Briefly:

Intraday trade: Our Tuesday's intraday outlook was neutral. The S&P 500 index gained 0.2% after opening 0.1% higher. It fluctuated following Monday's bounce off support level at 2,700. We may see some increased volatility after 2:00 p.m. today, because of the Fed's news release. The index will probably extend its short-term fluctuations. Therefore, we prefer to be out of the market, avoiding low risk/reward ratio trades.

Medium-term trade: In our opinion, no medium-term positions are justified.

Our intraday outlook is neutral. Our short-term outlook is neutral, and our medium-term outlook is neutral:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes gained 0.2-0.5% on Tuesday, as they retraced some of their Monday's sell-off. The S&P 500 index bounced off support level at around 2,700 on Monday, following breakout below last week's trading range. It gained just 0.2% yesterday, and it currently trades around 5.4% below January 26 record high of 2,872.87. The Dow Jones Industrial Average was relatively stronger than the broad stock market, as it gained 0.5%, and the technology Nasdaq Composite gained 0.3%.

The nearest important level of resistance of the S&P 500 index remains at 2,740-2,750, marked by Monday's daily gap down of 2,741.38-2,749.97. The next resistance level is at around 2,775-2,780, marked by last Wednesday's daily high. On the other hand, support level is at 2,695-2,700, marked by Monday's daily low, among others. Potential support level is also at 2,650-2,670, marked by previous local lows.

