Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

So, Trump is corona-positive, and over the weekend had possibly received treatment reserved for the most difficult cases (or is it that he improved and could be discharged today?) - but stocks recovered as I called for them to do at the onset of Friday. I said that this isn't the start of a new downleg but rather that this is an exaggerated reaction.

Friday's non-farm payrolls disappointed to a degree, but the recovery is still going on. And in the meantime, stimulus news are moving back into the headlines - will the price tag and mechanics be settled still before the elections?

The economy needs that, and any talk about overheating would obviously be very premature. The recovery is still too young, needing sufficient monetary and fiscal support.

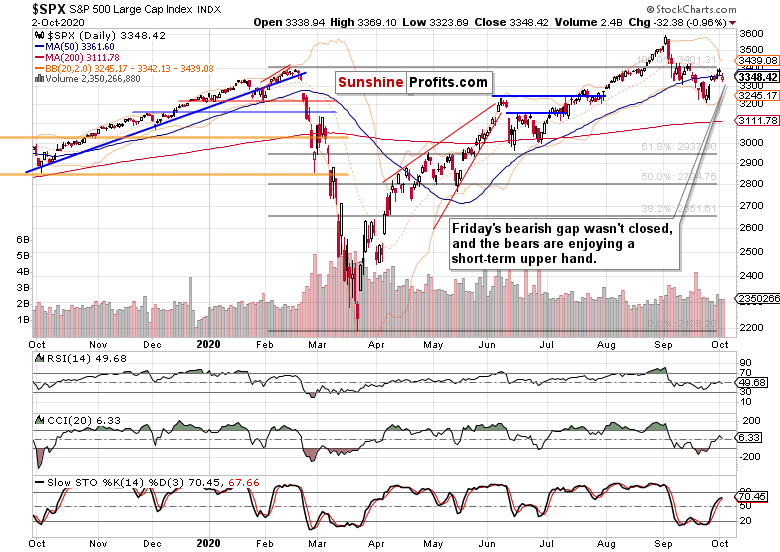

So, how much of the S&P 500 chart deterioration has been overcome on Friday exactly?

S&P 500 in the Medium- and Short-Run

I'll start with the weekly chart perspective (charts courtesy of http://stockcharts.com ):

The weekly price action points higher, true, but the sizable upper knot is sticking out like a sore thumb. While not all the downside appears to be in looking at this chart alone, I am not calling for a new downswing to start here. The weekly indicators remain fairly neutral, and sideways trading with bullish bias reasserting itself, is the best the bulls can look for.

The daily chart's view of Friday leaves quite something to be desired - but given the dramatic Trump headline, it's positive for the bulls that we saw buying emerging. All in all, sideways to higher trading appears to be the most likely development next.

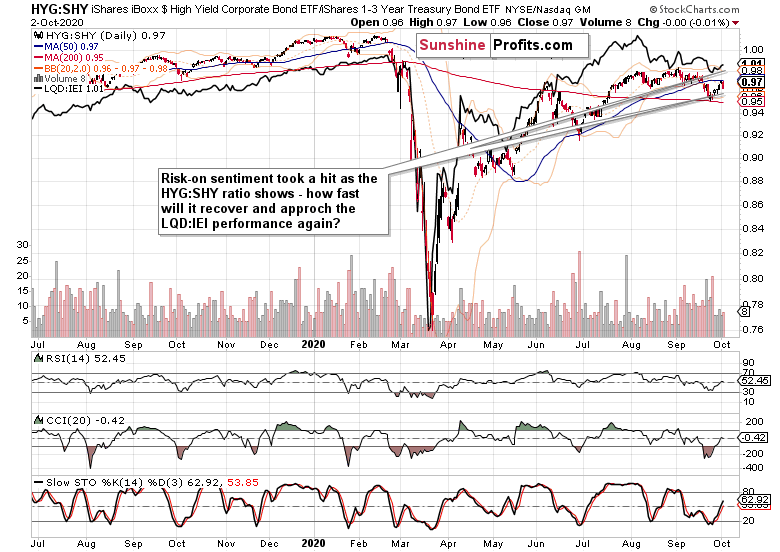

The Credit Markets' Point of View

Both leading credit market ratios - high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) - are not in unison. The more risk-on one (HYG:SHY) has weakened while LQD:IEI didn't, which can be expected to be seen when risk-on assets come under pressure the way they did in Friday's premarket session.

Long-term Treasuries (TLT ETF) haven't risen on Friday, which bodes well for stocks. But as the volume has declined, I wouldn't be surprised to see them turn north shortly. Not dramatically higher, but still. As regards Friday, the session didn't ring up the alarm bell, meaning that whatever bullish spirits there are in stocks, can run on - and that in the current circumstances means a measured uptrend reasserting itself.

The ratio of stocks to all Treasuries ($SPX:$UST) remains in an uptrend that has met its consolidation. The short-term dynamics is actually favorable to the stock bulls' prospects.

