Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 (accounting for yesterday's volatility) and initial upside target at 3550 are justified from the risk-reward perspective.

Tuesday's missed opportunity brought about a strong down day yesterday. S&P 500, oil, and even copper weren't unscathed. Let's check the pre-elections 2016 analogy, and more clues so as to see how this week's jitters compare to the past.

Doom and gloom? Yesterday, I answered that on a daily basis, maybe. So, is some dawn, false or real, on the horizon for stocks?

S&P 500 in the Short-Run

I’ll start with the daily chart perspective (charts courtesy of http://stockcharts.com ):

Tuesday's daily consolidation gave way to a renewed downswing yesterday – such is the conclusion the above chart gives. A new downtrend or volume spike at the bottom – let's head to other charts to check the odds.

Credit Markets’ Point of View

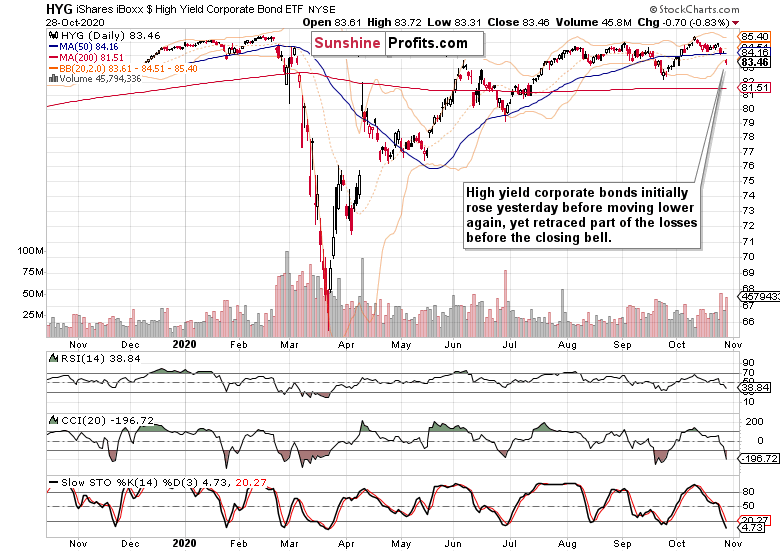

High yield corporate bonds (HYG ETF) plunged yesterday, but the intraday price action offers a glimmer of hope as the bulls didn't give up as easily as over in stocks.

High yield corporate bonds (HYG ETF) plunged yesterday, but the intraday price action offers a glimmer of hope as the bulls didn't give up as easily as over in stocks.

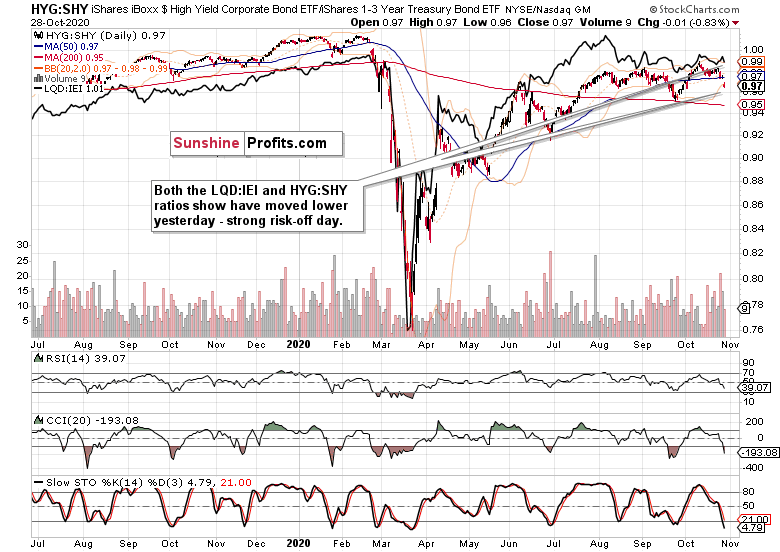

Both leading credit market ratios – high yield corporate bonds to short-term Treasuries (HYG:SHY) and investment grade corporate bonds to longer-dated Treasuries (LQD:IEI) – reflect the down day across the board yesterday. Yet, it isn't as bleak if coupled with the below look at long-term Treasuries (TLT ETF).

Almost an intraday reversal in TLT, and a down day in TIPS (TIP ETF). Is there a turn to risk-on on the horizon? However fledgling one – I look for the next week to be better than this one, for all the fundamental reasons.

Market Breath, Volatility and Technology

The advance-decline line has sure taken a plunge, and the bullish percent index shows that the bulls are likely to step in close to the 50 level – just as in June, July or September. Unless the market character has changed – and I see nothing to justify calling for that right now.

