Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

Stocks went to a record high yesterday after opening low due to the Afghan news. Today, however, we may see another weak opening. Is a real correction coming?

Stocks were extending an eleven-year-long bull market recently, as the DJIA and the S&P 500 indexes reached new record highs. Will this advance continue even further despite the Fed’s growing tapering fears? Today we will have a speech from Fed Chair Jerome Powell, and the markets may be volatile because of that event.

The S&P 500 gained 0.26% on Monday, and it reached a new record high at 4,480.26! Bulls are in full control, but we can see some negative technical divergences that may signal a coming weakness.

The broad stock market broke above its consolidation recently. The nearest important support level is now at 4,450, and the next support level is at 4,430. The S&P 500 index continues to trade above its three-month-long upward trend line, but it is still below the broken month-long upward trend line, as we can see on the daily chart (chart by courtesy of http://stockcharts.com):

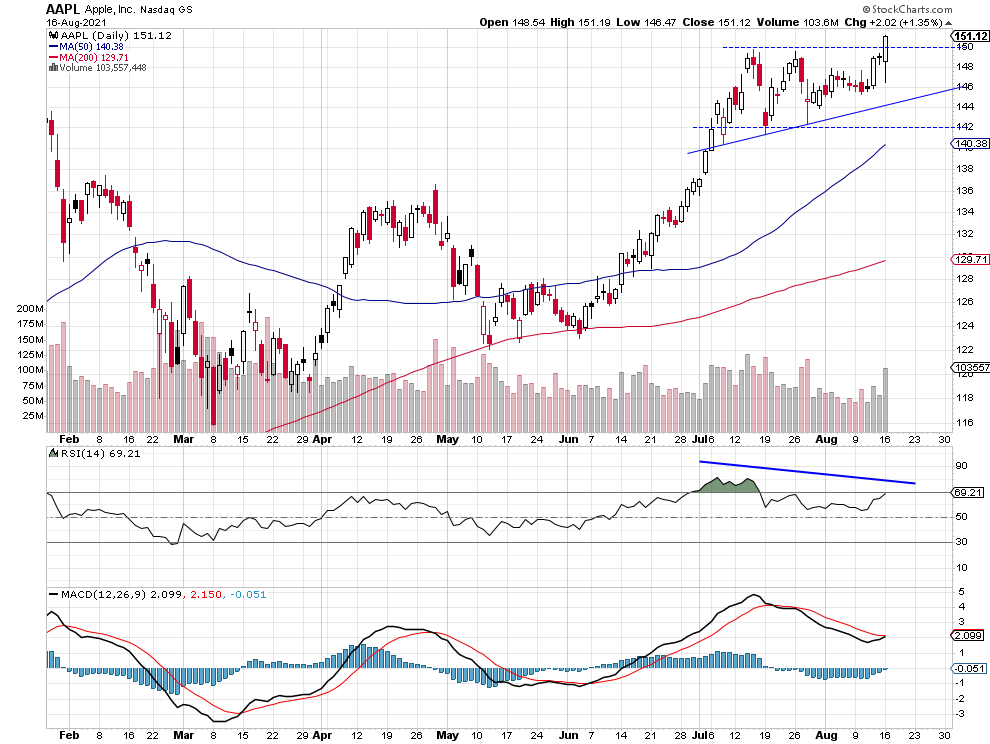

Apple’s Breakout

Apple stock broke above its previous high yesterday as it reached a new all-time high of $151.19. It drove the whole broad stock market higher! But will it continue its uptrend? The stock is expected to open 0.5% lower this morning. If it gets back below $150, that would be negative for indexes.

Conclusion

The S&P 500 index continued its over-eleven-year-long bull market yesterday despite a weak opening. It reached another new record high of 4,480.26. However, today we are expecting a lower opening again.

Here’s the breakdown:

- The market seems overbought and poised for a correction.

- Therefore, we decided to open a speculative short position on Thursday.

- We are expecting a 5% or bigger correction from the current levels.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term, our opinion; levels for S&P 500 continuous futures contract): short positions with an entry at 4,435 price level, with 4,520 as a stop-loss and 4,200 as a price target.

Thank you.

Paul Rejczak,

Stock Trading Strategist

Sunshine Profits: Effective Investments through Diligence and Care