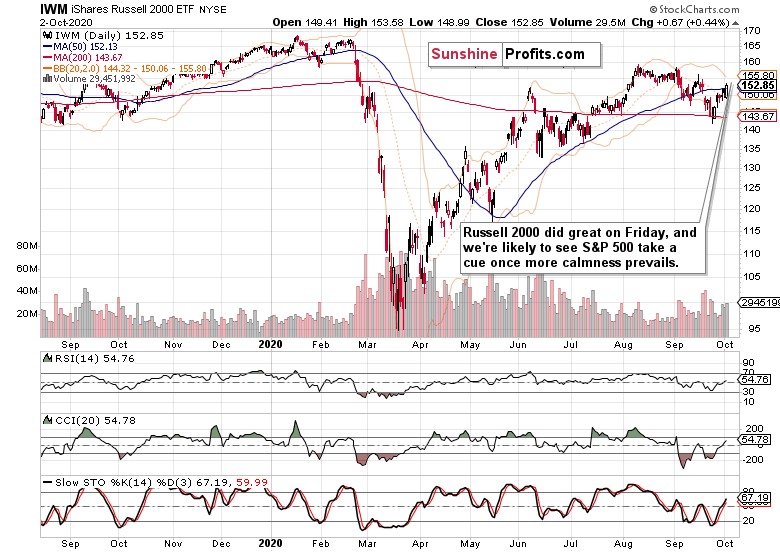

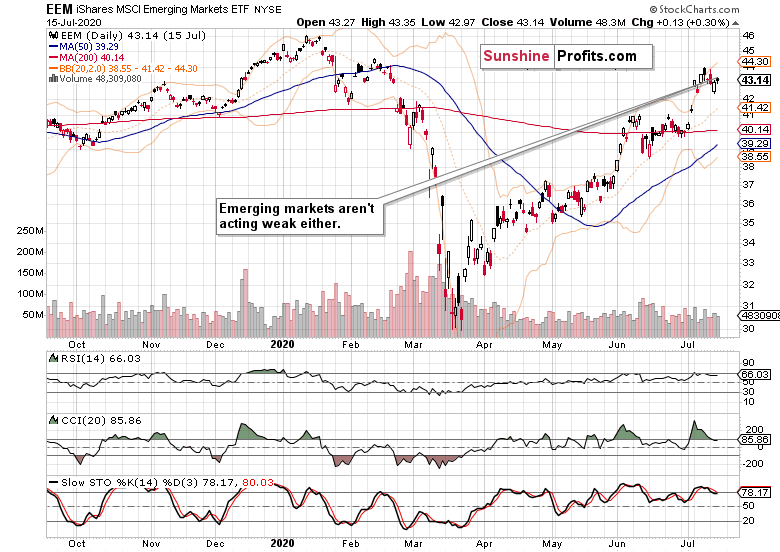

Smallcaps, Emerging Markets and Copper

The Russell 2000 (IWM ETF) isn't exactly breaking down - it actually recovered on solid volume. The stock bulls better pay attention that there are no signs of distribution, meaning that the bull market can go on.

Emerging markets (EEM ETF) aren't meeting a weak patch either, and I look for the positive influence from international stocks and U.S. smallcaps to translate into the 500-strong index perfomance as well.

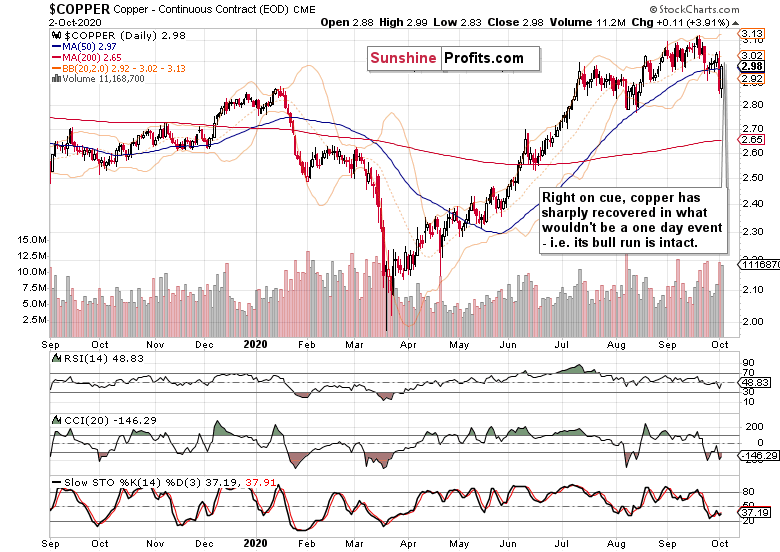

Along with gold and oil, the key barometer of economic health, the red metal, didn't disappoint me. Such were my Friday's observations:

(...) The red metal truly plunged yesterday, and on heavy volume. Sure, it was vulnerable to a takedown following the rebound off its 50-day moving average, but the slide looks a bit overdone. Certainly, it doesn't invalidate the bullish chart posture as copper stands to capitalize on the electric cars fever and the like it or not rush into green economy in general. The setback suffered will thus be reversed relatively shortly in my opinion.

And indeed, the rebound was strong and on heavy volume, meaning that it's more likely than not to proceed. The price is primed to go higher, and all we've seen in my opinion, is a breakdown attempt that will be proven to have failed.

Summary

Summing up, stocks have retraced a good part of Friday's premarket downswing, but are far from out of the woods. The short-term outlook remains muddied and sideways trading almost a surefire bet, while the medium-term bias remains up. The dollar continues treading water, and I fully expect (as I have been saying for months) that its 2020 top is in, which will facilitate via different avenues the gain in many risk-on trades, including stocks. The credit markets are supporting this notion, and once technology regains its lusted, the S&P 500 fireworks would return. As for now though, that appears weeks away still, so a very measured grind higher remains the most likely scenario for the days and immediate weeks ahead.

Trading position (short-term; S&P 500 futures; our opinion): long positions (100% position size) with stop-loss at 3140 and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits: Analysis. Care. Profits.