Instead of reversing, $VIX overcame the early September highs. How much of that action relates to elections, and how much to corona repercussions? It's easy to get scared if you look at what's happening over at Europe. A cynical view would be though that the seasonal flu is done this year, now that the deaths are classified / incentivized to be classified as corona. But the point is what the state response would do to the economy, and that isn't a good prospect.

Technology (XLK ETF) plunged, and so did semiconductors (XSD ETF) – but the latter are trading well above their September lows. That's a bullish divergence – one of the many reasons why I think that tech would move higher instead of much lower next.

Currencies Weigh In

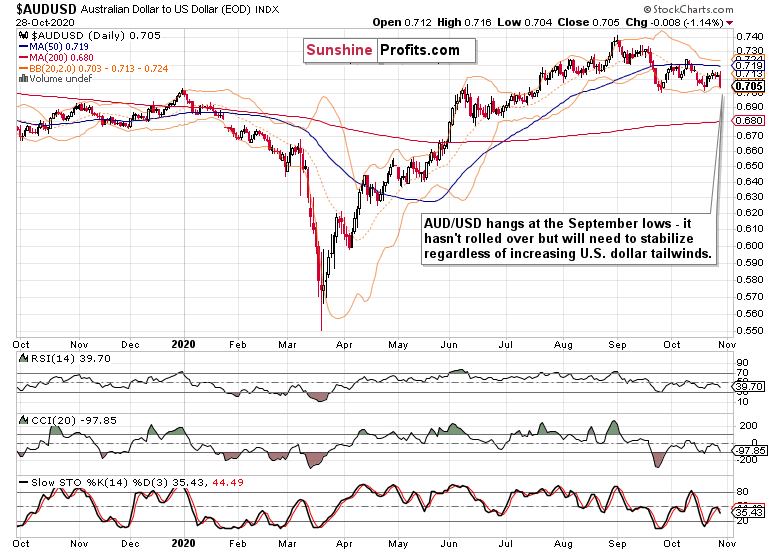

The Australian dollar isn't acting too weak – take away yesterday's session, and it's been quite resilient. Unless it clearly breaks below 0.7000, its medium-term outlook would remain sideways to higher. The present days' dollar resilience though favors headwinds here too – headwinds, not a trend reversal.

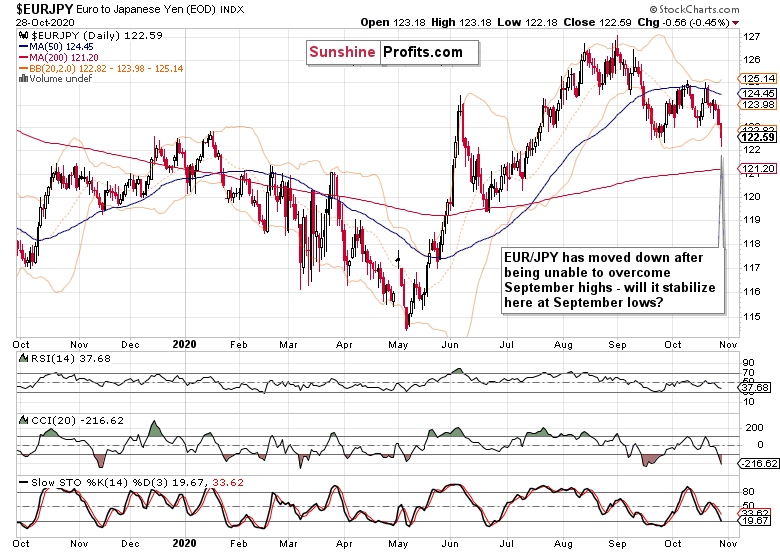

Given the European situation, the $EURJPY could have been doubting the economic recovery a lot more. While the pair's short-term dynamic is nothing to call home about, I view it as a regular consolidation, as no disaster.

Summary

Summing up, stock bulls have an opportunity to repair some of yesterday's damage, and create at least upper knots as was the case back in 2016. First, slowing down the decline, and then probing to go higher. Credit markets are offering signs of an impending turnaround, and technology shows that the bulls can prove themselves. Today's Big Tech earnings could easily be the story of sectoral turnaround. As for the dollar, there is no denying that it's most of the time a headwind for stocks, yet both the presented pairs paint no catastrophic picture. The pre-election volatility could easily turn on a dime, leaving the impression of us going through a springboard in the making. The medium-term bullish trend simply hasn't changed.

Trading position (short-term; S&P 500 futures; my opinion): long positions (100% position size) with stop-loss at 3115 (accounting for yesterday's volatility) and initial upside target at 3550 are justified from the risk-reward perspective.

Thank you.

Monica Kingsley

Stock Trading StrategistSunshine Profits: Analysis. Care. Profits.