside risk without the same type of upside potential as certain other sectors that may benefit more from a successful vaccine roll-out and economic reopening, like small-caps and materials.

Furthermore, the ETF’s volume is already low, and has been unstable. This screams volatility to me.

I just can’t see how you would benefit buying into this sector. It is hard to foresee how this sector will truly benefit from a vaccine and 2021 reopening relative to other sectors. Therefore, I give it a SELL call.

Health Care (XLV)

In theory, healthcare is a sector that should benefit from a vaccine. It’s had a very strong week this week and was one of the leading sectors on Tuesday (Dec. 15) and Thursday (Dec. 17).

A vaccine will cause short-term surges in companies that are directly involved in vaccine production and distribution such as Pfizer (PFE) and Moderna (MRNA), however, it will not be a long-term profit driver for these companies. Just take Pfizer’s and Moderna’s stock for example. Despite Pfizer’s vaccine roll-out commencing this week, and Moderna’s approval for emergency use seemingly imminent, Pfizer’s stock is down nearly 9% since December 10th, while Moderna’s is down nearly 7.50%! Meanwhile, the pandemic has caused hospitals and providers to lose a lot of money, and there could be more pain on the horizon.

Keep the following in mind as well. Hospitals make a lot of their money from elective procedures. With the pandemic, hospitals’ resources are being stretched thin, and they are often prohibiting these types of procedures.

Outside of some blue-chip companies to invest in for the long-term, it’s hard to see the upside in healthcare now, despite its strong week. If you’re really feeling dangerous, maybe taking a gamble on a vaccine stock and crossing your fingers for a short-term pop could be a strategy.

While there will not be as much upside in this sector as others, there is still some potential. Therefore, I give this a HOLD call (and if you own a vaccine stock, consider taking profits).

Utilities (XLU)

Utilities are like Subarus. They may be ugly, they may be boring, but they are dependable and get you from point A to point B. Utility stocks may offer the best opportunity to find value in a market this overinflated, manic, and unpredictable.

Utilities are considered to be defensive investments, and as a result, have underperformed the market. However, this sector has had a decent week.

This is frankly a boring sector not focused on growth or gains. But during uncertain times, this is a solid sector to find value in because it is cheap, does not swing much upwards or downwards, and is generally a safe place to park your money. In the short-term and long-term, this sector may be a good hedge against volatility and bad news and may also be a good way to gain exposure to renewable energy and 5G.

Utilities do not pose the same type of overheating risks as other sectors, such as small-caps. Most importantly, no matter what the economic condition is and no matter what the news of the day is, you can always count on utilities to stay relatively tame. The RSI is lower than other sectors and the ETF is trading below its 50-day moving average. The ETF’s volume, while low, has also been stable.

Therefore, at this valuation, I give utilities a BUY call - with the understanding that these stocks may not move much to the upside or downside but will provide a consistent yield.

Summary

While the surging spread of COVID-19 and resulting economic shutdowns may drive some short-term concerns, the progress made on the stimulus deal, as well as with the vaccine(s) poses significant optimism for 2021 and beyond. The start of global vaccinations, and the likely FDA approval of Moderna’s vaccine on Friday (Dec. 18), should be cheered by everyone. Although sentiment seemingly can change at the snap of a finger, the long-term outlook for equities could be very positive.

While we can officially enter 2021 with some glimmer of hope, COVID-19 is still here and has not been eradicated. Until that happens, there will inevitably be a tug of war between vaccine optimism and health/economic pessimism.

Please keep in mind that markets are forward looking instruments and are investment vehicles that look 6-12 months down the road. Although it is very plausible that there could be some short-term uncertainty and volatility, remember how sharp and swift the rally was after the crashes in March.

I do not believe a crash like that is on the horizon, but if there is a short-term correction or downturn, keep your eyes on buying opportunities. Why? Since markets bottomed on March 23rd, here is how the ETFs tracking the indices have performed: Russell 2000 (IWM) up 99.29%. Nasdaq (QQQ) up 83.03%. S&P 500 (SPY) up 68.37%. Dow Jones (DIA) up 64.88%.

In the long-term, markets always end up moving higher and are focused on the future rather than the present.

If the stimulus deal passes before the end of the year, and everything goes well with the vaccines, the short-term volatility may be worth monitoring for opportunities.

To sum up all our calls, I have a BUY call for:

- Small-Caps (IWM) - but ONLY on a pullback for the long-term

- Materials (XLB)- but ONLY on a pullback for the long-term

- Utilities (XLU)

HOLD calls for:

- Materials (XLB)

- Health Care (XLV)

And I have SELL calls for:

- Small-Caps (IWM) - in the short-term. But do not fully exit positions.

- Financials (XLF)

- Energy (XLE)

- US Dollar ($USD)

- Communication Services (XLC)

Thank you.

Matthew Levy, CFA

Stock Trading Strategist