Briefly:

Intraday trade: The S&P 500 gained 0.9% on Monday, after opening 0.5% higher. The market will probably open lower today. We may see some more short-term volatility following the recent rebound.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Our short-term outlook is neutral, and our medium-term outlook is neutral:

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): neutral

The U.S. stock market indexes gained 0.8-1.2% on Monday, as they retraced their Friday's decline. The S&P 500 index fell the lowest since the late April of 2017 and it traded 20.2% below September the 21st record high of 2,940.91 on Wednesday when it reached the new medium-term low of 2,346.58. Then the market rallied and got close to 2,500 mark. The Dow Jones Industrial Average gained 1.2% and the Nasdaq Composite gained 0.8% on Monday.

The nearest important level of resistance of the S&P 500 index remains at around 2,500-2,520, marked by the recent local highs. The resistance level is also at 2,530. On the other hand, the support level is at 2,400-2,420, among others.

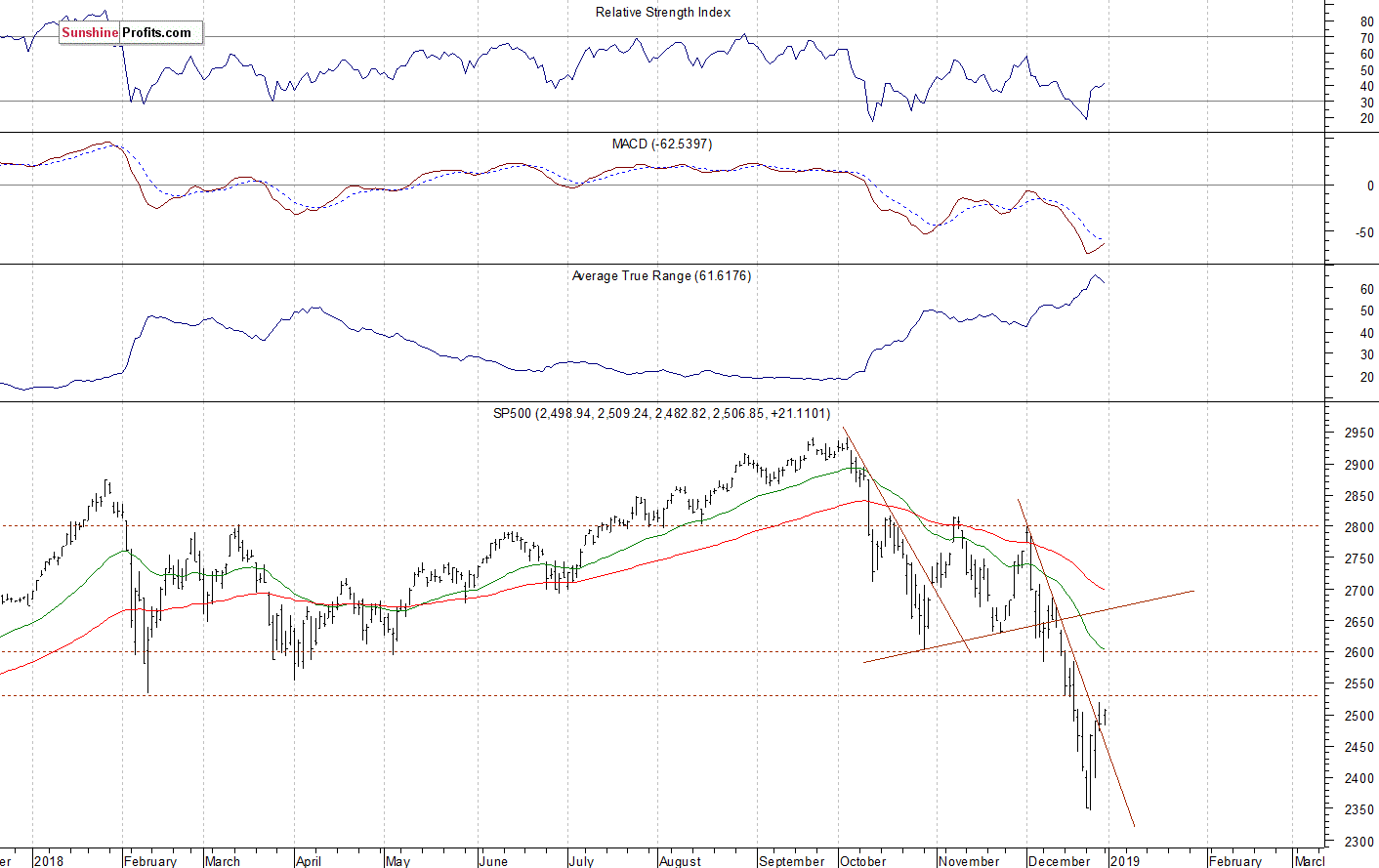

The broad stock market broke below its two-month-long trading range recently, as the S&P 500 index fell below the level of 2,600. Then the market accelerated lower and it broke below the level of 2,400 on Monday more than a week ago. The downward correction reached 20.2% from the September all-time high, surpassing January-February correction of around 12%. Is this a long-term bear market? It still looks like a medium-term downward correction, but the index remains below the recent consolidation, as we can see on the daily chart:

Negative Expectations, Downtrend Resumes?

Expectations before the opening of today's trading session are negative, because the index futures contracts trade 1.5-2.2% below their Monday's closing prices. The European stock market indexes have lost 0.3-1.5% so far. Investors will wait for the Manufacturing PMI number release at 9:45 a.m. The broad stock market may extend its short-term fluctuations following the recent sell-off and a quick rebound off the new medium-term low. For now, it still looks like an upward correction within a downtrend.

The S&P 500 futures contract trades within an intraday downtrend, as it retraces some of the recent advance. The nearest important level of resistance is at around 2,470-2,480, marked by the local highs. On the other hand, the support level is at 2,450. The futures contract trades below its recent upward trend line, as the 15-minute chart shows:

