Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,820 as a stop-loss and 4,450 as a price target.

The S&P 500 will open 1.8% lower this morning, as new Covid variant fears push global markets down. Will stocks go even lower today?

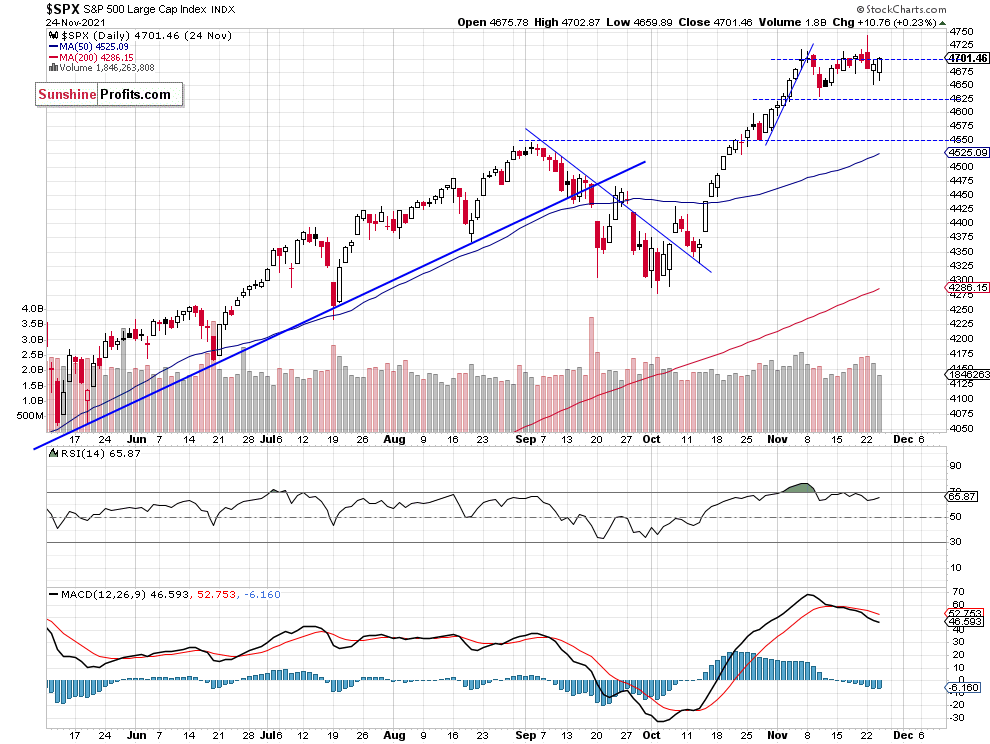

The S&P 500 index continued to fluctuate on Wednesday, as it gained 0.23%.The market remained close to the 4,700 level and it traded within an over two-week-long consolidation. It looked like a flat correction within an uptrend, and today the market will most likely break below that trading range. It may signal a more meaningful downward reversal.

The nearest important support level is now at 4,600-4,625. On the other hand, the resistance level remains at 4,700-4,750. The S&P 500 continued to trade along the 4,700 level, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

Short Position is Profitable!

Let’s take a look at the hourly chart of the S&P 500 futures contract. The market reached the new record high on Monday, but then it quickly got back below the 4,700 level and it broke below its month-long upward trend line.

It looked like a topping pattern following the advance from the early October lows. Therefore, we decided to open a speculative short position on Tuesday (4,678 price level). It’s in profit right now, as we can see on the chart (chart by courtesy of http://tradingview.com):

Conclusion

The S&P 500 index is expected to open 1.8% lower this morning following news about the new Covid variant detected in South Africa, among other factors. Then, we may see an intraday consolidation and attempts at rebounding from the support level of around 4,600. The trading session will be shortened and stocks will close at 1:00 p.m.

Here’s the breakdown:

- The S&P 500 traded within a short-term topping pattern early in the week and today, the market will most likely confirm the downward reversal.

- A speculative short position is justified from the risk/reward perspective.

- We are expecting a 5% correction.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with entry at 4,678 price level, with 4,820 as a stop-loss and 4,450 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care