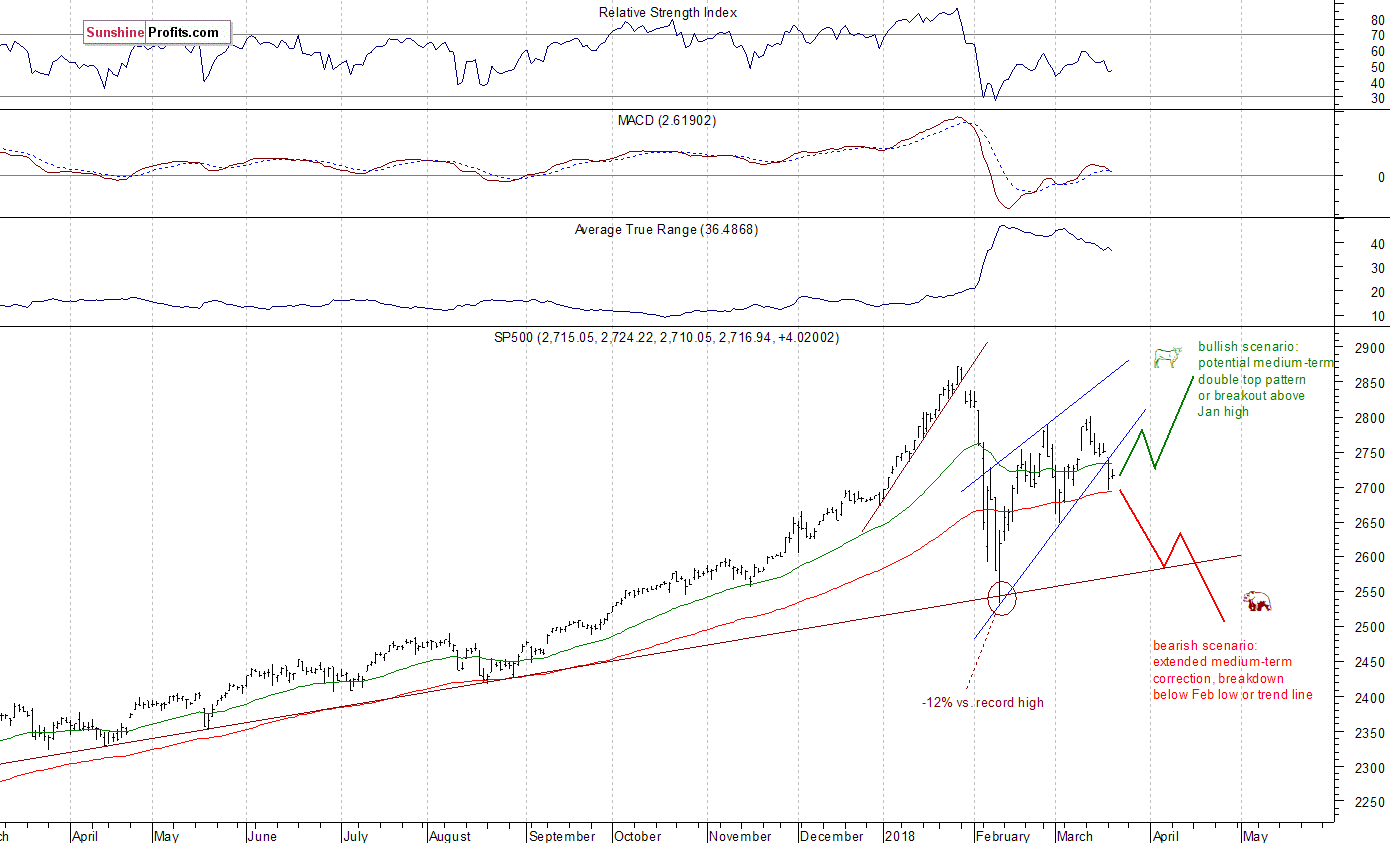

We can see that stocks reversed their medium-term upward course following whole retracement of January euphoria rally. Then the market bounced off its almost year-long medium-term upward trend line, and it retraced more than 61.8% of the sell-off within a few days of trading. Is this just an upward correction or uptrend leading to new all-time highs? The market is still in the middle of two possible future scenarios. The bearish case leads us to February low or lower after breaking below medium-term upward trend line, and the bullish one means potential double top pattern or breakout above the late January high. Monday's sell-off made the bearish case more likely again. You should take notice of a breakdown below potential rising wedge pattern. This over month-long trading range looks like an upward correction following late January - early February sell-off:

Mixed Expectations, Eyes on Fed

The index futures contracts trade between -0.3% and 0.0% vs. their yesterday's closing prices. It means that expectations before the opening of today's trading session are mixed. The main European stock market indexes have lost 0.1-0.3% so far. Investors will wait for today's FOMC Statement announcement at 2:00 p.m. They will also wait for some economic data releases: Existing Home Sales number at 10:00 a.m., Crude Oil Inventories at 10:30 a.m. Will Monday's sell-off continue today? Or is this some short-term bottoming pattern before reversing upwards? Fed's Rate Decision may increase short-term volatility. There may be some whipsaw trading action following that news release.

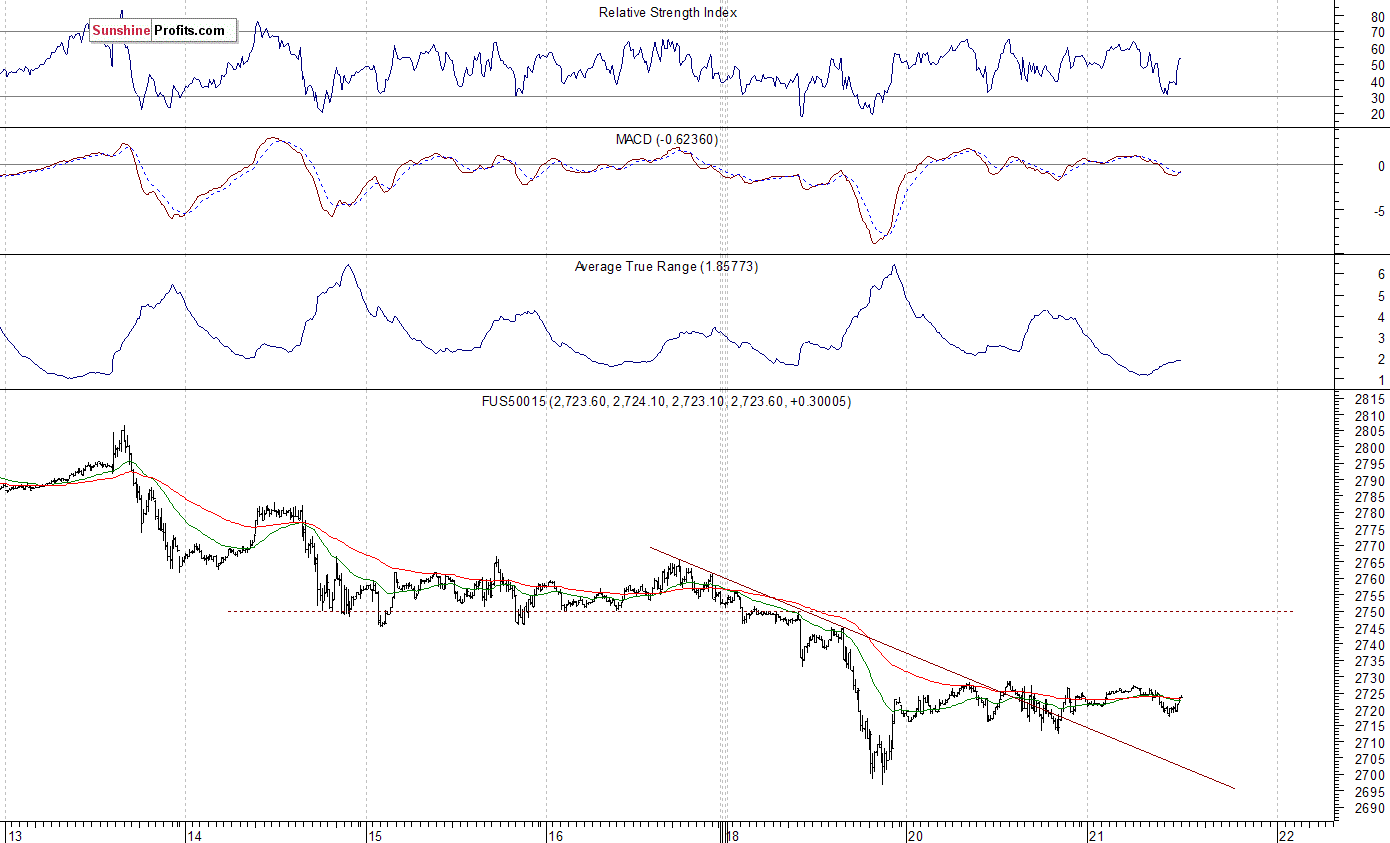

The S&P 500 futures contract trades within an intraday consolidation, as it extends its yesterday's fluctuations following rebound off support level. The nearest important level of support is at around 2,710-2,715, marked by short-term local lows. The next support level is at 2,695-2,700, marked by Monday's local low. On the other hand, resistance level is at around 2,725-2,730, marked by short-term consolidation. The futures contract is now above its short-term downward trend line, as we can see on the 15-minute chart:

Nasdaq Still at 6,900 Mark

The technology Nasdaq 100 futures contract follows a similar path, as it trades within a short-term consolidation after rebounding off support level at around 6,820-6,850 on Monday. The market gained more than 1,000 points off its February 9 bottom, as it remarkably retraced all of its late January - early February sell-off in one month. Is this just downward correction following record-breaking rally? For now, it looks like a correction and not some new medium-term downtrend. The nearest important short-term resistance level remains at around 6,920-6,930, marked by local highs, and the next level of resistance is at 6,950-6,970. The Nasdaq futures contract continues to trade along the level of 6,900, following yesterday's breakout above short-term downward trend line, as the 15-minute chart shows:

Apple Below Trend Line, Facebook Breaks Lower

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The market reached new record last week, but then it reversed the uptrend. We saw negative technical divergences - the most common divergences are between asset’s price and some indicator based on it (for instance the index and RSI or MACD based on the index). In this case, the divergence occurs when price forms a higher high and the indicator forms a lower high. It shows us that even though price reaches new highs, the fuel for the uptrend starts running low. The market formed a negative candlestick chart pattern called "bearish engulfing". It consists of a smaller white candlestick followed by a black candlestick that "engulfs" the white one. This downward reversal pattern has been confirmed by last week's Wednesday's move down. Consequently the market continued its downtrend, as it broke below the upward trend line on Monday. It may fluctuate along support level of $170-175:

Now let's take a look at Facebook, Inc. (FB) daily chart. It fell almost 7% on Monday, following data breach news release. Then it continued 2.6% lower on Tuesday, as it broke below its medium-term consolidation and potential downward reversal head-and-shoulders pattern. Monday's daily gap down acts a resistance level now. Overall, the stock remains relatively weaker than technology stocks sector and the whole broad stock market. It bounced off support level at $160-165 yesterday, but the nearest important level of resistance is at $170:

Dow Jones Going Sideways

The Dow Jones Industrial Average daily chart shows that blue-chip index was relatively weaker than the broad stock market and much weaker than record-breaking technology stocks recently, as it continued to trade well below late February local high. The market broke below 25,000 mark, as it retraced more of its recent rebound. Possible support level is at around 24,250, marked by previous local low. If the index breaks lower, it could continue towards February 9 panic low. In late February, there was a negative candlestick pattern called Dark Cloud Cover, a pattern in which the uptrend continues with a long white body, and the next day it reverses following higher open and closes below the mid-point between open and close prices of the previous day. It acted as a resistance level, as we can see on the daily chart:

Concluding, the S&P 500 index will probably extend its short-term fluctuations today following Monday's rebound off support level at 2,700. Will today's FOMC Statement release drive stocks much higher or lower? It may increase their intraday volatility, but they will probably remain pretty unchanged. If the index continues lower we would think about buying the dip at around the support level of 2,700 again.

Last week's rally failed to continue following negative political news releases. Was this just quick profit-taking action or more meaningful downward reversal? It's hard to say right now, but Monday's sell-off made medium-term bullish case less likely. There is also a negative over-month-long rising wedge pattern. If stocks continue lower from here, then they will probably reach or exceed February panic low.

Currently, we prefer to be out of the market, avoiding low risk/reward ratio medium-term trades. We will let you know when we think it is safe to get back in the market.

To summarize: no medium-term positions are justified from the risk/reward perspective at this moment.

Intraday trade:

No intraday position is justified from the risk/reward perspective today.

No medium-term position is justified from the risk/reward perspective at this moment.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts