Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Stocks were little changed on Monday as they fluctuated following last week’s rebound. Will the market go down again?

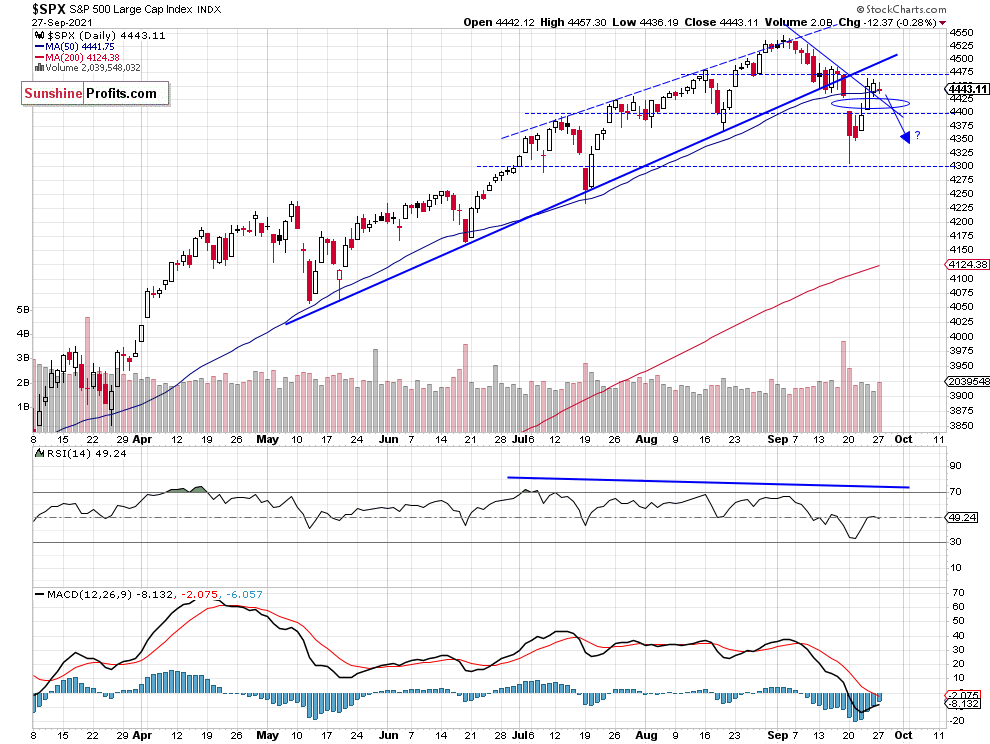

The S&P 500 index fell the lowest since July 20 on Monday a week ago, as it reached the local low of 4,305.91. It was 239.9 points or 5.28% below the September 2 record high of 4,545.85. Since Tuesday it has been bouncing and on Thursday it reached a local high of 4,465.40. Yesterday the index fell 0.3% but it remained close to its last week’s local high. This morning the S&P 500 is expected to open 0.7% lower, so we may see the downtrend resuming.

The nearest important support level of the broad stock market index is at 4,400-4,430, marked by last Monday’s daily gap down of 4,402.95-4,427.76. On the other hand, the nearest important resistance level is at 4,470-4,500. The S&P 500 broke below its over four-month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Our Short Position is Profitable

Let’s take a look at the hourly chart of the S&P 500 futures contract. We opened a short position on August 12 at the level of 4,435. It is profitable right now. We still think that a speculative short position is justified from the risk/reward perspective. (chart by courtesy of http://tradingview.com):

Conclusion

Since last Tuesday we’ve witnessed a short-covering rally fueled by the Wednesday’s FOMC Monetary Policy release. Most likely it’s just an upward correction within a downtrend. The S&P 500 index got back to the mid-September short-term consolidation and it may act as a short-term resistance level.

There have been no confirmed positive signals so far. Therefore, we think that the short position is justified from the risk/reward perspective.

Here’s the breakdown:

- The market accelerated its downtrend a week ago, as the S&P 500 index got close to 4,300 level.

- Our speculative short position is still justified from the risk/reward perspective.

- We are expecting some more downward pressure and a correction to 4,200-4,250 level.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with a stop-loss level of 4,550 and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care