Trading position (short-term; our opinion): long positions at market (that's 2407 currently) (100% position size) with stop-loss level at 2260 and the binding take-profit target at 2570. Stay tuned as finetuning the open trade positions' parameters during the day is highly likely.

The S&P 500 didn't slide to new 2020 intraday lows yesterday. The bulls staved off the downswing drive in the opening hours, and staged a recovery attempt during the course of the session. How shall today's trading action likely proceed given the bullish opening gap? Will a sizable rally develop and stick for more than a few hours?

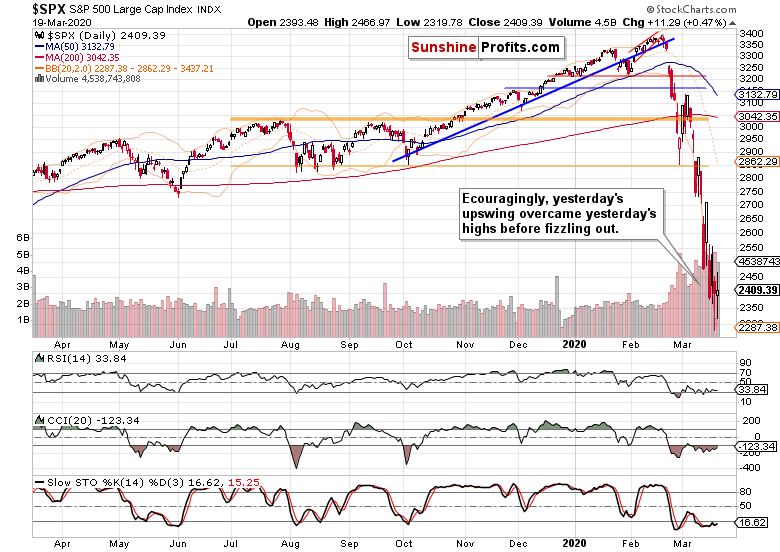

Let's dive into the daily chart (chart courtesy of http://stockcharts.com).

The pattern of lower intraday lows day in and day out, has been broken yesterday. While the upswing didn't stick, we neatly cashed in a 65-point profit on that move. Yesterday's session also brought three encouraging developments. First, the preceding day's highs were overcome on the intraday basis. Second, yesterday's candle was reminiscent of a doji, only with sizable upper and lower knots. Third, the pace of declines ground to a halt with yesterday's session.

These were our Wednesday's notes about the daily indicators:

(...) they're refusing to budge much lower with each daily slide (that speaks to prices being overextended to the downside), and Stochastics has even flashed its buy signal. While the signal came in its oversold area and thus is not as reliable as the one generated outside this range, it's still notable.

Today's view shows that Stochastics' buy signal has been regenerated after its yesterday's invalidation. The above observations thus remain valid also today, and despite the S&P 500 futures' decline below 2400 at the open, the risk is to the upside. One more thing though before introducing you to the short-term trade plan.

Let's recall our points regarding the medium-term picture, as our Wednesday's observations are still valid today:

(...) While the week is far from over, the price action smacks of a reversal in the making. Accounting for yesterday's session , the volume appears on track to beat last week's one. Should weekly closing prices stick around this level, that would support the likelihood of a turnaround. But what kind of a turnaround? It's our opinion that this would most likely mark a temporary respite only.

Summing up, whilethe bears have the upper hand, the potential for an upswing hasn't decreased since yesterday. Quite to the contrary, and we plan to take advantage of it. This is primarily supported by the daily indicators' posture and daily candles' analysis. The trading position details reveal our game plan in full.

Trading position (short-term; our opinion): long positions at market (that's 2407 currently) (100% position size) with stop-loss level at 2260 and the binding take-profit target at 2570. Stay tuned as finetuning the open trade positions' parameters during the day is highly likely.

Thank you.

Monica Kingsley

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care