Nasdaq Also Lower

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday downtrend. The market broke below its short-term consolidation this morning. The nearest important resistance level is at around 6,250-6,300. On the other hand, the support level remains at 6,000-6,100. The Nasdaq futures contract broke below its short-term consolidation, as we can see on the 15-minute chart:

Big Cap Tech Stocks - New Uptrend or Just Rebound?

Let's take a look at Apple, Inc. stock (AAPL) daily chart (chart courtesy of http://stockcharts.com). The stock further accelerated its sell-off recently, as it fell below the price of $150. The market reached the new medium-term low of $146.59 on Monday more than a week ago. Then it retraced some of the decline. The stock remains at its month-long downward trend line:

Now let's take a look at Amazon.com, Inc. stock (AMZN) daily chart. The stock accelerated its downtrend recently and it reached the new medium-term low of $1,307. Was last week's Wednesday's rally the upward reversal? For now, it looks like another upward correction. The market remains below its three-month-long downward trend line:

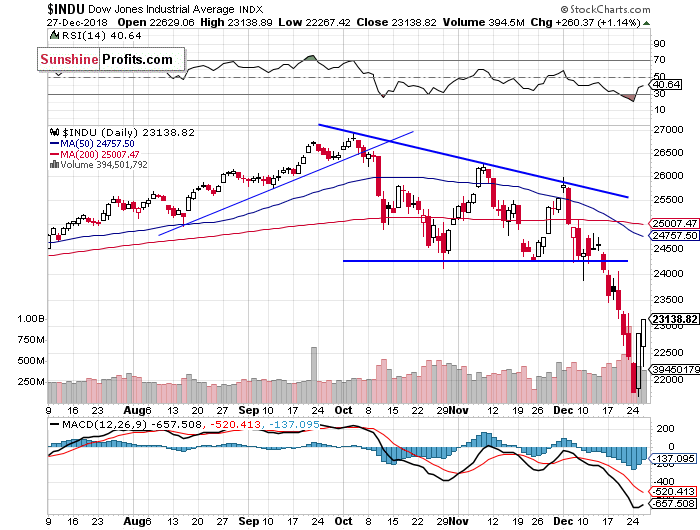

Dow Jones Slightly Above 23,000

The Dow Jones Industrial Average broke below its two-month-long consolidation in the mid-Decmber and then it accelerated much lower. The blue-chip stocks' gauge fell below the level of 22,000. It slightly extended the downtrend on Wednesday a week ago before sharply reversing higher and getting back to 23,000 mark. So was it an upward reversal or just a correction within a downtrend? The market remains below its October - December trading range:

The S&P 500 index extended its downtrend a week ago, before reversing higher. The broad stock market was more than 20% below its September's record high on Wednesday. Is this a new long-term bear market or just medium-term downward correction? For now, it looks like a correction. However, there have been no confirmed medium-term positive signals so far.

Concluding, the S&P 500 index will likely open lower today. We may see more short-term volatility after last week's Monday's panic-selling climax followed by Wednesday's rally.

Trading position (short-term; our opinion): no positions are justified from the risk/reward perspective.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts